Employer of Record in Spain (2026) – Top 10 Compared

Hiring in Spain sounds simple – until you’re dealing with Seguridad Social registration, collective bargaining agreements, payroll tax filings, and strict termination rules. Our independent Best Employer of Record in Spain guide ranks top global and regional EOR providers based on real Spanish payroll compliance, entity ownership, and local HR execution – so you can hire in Spain without setting up a company and stay fully compliant from day one.

Hiring employees in Spain isn’t always straightforward, particularly if you do not have a local Spanish entity established on the ground. Between strict labour protections under the Estatuto de los Trabajadores, mandatory social security registration with Seguridad Social, collective bargaining agreements (convenios colectivos), and IRPF income tax withholding, the regulatory environment can be complex for foreign employers. An Employer of Recordin Spain allows companies to hire employees legally without setting up a local subsidiary, while the EOR assumes responsibility for payroll processing, Seguridad Social contributions, tax compliance, and day-to-day employment administration.

Spain operates within the European Union’s single market, which includes 27 Member States and more than 440 million people, making it one of the largest integrated economic areas globally. As one of the Eurozone’s largest economies, Spain remains a strategic expansion destination supported by stable macroeconomic forecasts and continued labour market development.

For companies expanding across Southern and Western Europe, Spain is often evaluated alongside neighbouring markets such as Portugal and France, each with distinct payroll structures and labour regulations.

Selecting the right Employer of Record Spain provider is therefore essential to ensure full compliance with local employment law, social security contributions, and statutory payroll obligations.

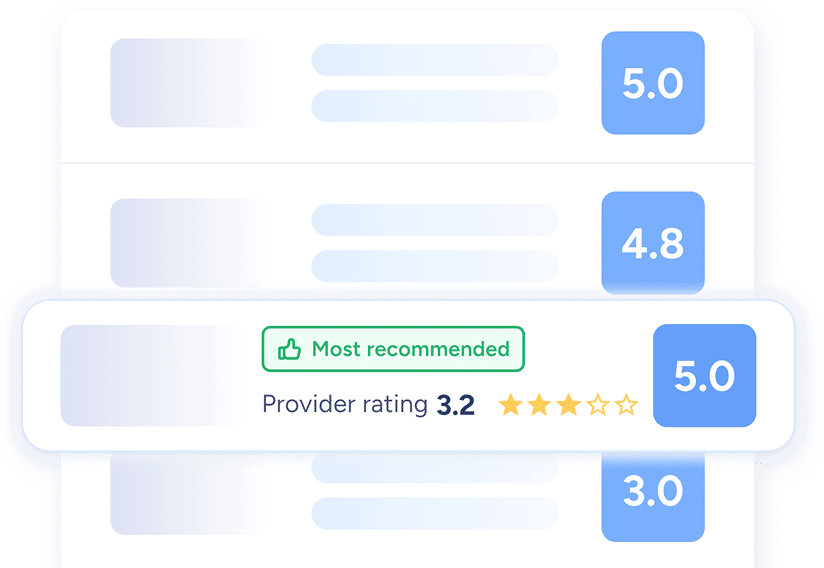

This guide compares the best Employer of Record in Spain for 2026 using a weighted global and Spain-specific scoring framework. We evaluate which providers operate through their own Spanish entities, how transparent pricing structures are, how quickly onboarding can be completed, and how robust their in-country compliance execution truly is; so you can choose an EOR Spain solution that aligns with your expansion strategy.

For broader multi-country expansion planning, our global Employer of Record comparison shows how providers perform across other European and international markets.

Quick Verdict: Best Employer of Record in Spain (Top 10)

Ø price p.m.

4.5/5

4.5/5

Ø price p.m.

4.5/5

4.4/5

Ø price p.m.

4.3/5

4.3/5

Ø price p.m.

4.2/5

4.3/5

Ø price p.m.

3.8/5

4.4/5

Ø price p.m.

4.4/5

4.0/5

Ø price p.m.

4.0/5

4.2/5

Ø price p.m.

3.4/5

4.6/5

Ø price p.m.

3.7/5

4.2/5

Ø price p.m.

2.4/5

4.1/5

Hire in Spain without an entity & compare EOR pricing. Real-time, 24/7 & for free.

Why Trust Our Best Spain EOR Comparison

100% independent. Employsome is not owned by or affiliated with any EOR provider.

Data-driven scoring. Every provider is evaluated using the same transparent scoring model, combining global capabilities with real Spanish execution.

Spain-specific verification. We independently validate whether providers operate through their own Spanish entity or rely on third-party partners, and how well they handle Spanish payroll and EOR regulations (e.g. consulting model or labour leasing?).

Built by true EOR experts. Employsome was created by former EOR founders and operators who have run payroll and compliance projects across Europe; including Spain. We know where EORs deliver and where they fall short.

In-Depth Review: Top Employer of Record Providers in Spain

Deel supports compliant employment contracts under Spanish law, manages payroll, social security contributions, and tax withholdings, and provides access to locally competitive benefits. For companies hiring in Spain long-term or planning to scale beyond a single employee, Deel offers one of the most reliable EOR setups available.

Global

Ø Fee per Employee per Month, First Year

- Enterprise-grade software

- Great price-for-value

✓ Global Coverage & Services (5.0/5): Deel provides EOR services in 150+ countries, operating through 120+ wholly owned legal entities (including Germany, UK, Spain, Australia, Canada, India, and UAE). Services include compliant employment contracts, payroll, statutory filings, terminations, country-specific benefits, immigration support, background checks, equipment provisioning via Deel IT, equity & stock option administration, and access to 200+ in-house legal experts covering local employment law.

✓ Pricing & Transparency (4.1/5): Public EOR pricing starts at USD 599 per employee/month (discounted to USD 499 in the first year in some markets). Contractor management is USD 49/month, and Deel HRIS is free. Security deposits of 1–3 months of gross salary apply in most countries. FX fees are borne by the transacting party. Optional add-ons (Deel Engage, Deel IT, time tracking) increase total cost as teams scale.

✓ Payment & Contract Terms (4.5/5): Deel offers month-to-month EOR contract flexibility with no long-term minimum commitment. Deposits are required in many countries and typically refunded within 60 days after contract termination. Payments are processed via regulated PSPs in multiple currencies. Deel Shield provides contractor misclassification protection covering up to USD 25,000 in legal costs per contractor.

✓ Customer Experience & Support (4.3/5): Deel provides 24/7 in-house chat support, with a 4.8/5 Trustpilot rating across 7,000+ reviews. Dedicated customer success managers are assigned to larger accounts. Payroll and compliance guidance is supported by Deel AI, with onboarding completed in 2–3 business days in many countries. Support is efficient but less white-glove for very small teams.

✓ Platform & Integrations (4.8/5): Deel offers a modern, self-service global HR platform with 120+ native integrations (including Workday, BambooHR, Personio, Greenhouse, QuickBooks, Xero, NetSuite, Slack, and Microsoft Teams). Supports bi-directional HRIS syncing, open API, Zapier automation, and can function as a standalone global HRIS with onboarding, PTO, documents, org charts, and compliance monitoring.

4.5/5

✓ Entity Ownership (5/5): Deel operates through its own Spanish legal entity, avoiding third-party partners and ensuring consistent service delivery and compliance.

✓ Onboarding Speed (4.5/5): Employment contracts and payroll setup typically completed within 1–2 weeks, including Social Security registration and compliant Spanish contracts.

✓ On-Site HR Support (4/5): Strong Spain-specific HR and payroll expertise with Spanish-language support; primarily remote, but highly responsive and knowledgeable on local practices.

✓ Visa & Work Permit Support (4.5/5): Solid support for Spanish work permits and residence processes via Deel’s immigration partners; reliable, though not the fastest for highly complex cases.

✓ In-Country Compliance (5/5): Full compliance with Spanish labour law, including Social Security contributions, income tax withholdings (IRPF), statutory leave, termination rules, and collective agreement considerations.

✓ Local Add-Ons (4/5): Competitive Spanish benefits packages, time-off tracking, expense management, and contractor conversion support; fewer Spain-specific “boutique” perks than local-only providers.

4.5/5

Spanish-owned local entity: Deel operates through its own Spanish legal entity, allowing it to act as the direct employer of record without relying on third-party in-country partners.

Strong Spanish labour law compliance: Deel handles Social Security registration, IRPF withholding, statutory leave, termination rules, and collective agreement considerations in line with Spanish employment law.

Automated payroll & compliance workflows: Deel’s platform automates payslips, tax filings, statutory benefits, and employment lifecycle events for Spanish employees.

Limited physical presence in Spain: While compliance and HR support are strong, Deel does not operate local walk-in offices in Spain.

Immigration handled via partners: Spanish work permits and residence processes are supported, but typically coordinated through immigration partners rather than in-house teams.

Premium pricing compared to local providers: Deel’s Spain EOR fees are higher than some Spanish-only EORs or payroll boutiques.

Deel is best suited for international companies that want a low-risk, highly compliant way to hire in Spain without opening a local entity. It’s an excellent choice for companies hiring their first employees in Spain, teams planning to scale beyond 2–3 hires and employers needing a provider that can later support multi-country expansion.

Multiplier is a global Employer of Record and HR platform that lets companies hire, onboard, pay, and manage employees in Spain without setting up a local entity. It supports employment compliance, payroll, benefits, and statutory obligations in 150 countries including Spain. Multiplier combines a technology-driven platform with human-first support, offering transparent pricing, rapid onboarding, and local compliance expertise aimed at startups through mid-sized and scaling businesses.

Global

Ø Fee per Employee per Month, First Year

✓ Global Coverage & Services (5.0/5): EOR services across 120+ countries, including contractor management, global payroll outsourcing, statutory compliance, benefits administration, and immigration support in selected jurisdictions.

✓ Pricing & Transparency (4.0/5): Generally clear pricing and competitive for scaleups at $505 per EOR contractor, though FX markups apply (stated ~2%, reported higher in some cases) and country-level cost breakdowns are not always fully transparent upfront.

✓ Payment & Contract Terms (4.5/5): No minimum contract commitment and flexible agreements. However, invoices are issued early and short payment windows (often ~7 days) can impact cash flow.

✓ Customer Experience & Support (4.5/5): Improved support quality in recent years with a solid self-service knowledge base. Support experience and escalation handling can vary by region.

✓ Platform & Integrations (4.5/5): Strong, modern platform with clean UX, efficient onboarding, and good multi-country reporting. Integration depth and automation are slightly behind top tech-first EORs.

4.5/5

✓ Entity Ownership (4.5/5): Multiplier operates through own entity called Multiplier Technologies Spain MTS SL.

✓ Onboarding Speed (4.5/5): Typically very fast onboarding with contract generation and payroll setup often completed in days to a couple of weeks.

✓ On-Site HR Support (4.0/5): Regional payroll and HR specialists provide Spain-specific guidance; support is strong but centralized.

✘ Visa & Work Permit Support (3.0/5): General immigration information and guidance available, but deep, in-house Spanish work permit sponsorship usually requires external partners.

✓ In-Country Compliance (5.0/5): Manages compliant Spanish employment contracts, payroll in EUR, tax withholding (IRPF), Social Security contributions, statutory benefits, and local filing obligations.

✓ Local Add-Ons (4.0/5): Local benefits packages, time-off tracking, expense management, and European compliance workflows; customization varies by plan.

4.4/5

Predictable pricing: Multiplier emphasizes clear cost structures with fewer hidden fees versus many competitors.

Human-first support model: 24/5 global support with dedicated account managers helps address local employment questions and operational issues.

Visa & permit support is limited: Immigration or Spanish work permit sponsorship typically requires external legal partners.

Benefits customization varies: Local benefit enhancements in Spain may be less flexible than country-specific boutique offerings.

Multiplier is a solid choice for companies looking to hire in Spain quickly and compliantly without setting up a local entity, especially where global hiring spans many countries. It works well for startups and mid-sized teams that need fast onboarding, transparent pricing, and a unified HR/payroll platform, but may be less ideal for employers needing deep bespoke local HR advisory or full immigration sponsorship in Spain.

Pebl is a global Employer of Record provider with a strong compliance-first positioning and a growing presence across Europe. In Spain, Pebl offers EOR services focused on legally robust employment, structured HR support, and reliable payroll execution. The company positions itself between highly automated global EOR platforms and local specialists, combining a solid software layer with hands-on human support for complex employment scenarios.

Global

Ø Fee per Employee per Month, First Year

- Strong global entity infrastructure

- Transparent (but high) pricing

✓ Global Coverage & Services (4.2/5): Leading global EOR coverage across core hiring markets with consistent, high-touch onboarding support. 65 own entity worldwide and 35 local partners. Well-suited for standard international hires, though invoicing and payroll complexity has been reported once companies operate across multiple markets.

✓ Pricing & Transparency (4.5/5): Clear and predictable pricing with good upfront cost visibility. Significant migration credits when transitioning from another EOR. Only downside: 3% FX markup & high bank wire fees.

✓ Payment & Contract Terms (4.2/5): Open-ended contracts without minimum commitments. Payroll cut-off on the 10th of each month with invoice issued on the 20th, payment due in 7 days. Standard, overall. If one commits to a one-year annual contract, then monthly fee drops to $599 instead of $699,

✓ Customer Experience & Support (4.3/5): 24h SLA in response times. Solid responsiveness for day-to-day operations, handled through off-shore support teams. No support offered via WhatsApp.Teams in 65+ countries, 43 languages spoken, with local experts who help you hire and support talent.

✓ Platform & Integrations (4.3/5): Modern platform designed to handle the basic EOR workflows. However, by far not as strong as its competitors. It feels Pebl is still playing “catch-up”. Integration ecosystem is solid but not as extensive as larger enterprise HR suites.

4.3/5

✓ Entity Ownership (5/5): Pebl delivers EOR services in Spain using a their own entity called Velocity Global Spain S.L. (NIF B88525712).

✓ Onboarding Speed (4.0/5): Typical onboarding timelines range from 7–14 business days, depending on documentation, contract customization, and Social Security registration.

✓ On-Site HR Support (4.0/5): Access to HR and payroll specialists familiar with Spanish labour law, employee lifecycle management, and termination processes. Support is reliable, though not deeply localized in every region.

✘ Visa & Work Permit Support (3.5/5): Advisory support for Spanish work permits and residency processes. More complex non-EU immigration cases may require external immigration partners.

✓ In-Country Compliance (4.5/5): Strong compliance with Spanish employment law, including Social Security contributions, statutory benefits, notice periods, severance rules, and collective bargaining agreements.

✓ Local Add-Ons (4.0/5): Spanish payroll, compliant contracts, statutory benefits administration, and optional private health insurance. Fewer Spain-specific benefit customizations than local specialists.

4.3/5

Compliance-first EOR model: Strong focus on correct application of Spanish labour law and payroll regulations.

Global scalability: Suitable for companies hiring in Spain as part of a broader multi-country strategy.

Spain is not a core legacy market: Local depth is solid but not as mature as Spain-native EOR specialists.

Immigration support is limited: Complex visa sponsorship often requires third-party providers.

Pebl is a strong fit for companies hiring in Spain as part of a broader European or global expansion, especially when compliance, reliability, and structured support matter more than ultra-fast onboarding. It works well for SMBs and mid-sized companies that want a dependable EOR without the cost or rigidity of enterprise-only providers. Companies looking for a deeply local Spanish specialist or highly customized immigration handling may prefer alternative options.

Oyster is a global Employer of Record platform that enables companies to hire and pay employees in Spain without the need to open a local entity. Its technology automates key employment processes; such as compliant contract generation, payroll in euros, social security withholdings, tax filings, and management of time-off and benefits while providing employer compliance infrastructure in over 100 countries.

Global

Ø Fee per Employee per Month, First Year

- B-Corp Certified

- Excellent UI/UX

- Owned entity infrastructure in most markets

✓ Global Coverage & Services (4.0/5): EOR services in 100+ countries covering employment contracts, payroll, statutory filings, expense reimbursements, and offboarding. Standardized, compliance-first delivery model.

✓ Pricing & Transparency (4.0/5): Flat EOR pricing of USD 699 per employee/month. Pricing is public and predictable. FX markups are not disclosed and can be significant depending on currency.

✓ Payment & Contract Terms (4.0/5): Invoices are net 7 days. A minimum one-month security deposit applies and may increase based on risk. Late payments accrue 1.5% daily interest.

✓ Customer Experience & Support (4.5/5): Guided onboarding, strong compliance documentation, and structured support processes. Onboarding speed varies due to regulatory checks.

✓ Platform & Integrations (4.3/5): Clean UI with core HRIS features (leave, expenses, invoicing, reporting). Fewer native integrations and automations than Deel or Remote.

4.2/5

✓ Entity Ownership (4.5/5): Operates through an owned or tightly controlled local structure.

✓ Onboarding Speed (4.0/5): Onboarding timelines influenced by social security registration and contract formalities.

✓ On-Site HR Support (4.5/5): Strong local HR expertise covering Spanish labour law and payroll.

✓ Visa & Work Permit Support (4.0/5): Advisory support only; Oyster does not directly sponsor Spanish work permits or visas and non-EU hires usually require external immigration counsel.

✓ In-Country Compliance (4.5/5): Manages compliant Spanish employment contracts, payroll in EUR, IRPF withholding, Social Security contributions, statutory leave, severance calculations, and payslip requirements.

✓ In-Country Compliance (4.5/5): Statutory and supplemental benefits administration, time-off management, employee self-service portal, and standardized HR workflows; limited bespoke Spain-specific benefit customization.

4.3/5

Payroll compliance & tax withholding: Oyster handles payroll processing in Spain, including correct income tax (IRPF) withholding, Social Security contributions, and mandatory filings on behalf of the legal employer.

Self-serve HR tooling: Oyster’s platform includes tools for managing time off, expenses, benefits, and employee records, centralised within one interface for Spanish hires as part of global EOR services.

Immigration & work permit support limited: Oyster’s platform does not focus on deep immigration or visa sponsorship services for non-EU workers in Spain, meaning complex work permit cases may need external legal support.

Benefits depth varies: While Oyster offers local benefits, the depth and range of Spain-specific benefit enhancements (such as supplementary pension plans or industry-specific allowances) are less extensive than some dedicated Spanish HR specialists.

Oyster is best suited for companies that want a clean, software-first way to hire full-time employees across multiple countries, including Spain, without building deep local HR infrastructure themselves. It works well for startups and mid-sized teams that value a unified global platform, standardized employment processes, and predictable compliance handling, but it is less ideal for employers who need hands-on local advisory, complex immigration sponsorship, or highly customized country-specific benefit structures.

Globalization Partners (G-P) is one of the longest-established global Employer of Record providers and Spain is one of its core European markets. The company operates a compliance-first EOR model, allowing international employers to hire employees in Spain without setting up a local entity, while G-P assumes full legal employer responsibility for contracts, payroll, tax withholding, and statutory benefits. G-P is particularly known for its conservative compliance approach, strong legal infrastructure, and immigration capabilities, rather than speed or pricing flexibility.

Global

Ø Fee per Employee per Month, First Year

- White-glove service

- Enterprise-grade software

✓ Global Coverage & Services (4.5/5): EOR services across 125+ countries, covering compliant employment contracts, payroll processing, statutory filings, terminations, and benefits administration. Supports contractor management (USD 39/month per contractor), global payroll, immigration and visa services, insurance and pension support, background checks, equipment procurement, and equity & stock option administration.

✓ Pricing & Transparency (3.0/5): EOR pricing typically ranges around USD 940 per employee/month plus a one-time setup fee of USD 2,820. Security deposits of 1–2.5 months of total employment cost apply depending on credit checks. FX markup estimated at ~3%. Pricing is sales-led only, with no public or self-serve country-level cost breakdowns.

✓ Payment & Contract Terms (3.0/5): Enterprise-leaning contract structures, often requiring longer minimum commitments (up to 12 months). Invoices are issued around the 15th of the month with net-7 payment terms. Late payments incur 5% interest. Offboarding fees of USD 1,000 may apply. Contracts are standardized, compliance-driven, and relatively rigid.

✓ Customer Experience & Support (4.5/5): Enterprise-grade, consultative support model with dedicated account managers, live chat (≈2-minute first response), phone support, onboarding and termination assistance, compliance alerts, and AI-supported guidance. Strong depth across HR, legal, and compliance topics.

✓ Platform & Integrations (4.0/5): Stable enterprise platform covering payroll, employment documents, time-off, expenses, reporting, and compliance workflows. Includes G-P Assist AI. SOC 2 and ISO 27001 certified. Integrations available with major HRIS/HCM systems (Workday, SAP SuccessFactors, UKG, BambooHR, HiBob). Reliable, but less automation-heavy than newer tech-first platforms.

3.8/5

✓ Entity Ownership (5/5): G-P operates through its own Spanish legal entity and does not rely on third-party in-country partners. This ensures a single accountable employer, direct payroll control, and consistent compliance with Spanish labour law.

✓ Onboarding Speed (4/5): Typical onboarding takes 5–10 business days depending on documentation, role complexity, and regional requirements. Slightly slower than software-first EORs, but reliable and well-structured.

✓ On-Site HR Support (4.5/5): Access to Spain-specific HR, payroll, and legal specialists with experience across collective bargaining agreements (CBAs), terminations, and inspections. Support is expert-level, though more formal than startup-oriented providers.

✓ Visa & Work Permit Support (4.5/5): Strong immigration capabilities, including support for Spanish work permits, EU Blue Card coordination, and relocation advisory. One of G-P’s core strengths compared to most EOR competitors.

✓ In-Country Compliance (4.5/5): Full compliance with Spanish labour law, including Social Security registration, statutory benefits, severance rules, collective agreements, and compliant employment contracts. Particularly strong in handling terminations and audits.

✓ Local Add-Ons (4/5): Spanish statutory benefits, supplemental private health insurance options, expense management, and localized contract structures. Benefits offering is solid but less customizable than some benefits-first platforms.

4.5/5

Owned Spanish entity: G-P employs Spanish workers directly through its own local entity, reducing risk and eliminating subcontractor dependency.

Best-in-class compliance: Deep expertise in Spanish labour law, termination rules, severance calculations, and regulatory changes.

Strong immigration capabilities: One of the few EORs with in-house teams supporting Spanish work permits and non-EU hiring.

High pricing: Typically among the most expensive EOR providers in Spain, especially for small teams or early-stage companies.

Slower onboarding & sales cycles than tech-first EORs: Compliance checks and legal review can slow down start dates compared to Deel or Remofirst.

Platform feels dated: Product experience is functional but less modern and automated than newer competitors.

G-P is best suited for companies that prioritize maximum legal certainty and immigration support when hiring in Spain, especially for senior roles, non-EU employees, or regulated environments. It’s a strong choice for mid-market and enterprise teams that can absorb higher costs in exchange for compliance depth, but it’s often overkill for startups or budget-sensitive teams hiring their first employee in Spain.

ThisWorks is a European Employer of Record provider with operations across several EU countries, primarily focused on compliant employment and payroll services within Europe. While the company has an established track record in other European markets, Spain is a newer EOR market for ThisWorks, launched in early 2025. In Spain, ThisWorks operates through its own Spanish legal entity, allowing it to act as the direct employer of record rather than relying on third-party partners. The company positions itself between local specialists and global EOR platforms, combining European compliance expertise with a service-led delivery model.

Regional

Ø Fee per Employee per Month, First Year

✓ Global Coverage & Services (4.0/5): Focused regional EOR with deep expertise in key European markets (Netherlands, UK, Germany, Poland, Spain). While coverage is not global, ThisWorks is widely used as a trusted in-country partner by larger global EORs in these markets – making them a strong choice if you want to work directly with the execution layer rather than via intermediaries.

✓ Pricing & Transparency (4.5/5): Clear pricing once engaged, with no hidden post-contract fees. Pricing is quote-based and not publicly listed, reflecting a service-led, white-glove model rather than a self-serve SaaS approach.

✓ Payment & Contract Terms (4.4/5): High-quality, compliant European employment contracts with strong legal structuring and risk mitigation. More traditional contract setup, but robust and well suited for regulated EU environments.

✓ Customer Experience & Support (4.8/5): Standout strength. White-glove, senior-level local support with deep labour-law and immigration expertise. Particularly strong for complex cases in the Netherlands and UK.

✓ Platform & Integrations (Not Rated): No proprietary HRIS or automation-heavy platform. ThisWorks is intentionally service-first; platform experience is not rated to avoid penalising hands-on local execution.

4.4/5

✓ Entity Ownership (5/5): ThisWorks operates through its own Spanish legal entity, enabling direct employment, payroll processing, and legal responsibility under Spanish labour law.

✓ Onboarding Speed (3.5/5): As a newly launched Spain EOR offering, onboarding typically takes 7–14 business days. Processes are compliant but still maturing compared to long-established Spain providers.

✓ On-Site HR Support (4.0/5): Access to European HR and payroll specialists with Spain-specific knowledge. Support is competent, though Spain-specific operational depth is still building post-launch.

✘ Visa & Work Permit Support (3.0/5): Provides advisory support on Spanish work permits and residency requirements. Does not yet offer end-to-end immigration handling comparable to immigration-heavy providers.

✓ In-Country Compliance (4.5/5): Strong compliance framework covering Social Security, statutory benefits, employment contracts, terminations, and collective bargaining agreements, leveraging ThisWorks’ broader EU experience.

✓ Local Add-Ons (3.5/5): Spanish payroll, compliant employment agreements, statutory benefits administration, and HR support. Benefits customization and advanced add-ons are more limited at launch stage.

4.0/5

Owned Spanish entity: ThisWorks operates through its own Spanish legal entity, acting as the direct employer of record and avoiding third-party in-country partners.

Strong EU compliance expertise: Built on years of operating across multiple European countries, with solid handling of Spanish labour law, Social Security, CBAs, and termination rules.

Hands-on HR support based on Holland: Service-led model with access to European HR and payroll specialists, well-suited for companies that value human support over automation.

Spain EOR offering is new: Spain launched in 2025, so the local track record is shorter than long-established Spain-only providers.

Limited automation and integrations: Platform capabilities are functional but less advanced than software-first EORs like Deel or Rippling.

ThisWorks is a good fit for companies hiring within Europe, including Spain, that want a European compliance-focused EOR without the complexity or cost of large global platforms. It suits SMEs and mid-sized companies expanding into Spain as part of a broader EU strategy, especially when compliance and hands-on support matter more than advanced software automation. Companies looking for a long-established Spain-only specialist or a highly automated global EOR may find better alternatives.

Rippling is a global HR and payroll platform that offers Employer of Record services in Spain as part of its broader workforce management suite. Through its EOR setup, Rippling enables companies to hire employees in Spain compliantly while managing payroll, taxes, social security, and statutory benefits through a single, highly automated platform. Its main strength in Spain is the integration of EOR with HR, IT, and finance workflows, making it a strong option for companies that already use – or want to centralize around – the Rippling ecosystem.

Global

Ø Fee per Employee per Month, First Year

- Strong for U.S. based businesses

- Enterprise-grade software

✓ Global Coverage & Services (4.0/5): Growing EOR coverage paired with a very broad service ecosystem spanning U.S. PEO, HRIS, global payroll, benefits (focus on the U.S.), and spend management. Strong variety in solutions, though depth and consistency still vary by country as global coverage continues to expand.

✓ Pricing & Transparency (3.0/5): Modular pricing model offers flexibility, but EOR pricing lacks upfront clarity. Sales cycle was also very challenging to navigate through.

✓ Payment & Contract Terms (4.0/5): Flexible, open-ended contracts without any minimum commitment.

✓ Customer Experience & Support (4.0/5): Experienced local EOR advisors and user-friendly payroll cycles in supported regions. Again, support quality can vary by country and is more product-led than white-glove for more complex hiring cases.

✓ Platform & Integrations (5.0/5): Together with Deel, best-in-class unified platform combining HR, IT, and finance with advanced automation and many integrations. Platform depth may exceed the needs of smaller or less complex teams and more tailored towards enterprises.

4.0/5

✓ Entity Ownership (3/5): Rippling does not publicly confirm a fully owned Spanish EOR entity and commonly operates through local partners for Spain employment compliance.

✓ Onboarding Speed (4/5): Onboarding typically completed within 5–10 business days, supported by automated contract generation and document collection.

✓ On-Site HR Support (4/5): Regional payroll and HR specialists provide Spain-specific guidance; no dedicated in-country Spanish HR team publicly disclosed.

✘ Visa & Work Permit Support (2/5): Rippling offers limited advisory support only; work permits and non-EU visa sponsorship require external immigration providers.

✓ In-Country Compliance (5/5): Manages Spanish payroll in EUR, IRPF income tax withholding, Social Security contributions, statutory leave, severance calculations, and compliant employment contracts.

✓ Local Add-Ons (4/5): Benefits administration, paid time-off tracking, expense management, and employee self-service; Spain-specific benefit customization is limited.

4.2/5

Best-in-class platform: Rippling combines EOR, global payroll, HRIS, IT device management, app access control, and identity management in one unified system, which is significantly more advanced than most EOR-only providers.

Fast, automated onboarding: Contract generation, document collection, and payroll setup are largely automated, allowing most Spain hires to be onboarded within 5–10 business days.

Entity Ownership: Rippling operates EOR services in Spain through its own legal entity, allowing it to employ workers directly without relying on third-party in-country partners.

Limited immigration support: Rippling does not directly sponsor Spanish work permits or visas and only offers high-level advisory support, requiring external immigration providers for non-EU hires.

Less local advisory depth: While compliance execution is strong, Rippling provides less hands-on, country-specific HR guidance than boutique Spanish EOR specialists.

Overkill for small teams: Companies hiring only one or two employees in Spain may find Rippling’s platform complexity and pricing unnecessary compared to simpler EORs.

Rippling in Spain is best suited for companies that want to manage Spanish employees alongside global teams within a single, highly integrated HR and IT platform. It’s an especially strong fit for tech-driven organizations that value automation, centralized payroll and device management, and already use (or plan to use) Rippling for HR, payroll, or IT, but it’s less ideal for teams that only need basic EOR services or require hands-on, locally focused HR advisory in Spain.

Iberia EOR is a Spain-focused EOR provider specializing in compliant employment, payroll, and HR administration within Spain. They’re a sub-brand of UAE-based Connect Resources and based out of Dubai. The provider positions itself as a local specialist rather than a global platform, offering hands-on support, deep familiarity with Spanish labour law, and direct management of employment relationships. Iberia EOR is primarily used by companies hiring exclusively in Spain or the Iberian region.

Global

Ø Fee per Employee per Month, First Year

✓ Global Coverage & Services (3.5/5): Strong Spain-focused EOR provider with limited regional coverage (Spain, Portugal, Germany). Delivers compliant local employment, payroll, and immigration support, but does not offer multi-country payroll consolidation, global contractor management, or international HR tooling. Best suited for Spain-only or Iberia-centric hiring.

✓ Pricing & Transparency (3.0/5): Pricing is clearly communicated during sales conversations for Spain-specific EOR services, with no hidden FX markups for local payroll. However, no public pricing is available, and costs are negotiated case-by-case, reducing predictability at scale.

✓ Payment & Contract Terms (3.0/5): Flexible, service-led contracts without mandatory long-term lock-ins for Spain-only engagements. Contract terms are not standardized across countries and are less suitable for coordinated multi-country rollouts.

✓ Customer Experience & Support (4.2/5): High-quality local support with Spanish-speaking HR, payroll, and immigration specialists. Direct access to in-country experts is a key strength, though there is no global follow-the-sun support model and escalations outside Spain are limited.

✓ Platform & Product Experience (Not Rated): As a small, service-led local provider, Iberia does not offer a proprietary HRIS or self-service platform. This category is excluded to avoid penalising strong local execution in favour of software depth.

3.4/5

✓ Entity Ownership (5/5): Iberia Employer of Record operates through its own Spanish legal entity and acts as the direct employer of record, without subcontractors or layered partner structures.

✓ Onboarding Speed (4.0/5): Employee onboarding typically takes 5–10 business days once documentation is complete. Immigration-led hires depend on visa timelines but onboarding itself is efficient and well-coordinated.

✓ On-Site HR Support (5.0/5): Strong Spain-based HR and payroll team providing hands-on, local-language support across the full employee lifecycle. Particularly strong in handling employee questions, payroll issues, audits, and labour authority interactions.

✓ Visa & Work Permit Support (5.0/5): End-to-end immigration execution, including document preparation, application filing, compliance checks, and coordination with Spanish authorities. IberiaEOR manages employment visas, work permits, and employee relocation directly, with typical processing timelines of 1–3 months depending on case complexity and document readiness.

✓ In-Country Compliance (5.0/5): Deep expertise in Spanish labour law, Social Security registration, statutory benefits, collective bargaining agreements, and termination rules. IberiaEOR assumes full compliance responsibility and actively manages regulatory adherence throughout employment.

✓ Local Add-Ons (4.5/5): Comprehensive local services including EOR and PEO services, payroll outsourcing, employee relocation, visa processing, and HR administration. Strong depth for Spain-focused hiring, though limited outside the region.

4.6/5

Full-service Spain offering: Covers EOR, PEO services, payroll outsourcing, and employee relocation, making it a comprehensive local solution for Spain-only hiring.

Best-in-class immigration support: End-to-end handling of Spanish work permits, employment visas, and employee relocation, including document preparation, filings, and compliance with Spanish immigration authorities.

No multi-country coverage: Iberia Employer of Record is Spain-focused and not suitable for companies planning international expansion beyond Spain.

No proprietary EOR software platform: Service delivery is largely manual and human-led, with limited self-service tooling compared to global EOR platforms.

Iberia Employer of Record is best for companies that want to hire in Spain only and need deep, hands-on local expertise rather than a global EOR platform. It’s a strong fit for employers hiring non-EU nationals, managing work permits and relocations, or dealing with complex Spanish labour-law requirements where local language, local presence, and immigration know-how really matter. IberiaEOR works especially well for small to mid-sized teams, professional services firms, and companies entering Spain for the first time who value compliance certainty and human support over software automation or multi-country scalability.

WorkMotion is a Berlin-based global Employer of Record (EOR) and HR platform founded in 2020 that helps companies hire, onboard, pay, and manage employees in over 100 countries without establishing local legal entities. Their automated platform combines contract generation, payroll, compliance, and onboarding workflows with local legal and payroll infrastructure to deliver compliant employment in new markets quickly. WorkMotion emphasizes global coverage, transparent pricing, and compliance automation, enabling fast expansion across Europe, Asia, the Americas, and beyond.

Global

Ø Fee per Employee per Month, First Year

✓ Global Coverage & Services (4.0/5): Strong European EOR coverage with compliant employment contracts, payroll, statutory filings, terminations, and benefits administration. Immigration and recruitment add-ons are available in selected markets. Coverage outside Europe is more limited, and service depth varies between owned-entity and partner countries.

✗ Pricing & Transparency (2.8/5): Base EOR pricing starts at $694 per employee/month with $0 setup and bank wire fees. However, pricing includes mandatory deposits (one-time 2× total employment cost) and an ongoing 6.5% of gross salary severance accrual. FX markup is not clearly disclosed, and additional costs apply for offboarding ($465 / €399) and client-initiated terminations.

✓ Payment & Contract Terms (3.5/5): Minimum commitment of 3 months with a 30-day notice period. Invoices are issued on the 1st of the month and payable within 10 days. Supports payments in EUR, USD, GBP, and CHF via bank transfer. Payroll cut-off differs by model (15th for owned entities, 10th for partner countries). Late payment interest applies.

✓ Customer Experience & Support (4.0/5): Dedicated account manager included, with ~24-hour first response time and phone support. Strong, compliance-first advisory approach. Onboarding and termination support included. No live chat, WhatsApp support, AI assistance, or automated compliance alerts. Support quality can vary slightly by country.

✓ Platform & Integrations (4.0/5): Clean, functional HRIS covering onboarding, contracts, payroll, time-off, expenses, and reporting. Integrates with Personio, HiBob, BambooHR, and Workday. Self-service help center available. No mobile app, and automation, analytics, and customization are more limited than top-tier, tech-first EOR platforms.

3.7/5

Entity Ownership (5.0/5): Operates with a local Spanish legal entity, enabling direct employment without relying on third-party in-country partners.

Onboarding Speed (4.0/5): Typical onboarding takes 1–2 weeks depending on role complexity, regional requirements, and documentation readiness.

On-Site HR Support (4.5/5): Spanish employment specialists available; strong understanding of local labor law, collective agreements, and termination procedures.

Visa & Work Permit Support (4.0/5): Supports work permit and residency coordination via immigration partners; not positioned as a high-volume immigration specialist but reliable for standard cases.

In-Country Compliance (4.5/5): Full compliance with Spanish labor law, social security registrations, payroll tax filings, statutory leave, severance calculations, and contract requirements.

Local Add-Ons (3.5/5): Statutory benefits handled fully; supplemental benefits and flexible perks are available but more limited compared to premium global EORs.

4.2/5

Owned Legal Entity Presence: WorkMotion operates its own legal entities in Spain, which typically improves compliance consistency and service quality.

Good Service Support in Spanish Market: Local expertise and German/European support structures make it easier for DACH/EU clients hiring in Spain.

Higher Cost Structures: Mandatory security deposits and severance accrual practices can make Spain hiring via WorkMotion more expensive than with some competitors.

Limited Add-Ons in Spain: Compared to some EOR competitors, WorkMotion’s local services (like equipment procurement, equity administration) are more limited.

Weak Pricing Transparency & High Deposits: Mandatory security deposits, severance accruals (up to 6.5%), and FX markups make total cost harder to predict.

WorkMotion is best suited for companies that prioritize legal certainty and structured compliance over cost efficiency. It works well for European or international firms hiring long-term employees in Spain who want a conservative, low-risk employment setup and are comfortable with higher fees. It is less suitable for startups, budget-sensitive teams, or companies seeking maximum flexibility and fast experimentation in the Spanish market.

Parakar is a regional European Employer of Record and payroll specialist with a focus on EU markets including Spain. Their model blends compliance expertise with flexible service delivery and is particularly focused on supporting companies that want local advisory and operational execution across Europe. Parakar emphasises transparency, legal alignment with EU labour laws, and custom service offerings rather than rigid global software footprints making it a different fit compared to larger global EORs.

Regional

Ø Fee per Employee per Month, First Year

- Europe-Focus

✓ Global Coverage & Services (3.0/5): Strong coverage across multiple European countries with deep local HR and compliance expertise. However, Parakar has no meaningful reach outside Europe and is not suitable for global or multi-continent hiring strategies.

✗ Pricing & Transparency (1.0/5): High setup fees (≈ USD 750) and high monthly EOR fees (≈ USD 750 per employee). Additional charges apply for variable pay, off-cycle payroll, FX (reported up to 8%), onboarding, offboarding, and country-specific extras, resulting in unpredictable monthly costs.

✓ Payment & Contract Terms (3.0/5): Traditional European service contracts with predictable structures, but includes a 3-month commercial notice period and limited flexibility for short-term or fast-scaling hiring needs.

✓ Customer Experience & Support (4.0/5): Strong, human-led support model with experienced local HR teams. Well suited for complex payroll, visa processes, and statutory requirements, though support is limited to EU time zones and not designed for high-volume or self-service workflows.

✗ Platform & Integrations (1.0/5): No proprietary HRIS or software platform. No integrations with HR, finance, or ATS systems. Processes rely heavily on email, manual workflows, and third-party tools.

2.4/5

✓ Entity Ownership (5/5): Parakar operates through its own Spanish legal entity and does not rely on third-party in-country partners in Spain. This allows Parakar to act as the direct employer of record, maintain payroll control, and take full legal responsibility under Spanish labour law.

✓ Onboarding Speed (4/5): Onboarding in Spain typically takes 5–10 business days, depending on role complexity, regional Social Security registration, and contract customization. Not the fastest in the market, but predictable and compliant.

✓ On-Site HR Support (4.5/5): Strong Spain-based HR and payroll expertise with hands-on support for local employment questions, contract interpretation, and employee lifecycle management. Particularly strong for companies unfamiliar with Spanish labour practices.

✘ Visa & Work Permit Support (3/5): Parakar provides advisory support around Spanish work permits and residency requirements but does not operate a large in-house immigration team. More complex or non-EU immigration cases may require external counsel.

✓ In-Country Compliance (4.5/5): Full compliance with Spanish employment law, including Social Security contributions, statutory benefits, termination rules, and alignment with applicable collective bargaining agreements (CBAs). Well-suited for risk-averse employers.

✓ Local Add-Ons (3.5/5): Supports Spanish payroll, statutory benefits, compliant employment contracts, and HR administration. Benefits customization and broader add-ons (equity, advanced benefits, equipment programs) are more limited than global EOR platforms.

4.1/5

Regional employment expertise: Parakar’s core strength lies in its detailed understanding of EU labour laws and statutory requirements, including Spain.

Customized service approach: More tailored compliance, advisory, and operational execution than many global “one-size-fits-all” EOR platforms.

Slower onboarding: Manual contract approvals and regional compliance checks can lengthen onboarding time compared to tech-first EORs.

No modern platform experience: Parakar only uses a service approach and does not have a platform-

Parakar is a good fit for companies that prioritise European labour law expertise and tailored compliance support when hiring in Spain, especially if they are focused on broader EU expansions rather than fast global scale. It works well for teams that value regionally nuanced advisory and payroll accuracy over highly automated, software-centric hiring workflows, but is less suitable for startups or companies seeking fully self-serve tools and rapid onboarding.

How We Score & Rank Employer of Record Providers in Spain

Selecting the best Employer of Record in Spain means evaluating both the EOR’s global service delivery capabilities as well as how well an EOR actually performs on the ground in Spain.

Our scoring model reflects this by combining two independent evaluations, the Global EOR Score and the Spain EOR Score.

Global EOR Score – Overall provider performance (Weighted 40%)

This score measures an EOR provider’s overall quality across all countries, focusing on how reliably the service performs once you are actively using an EOR at an international level. It includes:

- Global Coverage & Services. Breadth of country coverage, delivery model (owned entities vs. in-country partners), and availability of services such as global payroll, contractor management, recruitment, equipment provisioning, and immigration support.

- Pricing & Transparency. Clarity of the full cost structure, including base fees, FX mark-ups, security deposits, termination fees, and add-ons.

- Payment & Contract Terms. Minimum commitments, notice periods, invoicing cycles, payment terms, and flexibility to exit or amend contracts.

- Customer Experience & Support. Responsiveness of the support team, depth of EOR expertise, and quality of issue resolution.

- Platform & Integrations. Usability of the software, onboarding workflows, employee self-service, payslips, reporting, integrations, and platform reliability.

Spain EOR Score – On-the-ground performance

- Entity Ownership & Compliance. Whether the EOR operates through its own Spanish legal entity or relies on an in-country partner.

- Onboarding Speed. Speed and reliability of issuing compliant Spanish employment contracts and setting up payroll.

- Local HR & Payroll Support. Availability of Spanish-speaking HR and payroll specialists familiar with local labor regulations.

- Visa & Work Permit Support. Ability to support the legal hiring of non-EU nationals under Spanish immigration rules.

- Local Add-On Services. Spanish benefits administration, equipment provisioning, termination support, and local HR advisory.

How The Final Rankings Work

Final rankings use a 60% Spain score + 40% global score, ensuring local execution matters more than marketing claims made by EORs.

Best Spain EOR for Every Use Case (2026)

Choosing the best Employer of Record in Spain depends on your hiring plans, budget, and how quickly you want to enter the Spanish market. Below, we highlight the best EOR providers in Spain for the most common real-world hiring scenarios.

Best Overall EOR for Hiring in Spain → Deel

Deel stands out as the best all-around Employer of Record in Spain thanks to its combination of strong local execution and enterprise-grade global software platform. Deel operates through its own Spanish legal entity, enabling fast, fully compliant onboarding under Spanish labor law, including social security registration, payroll, and statutory benefits.

The Deel platform handles complex requirements such as automatically-created Spanish employment contracts and automated tax remittances, while still offering one of the most polished EOR software experiences on the market. For companies looking to hire in Spain quickly, compliantly, and at scale without sacrificing visibility or control, Deel remains the most reliable overall choice.

Best EOR for Budget-Sensitive Hiring → ThisWorks

ThisWorks is the most budget-friendly EOR option in Spain because it focuses on lean, local execution rather than expensive global infrastructure. The European regional EOR operates through its own Spanish legal entity and keeps pricing competitive as it mainly caters larger EORs as a reseller and also doesn’t offer a complex (and expensive to develop). There are no unnecessary setup fees and FX fees since ThisWorks is invoicing in the payroll currency directly: EUR.

For companies that want compliant hiring in Spain at the lowest possible ongoing cost, without paying for global coverage and software they don’t need: ThisWorks is the most cost-efficient choice.

Best Local Spanish Specialist EOR → Iberia EOR

Iberia EOR is the best choice when looking for a true local Spanish employment specialist. Operating through its own Spanish entity (of course) and local legal, HR and payroll team, Iberia EOR handles the whole end-to-end hiring process via its onsite Spanish team. For companies looking to hire in Spain only wanting to work with a local specialist rather than a global EOR, we believe Iberia EOR is the way to go.

Best EOR for Immigration & Work Permits → Pebl

Pebl, formerly known as Velocity Global, is well-known to have a strong global mobility and immigration function. For Spain in particular, they have a local Spain based in-house legal and mobility team to ensure a smooth process for its clients, making Pebl a reliable partner when hiring non-EU nationals in Spain. Note that Pebl’s services for Spain start from $1,000 per month per expatriate (white glove, premium-price).

Best EOR for Hiring Executives in Spain → Oyster

Oyster is the strongest option for executive hiring in Spain because it handles senior-level employment complexity better than most EORs. This includes tailored Spanish employment contracts, support for executive titles (e.g. Director, VP, Managing Director), variable compensation structures, and higher-risk termination scenarios under Spanish labour law. Oyster also tends to provide more hands-on account management for senior hires, which matters when contracts, notice periods, and severance exposure need to be handled carefully.

Legislation on Employer of Record in the Spain

Unlike in countries with specific EOR legislation, Spain does not currently have a formal legal framework that recognises the traditional Employer of Record model in the way it exists in the United States, United Kingdom, or Canada. Only licensed Temporary Work Agencies (ETTs) are permitted to lease employees to third parties.

As a result, most EORs in Spain operate using a consulting-style employment model, rather than a classic labour leasing framework. This approach is widely used by global EOR providers operating in Spain, but it must be structured carefully to avoid reclassification risks.

Key best practices include:

- The EOR remains the legal employer at all times

- The client does not act as a Spanish employer and typically does not hold a Spanish legal entity

- Employees usually work remotely, not from the client’s local offices

- Clear separation between HR/employment responsibility and day-to-day operational supervision

Spanish legal experts have raised concerns where EOR arrangements begin to resemble labour leasing too closely. In practice, however, well-structured EOR models are widely used and accepted in Spain when these boundaries are clearly respected.

How Most EORs Operate in Spain

As mentioned above, most Employer of Record providers setup their local entity as a consulting entity and hire EOR employees under a service/consulting setup. Others may partner with local EORs that are in fact authorised to operate as Temporary Employment Agency.

For example, EORs such as Rippling (Rippling Spain SL) or Oyster HR (Oyster HR Spain SL) operate as local consulting entity and do not possess any valid employment agency license.

On the contrary, providers such as SafeGuard Global (Safeguard Global Ett SL) and WorkMotion (Workmotion Spain Employment Services Ett SL) are fully licensed as a Spanish Temporary Employment Agency. This can be spotted through the addition of “Ett” as part of the legal entity name, which stands for Empresa de Trabajo Temporal (in English: Temporary Employment Agency).

Practical Guidance for Employers Considering an EOR in Spain

- Check entity and licence status. Ask whether the EOR operates through a Spanish legal entity or relies on local partners/consultancy structures, and whether they are authorised as an ETT where that is relevant (spotted by the addition of “Ett” to its legal entity name).

- Clarify employment vs. consultancy. Ensure the contract and service model do not simply describe an outsourcing or “consultancy” relationship that could be reclassified under Spanish labour law.

- Understand local compliance. Verify the provider’s expertise with Spanish employment contracts, collective bargaining agreements (convenios colectivos), social security, payroll withholding, and statutory rights.

💡 Employsome Tip: Precautions to Structure an EOR in Spain

When using an EOR in Spain, the safest and most common approach is to keep EOR workers fully remote. Avoid having them work from the client’s local offices, as on-site presence can increase the risk of the arrangement being viewed as labour leasing rather than an employment administration model.

Hiring in Spain: What You Need to Know

Spain has one of the most employee-protective labour frameworks in Europe. While this offers strong stability for workers, it also means employers must follow strict rules around contracts, payroll, working hours, and termination. Understanding these fundamentals is critical before making your first hire.

Employment Contracts

In Spain, indefinite (permanent) contracts are the default. Fixed-term contracts are allowed only in limited circumstances and are closely monitored by labour authorities. Misusing temporary contracts often results in automatic conversion to permanent employment, along with penalties. This is a major compliance risk for inexperienced EORs or consulting-style providers.

Contracts must clearly define salary, job role, working hours, and compensation structure. Spanish law also strongly restricts probation periods, which are typically capped between 2 and 6 months, depending on role and agreement.

Payroll, Social Security & Employer Costs in Spain

Spain has one of the highest employer social security burdens in Europe.

Employers typically pay approx. 30% of the employee’s gross salary in employer contributions, covering:

• Social Security (pensions, healthcare, unemployment)

• Work accident insurance

• Professional training contributions

Payroll is usually run monthly, with salaries paid on the last business day of the month. Local payslips must follow strict Spanish formatting rules (usually created directly from the payroll system).

For companies used to lighter payroll regimes, Spain can feel expensive and administratively heavy, which is why EORs with real local payroll expertise matter far more here than in simpler markets.

Working Hours, Overtime & Leave

The standard working week in Spain is 40 hours. Overtime is regulated and must be compensated or offset with time off, subject to annual limits.

Employees are entitled to 30 calendar days of paid annual leave, plus national and regional public holidays. Vacation days cannot generally be replaced with cash, except upon termination.

Termination Rules & Severance Risk

Termination is one of the highest-risk areas when hiring in Spain. Unless the termination can actually be proven with disciplinary reasons, employers are generally required to pay statutory severance, typically:

- 20 days’ salary per year of service for objective dismissal

- 33 days’ salary per year of service for unfair dismissal (up to statutory caps)

Because severance obligations can be material, the best Spain EOR service providers will often require a EOR security deposits or conservative risk buffers before onboarding employees. This is not a red flag. It’s a sign the EOR understands Spanish labour law.

Contractors Are Heavily Scrutinized

Spain applies strict rules around contractor classification. Independent contractors (autónomos) who work under direction, fixed schedules, or economic dependency are frequently reclassified as employees. Misclassification can lead to retroactive social contributions, fines, and employment recognition.

For long-term or integrated roles, employment through an EOR is usually far safer than contractor arrangements.

Visas & Work Permits for Non-EU Nationals

Especially many Latin Americans want to work in Spain as they speak the same language. Hiring non-EU employees requires valid work authorization and residence permits. Processing times can take several months, and employers must meet compliance requirements. Not all EOR providers support immigration in Spain, so this should be confirmed upfront.

Final Verdict on Best EOR in Spain (2026)

Having reviewed over 100 EOR providers operating in Spain and deeply vetting how they deliver their services, we’ve summarised in this article our top recommendations for hiring in:

- 🌟 Best EOR for hiring in Spain overall: Deel – with its own legal entity LetsDeel Spain S.L., an enterprise-ready & best-in-class software solution along with strong support systems, Deel is our no. 1 choice for EOR in Spain.

- 💰 Best EOR for budget-sensitive hiring: ThisWorks – the European regional EOR scores with a local team in Spain paired with white-glove services, all at a very affordable price-tag,

- 📍 Best local Spanish specialist EOR: Iberia EOR – office in Barcelona and strong local expertise into labour-related topics in Spain incl. work permit sponsoring.

- 🪪 Best EOR for immigration & work permits: Pebl (Velocity Global) – Spain being one of the core markets in Europe for Pebl, they have long-standing on-site experience and well equipped with a dedicated mobility team to support.

- ⚠️ Best EOR for hiring executives: Oyster HR – the UK-based Europe-focused global EOR is a good choice when looking to hire leadership roles in Spain. Oyster offers a dedicated account manager and allows for executive job titles (e.g. Chief Technology Officer).

Our above best Spanish EOR recommendations have been created looking at actual EOR service delivery, compliance strength and customer experience, not marketing claims or paid placements.

Frequently Asked Questions on Spain EOR

An Employer of Record in Spain is a third-party company that legally employs workers on your behalf, handling payroll, taxes, contracts, and compliance with Spanish labour law while you manage day-to-day work.

Yes. Our global Employer of Record comparison covers worldwide EOR performance.

Yes. EOR services are legal in Spain as long as employment contracts, payroll, and labour-law obligations comply with Spanish regulations, including social security and collective agreements.

No. An EOR allows you to hire employees in Spain without setting up a Spanish legal entity, saving time, cost, and administrative complexity.

Most EOR providers in Spain charge €300–600 per employee per month, plus pass-through employment costs such as social security and benefits.

Hiring through an EOR in Spain typically takes 5-15 business days, depending on contract complexity and documentation.

Spanish employer social security contributions usually add 30–35% on top of gross salary, covering pensions, unemployment insurance, and other statutory contributions.

Some EOR providers can support work permits and residence visas for non-EU nationals, but immigration services vary by provider and should be confirmed upfront.

Yes. Applicable collective bargaining agreements (convenios colectivos) still apply when using an EOR and may affect salary, working hours, bonuses, and leave entitlements.

Most EORs support employee transfers to your own Spanish entity once it’s established, typically after 12–24 months of EOR employment.

For long-term or integrated roles, an EOR is usually safer. However, this solely depends on your companies overall hiring plans, budget and compliance/risk appetite. Spain strictly enforces contractor classification and misclassification can lead to fines and retroactive social security payments.

Written by

Courtney Pocock is a Copywriter & EOR/PEO Researcher at Employsome with 15+ years of experience writing for the HR, corporate, and financial sectors. She has a strong interest in global business expansion and Employer of Record / PEO topics, focusing on news that matters to business owners and decision-makers. Courtney covers industry updates, regulatory changes, and practical guides to help leaders navigate international hiring with confidence.

Our content is created for informational purposes only and is not intended to provide any legal, tax, accounting, or financial advice. Please obtain separate advice from industry-specific professionals who may better understand your business’s needs. Read our Editorial Guidelines for further information on how our content is created.