Pebl Expert EOR Review [2026]

Pebl, formerly know as Velocity Global, is one of the legacy global EORs and has been around since 2017.

Overview: Pebl at a Glance

Velocity Global is now called Pebl and one of the veterans of the Employer of Record (EOR) industry. Founded in 2014 and headquartered in Denver, Colorado, the company became known for its global compliance network, strong HR support, and wide international coverage. Nowadays, Pebl supports hiring in over 100 countries (though the advertise 185 countries), offering EOR, global contractor management, and payroll solutions for distributed teams.

The platform is primarily used by mid-market and enterprise clients that need a risk-averse, service-heavy global hiring partner rather than a tech-first automation platform.

We also went through their entire sales cycle and saw that their supposed US$ 399 per month per employee on their website was not accurate for most countries and additional fees beyond apply. They are eager to close though, and are offering great migration credits. During our experience, response times were slow, and when communication did happen, the sales focus leaned heavily on criticising competitors rather than presenting their own strengths.

Key Features & Services of Pebl

Global Employer of Record (EOR)

Need to hire a full-time employee in another country? Pebl’s flagship offering enables companies to hire full-time employees abroad without setting up local entities. Pebl/Velocity Global is known for a hands-on HR support model, with dedicated specialists guiding companies through every employment decision. So you won’t be just talking to some AI assistant.

This service includes:

- Compliant employment contracts

- Local HR guidance

- Global payroll & statutory contributions

- Benefits administration

- Onboarding & offboarding support

- IP protection & assignment

- Local compliance & risk prevention

Global Contractor Management

In case you want to rather hire contractors than full time employees, you can also do it with Pebl. They take Contractor management seriously and it is more conservative than providers like Deel. Pebl does that with the intention to minimize misclassification exposure.

Features include:

- Contract templates

- Compliance & misclassification guidance

- Multi-currency contractor payments

- Consolidated invoicing

- Document & tax record management

Global Payroll

For companies that already own entities but need centralized, fully-managed payroll operations, Pebl offers global payroll service.

Global payroll service offers:

- Monthly payroll processing

- Local tax filings & employer contributions

- Multi-country payroll reporting

- Single payroll dashboard

Pebl positions this product as a premium, service-based payroll outsourcing model.

EOR Pricing Overview of Pebl

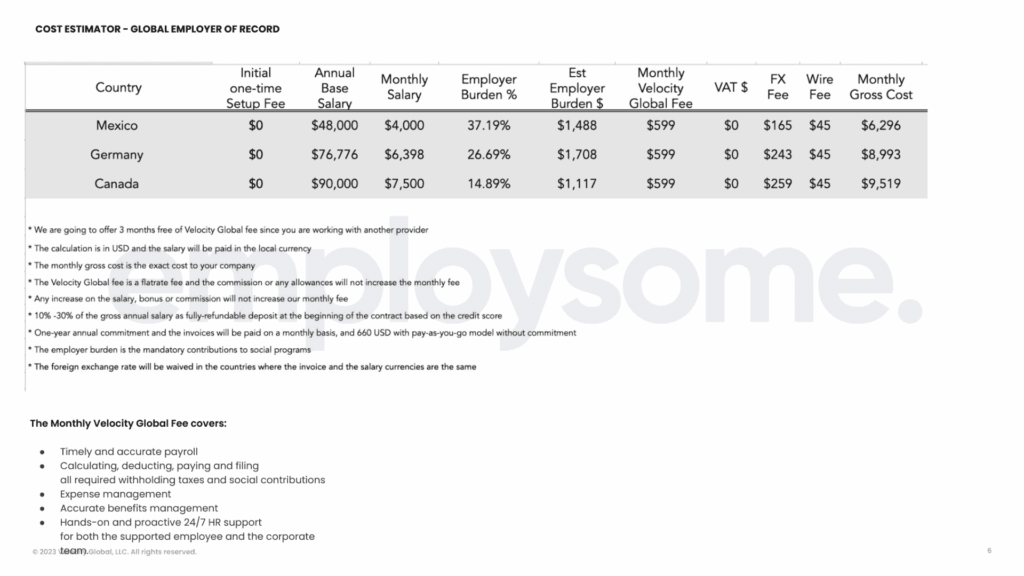

While Pebl does not publicly list all prices, our Employsome EOR experts at have reached out to Pebl and have been able to obtain their pricing:

Security Deposit. 10%-30% of the gross annual salary as fully-refundable deposit at the beginning of the contract based on the credit score.

Setup fee. US$0

Monthly EOR base fee. US$660 per employee per month.

Pebl offers a reduced fee of US$599 if one commits for one year. If the employee leaves the company for any reason, as long as the company replaces this role, there is no additional payment on top of that. If the employee leaves after 8 months with the annual subscription model, the monthly fee for the remaining months has to be paid (US$599) unless the company replaces this role with another candidate.

Transfer credits when moving from another EOR. It’s worth noting that Pebl offers 3 months free EOR when moving over from another EOR. That’s a pretty good deal and aimed at taking market share.

Foreign transaction and processing fee. 3% to the previous day’s spot rate as provided by Xignite.

Pebl stated that “this fee accounts for administrative and processing costs, exchange fees charged to Pebl, and currency risk carried by Pebl between the date funds are paid by the Company and the date those funds are paid to the Employee”.

Info: Pebl is not going to charge the FX fee where the invoice currency and the salary currency are the same. As such, we advice you to make sure you wire the funds to Pebl in the employee’s currency and use a more competitive banking service such as Wise for to manage the conversion rate.

Late payment fee. 1.5% interest p.a. on the unpaid amount.

Off-cycle payment fee. Subject to change according to the country, but usually at US$199.

Payroll cut-off date. 10th of each month. Pebl allows you to make any changes until the 10th and then they generate the invoice on the 20th of each month payable within 7 days.

Overall, it’s fair to say that Pebl/Velocity Global generally sits in the higher pricing tier compared to Deel, Oyster HR, or Remote because they provide more manual HR support.

How Pebl Is Scoring: Our Data-Driven Analysis

Pebl is a modern, scale-friendly EOR provider focused on fast onboarding, clear pricing, and a product-led experience. It performs especially well for startups and scaleups that want to hire internationally with minimal friction, while still maintaining solid baseline compliance across key markets.

4.3 /5.0

✓ Broad global coverage across core hiring regions

✓ Standardised EOR and contractor services

✓ Consistent onboarding experience across countries

✓ Contractor management included

✗ Less depth in highly regulated or niche markets

✗ Limited advisory-led services for complex setup

✗ No broad marketplace of optional tools

4.2 /5.0

✓ Clear, predictable pricing model

✓ No salary-based commission structures

✓ Strong cost visibility for budgeting and scaling

✗ Less flexibility for bespoke enterprise pricing

✗ Fewer country-specific pricing customisations

4.5 /5.0

✓ Standardised, compliant contract templates

✓ Clear payroll and invoicing timelines

✓ Straightforward termination mechanics

✗ Limited flexibility for non-standard contract clauses

✗ Not optimised for highly customised employment structures

4.2 /5.0

✓ Responsive support for day-to-day operations

✓ Clear onboarding guidance and documentation

✓ Well suited for repeatable hiring workflows

✗ Less high-touch advisory support for edge cases

✗ Support depth may vary by country

4.3 /5.0

✓ Clean, intuitive, and easy-to-use platform

✓ Strong self-serve onboarding and employee management

✓ Designed for fast-moving, distributed teams

✗ Integration ecosystem smaller than enterprise suites

✗ Limited advanced automation for complex workflows

4.4 /5.0

Pebl Country Coverage: Owned Entities vs Partner Network

Pebl’s Strength & Weaknesses

Pebl is built around strict legal and regulatory standards, making it a safe choice for companies hiring in countries with complex labor laws. Their internal processes and automatically generated contracts all prioritise staying fully compliant, which reduces misclassification and payroll errors.

With a decade in the global employment market, the provider has seen most edge cases and built processes around real-world scenarios. Their experience translates into stronger local expertise, more stable operations and better support for complex hiring situations.

Beyond core EOR services, they offer visa, mobility, and recruitment assistance. This is valuable for companies looking to relocate talent, hire internationally at speed, or source candidates in new regions all through one centralised provider.

Companies switching from another EOR or payroll provider to Pebl receive financial incentives to help cover the costs of transition. This lowers barriers for teams considering migration and encourages a smooth onboarding onto the platform.

While some countries onboard quickly, others can take significantly longer due to strict local regulations or administrative bottlenecks. This inconsistency means timelines can vary widely depending on where you hire. When we requested onboarding times for some France and Italy, we were told a 14 days onboarding period.

The FX markup used for payroll, payments, or reimbursements can be noticeably higher than market mid-rate. Most other EOR providers add a 2% FX rates markup and Pebl actually 4%. If your employee or contractor gets a US$ 10,000 monthly salary this will result in US$ 400 of monthly costs a lot. This adds up – especially for larger teams that operate in multiple currencies.

Pricing is not fully broken down publicly, and many costs such as add-ons, taxes, benefits, and FX fees become clear only after a contract or sales call. This makes it difficult to forecast the true total cost compared to providers with more open pricing structures.

Who Is Pebl Best For

This visual highlights where this provider performs best across common buyer dimensions, based on Employsome’s independent, data-driven analysis. It reflects typical real-world usage patterns rather than marketing positioning.

Compare Pebl with Others

Written by

Courtney Pocock is a Copywriter & EOR/PEO Researcher at Employsome with 15+ years of experience writing for the HR, corporate, and financial sectors. She has a strong interest in global business expansion and Employer of Record / PEO topics, focusing on news that matters to business owners and decision-makers. Courtney covers industry updates, regulatory changes, and practical guides to help leaders navigate international hiring with confidence.

Our content is created for informational purposes only and is not intended to provide any legal, tax, accounting, or financial advice. Please obtain separate advice from industry-specific professionals who may better understand your business’s needs. Read our Editorial Guidelines for further information on how our content is created.