Table of Contents

Are you planning to hire employees in France without setting up a local legal entity? This guide ranks the best Employer of Record providers in France, helping you compare pricing, entity ownership, compliance structure, and execution under French labour law. Given France’s strict labour code (Code du Travail), extensive collective bargaining coverage, and high employer social contributions, choosing the right Employer of Record in France is critical for compliant and scalable hiring.

An Employer of Record France solution enables foreign companies to hire employees legally in France while the EOR becomes the official employer for payroll processing, tax withholding, and statutory compliance. This structure is particularly valuable in France, where termination protections, social security contributions, and mandatory employee benefits are heavily regulated and actively enforced.

France is one of the European Union’s largest labour markets, with an employment rate of 75.0% among people aged 20–64 in 2023 and more than 30 million people in employment, underscoring the scale and complexity of its workforce environment.

As one of Europe’s largest economies, France remains a strategic expansion destination for multinational companies, with recent economic growth data reinforcing its continued importance in global expansion strategies. This combination of economic scale and strict employment regulation makes selecting the right Employer of Record France provider essential for reducing compliance risk and accelerating market entry.

At Employsome, our rankings are based on structured evaluation criteria including entity ownership, local compliance depth, pricing transparency, onboarding speed, and in-country execution capabilities. We independently assess each Employer of Record in France to provide a data-driven comparison framework designed for founders, CFOs, and global hiring teams making high-stakes expansion decisions.

If you are also evaluating neighboring markets, see our guide to the best EOR providers in Germany or explore our full global Employer of Record comparison for a broader international overview.

Quick Verdict: Best Employer of Record in France

Ø price p.m.

4.5/5

4.6/5

Ø price p.m.

3.8/5

4.7/5

Ø price p.m.

4.2/5

4.4/5

Ø price p.m.

4.5/5

4.0/5

Ø price p.m.

4.0/5

4.1/5

Ø price p.m.

3.4/5

4.4/5

Ø price p.m.

3.9/5

3.3/5

Ø price p.m.

2.4/5

4.2/5

Why Trust Our Best France EOR Guide

Independent and unbiased. Employsome is not owned by, affiliated with, or funded by any EOR provider. Providers cannot pay to influence our rankings. We deliberately highlight both strengths and limitations so you can make a genuinely informed decision.

Data-driven EOR scoring. Every provider is evaluated using our Global EOR Score alongside a dedicated France local score. This framework assesses pricing transparency, contract terms, platform quality, support responsiveness, and real on-the-ground execution in France.

Verified France-specific data. We independently validate each EOR’s French setup, including whether services are delivered via portage salarial or a classic EOR model, local entity registration, and the depth of in-country servicing capabilities.

Built by former EOR operators. Employsome was created by people who have operated EOR, payroll, and labour-leasing models at scale. We’ve seen where providers deliver – and where they overpromise. Our goal is to bring clarity, accuracy, and realism to companies hiring in France.

In-Depth Review: Top Employer of Record Providers in France

Deel is one of the world’s leading EOR providers and remains a top choice for hiring in France. They are known for their fast,all-in-one platform available in multiple languages, including French. Deel uses the Portage Salarial model, which allows companies to hire remote professionals quickly, legally, and without unnecessary bureaucracy.

Global

Ø Fee per Employee per Month, First Year

- Enterprise-grade software

- Great price-for-value

✓ Global Coverage & Services (5.0/5): Deel provides EOR services in 150+ countries, operating through 120+ wholly owned legal entities (including Germany, UK, Spain, Australia, Canada, India, and UAE). Services include compliant employment contracts, payroll, statutory filings, terminations, country-specific benefits, immigration support, background checks, equipment provisioning via Deel IT, equity & stock option administration, and access to 200+ in-house legal experts covering local employment law.

✓ Pricing & Transparency (4.1/5): Public EOR pricing starts at USD 599 per employee/month (discounted to USD 499 in the first year in some markets). Contractor management is USD 49/month, and Deel HRIS is free. Security deposits of 1–3 months of gross salary apply in most countries. FX fees are borne by the transacting party. Optional add-ons (Deel Engage, Deel IT, time tracking) increase total cost as teams scale.

✓ Payment & Contract Terms (4.5/5): Deel offers month-to-month EOR contract flexibility with no long-term minimum commitment. Deposits are required in many countries and typically refunded within 60 days after contract termination. Payments are processed via regulated PSPs in multiple currencies. Deel Shield provides contractor misclassification protection covering up to USD 25,000 in legal costs per contractor.

✓ Customer Experience & Support (4.3/5): Deel provides 24/7 in-house chat support, with a 4.8/5 Trustpilot rating across 7,000+ reviews. Dedicated customer success managers are assigned to larger accounts. Payroll and compliance guidance is supported by Deel AI, with onboarding completed in 2–3 business days in many countries. Support is efficient but less white-glove for very small teams.

✓ Platform & Integrations (4.8/5): Deel offers a modern, self-service global HR platform with 120+ native integrations (including Workday, BambooHR, Personio, Greenhouse, QuickBooks, Xero, NetSuite, Slack, and Microsoft Teams). Supports bi-directional HRIS syncing, open API, Zapier automation, and can function as a standalone global HRIS with onboarding, PTO, documents, org charts, and compliance monitoring.

4.5/5

✓ Entity Ownership (5.0/5): Deel operates through its own French legal entity, allowing direct employment without subcontractors and stronger governance.

✓ Onboarding Speed (4.5/5): Onboarding typically completed within ~5 business days, which is fast for France given local registration and benefit requirements.

✓ On-Site HR Support (4.5/5): Centralized French HR and payroll specialists available; support is mostly remote rather than in-person.

✓ Visa & Work Permit Support (4.5/5): Immigration and work permit support available, suitable for standard expat and talent mobility use cases.

✓ In-Country Compliance (5.0/5): Strong compliance with the Code du Travail, URSSAF registrations, social charges, termination rules, and statutory reporting.

✓ Local Add-Ons (4.5/5): Supports health insurance (mutuelle), meal vouchers (tickets restaurant), transport allowance, and supplementary retirement schemes. Limited flexibility for highly customized contract structures.

4.6/5

France-owned local entity: This means you don’t have to deal with additional French partners or subcontractors.

Only provider with portage salarial model: This ensures fully-compliant hiring in France.

48-hour onboarding: This ensures your employees in France are ready to work as soon as possible.

No deposit/setup fees: This can be a substantial add-on with other providers.

Advanced software with automated payroll: Deel is one of the few providers to have a full HRIS functionality.

Minimum one-year contract: This means you are locked in a lot longer than some other providers.

Software-first model that lacks personal touch: Some users have reported it being hard to get good human support at Deel.

FX exchange rates: The mark-up is higher than some other providers.

Deel is best for tech first companies that want to hire remote people in France for long-term employment. Deel is the perfect one in all solutions, especially if you want to expand in more countries besides France.

Globalization Partners (G-P) is the veteran in the EOR industry with great focus on compliance and support. They are quite service oriented which also means they are not as focused on technology as much as other providers. They are highly professional which is great for full compliance but often comes with the cost of potential delay. We went through the entire G-P sales and onboarding process in France, so you don’t have to. What we experienced was a Sales process that took 3 sales calls to get a first price for France (that was substantially higher than other prices) and a long onboarding process of 3 weeks.

Global

Ø Fee per Employee per Month, First Year

- Enterprise-grade software

- White-glove service

✓ Global Coverage & Services (4.5/5): EOR services across 125+ countries, covering compliant employment contracts, payroll processing, statutory filings, terminations, and benefits administration. Supports contractor management (USD 39/month per contractor), global payroll, immigration and visa services, insurance and pension support, background checks, equipment procurement, and equity & stock option administration.

✓ Pricing & Transparency (3.0/5): EOR pricing typically ranges around USD 940 per employee/month plus a one-time setup fee of USD 2,820. Security deposits of 1–2.5 months of total employment cost apply depending on credit checks. FX markup estimated at ~3%. Pricing is sales-led only, with no public or self-serve country-level cost breakdowns.

✓ Payment & Contract Terms (3.0/5): Enterprise-leaning contract structures, often requiring longer minimum commitments (up to 12 months). Invoices are issued around the 15th of the month with net-7 payment terms. Late payments incur 5% interest. Offboarding fees of USD 1,000 may apply. Contracts are standardized, compliance-driven, and relatively rigid.

✓ Customer Experience & Support (4.5/5): Enterprise-grade, consultative support model with dedicated account managers, live chat (≈2-minute first response), phone support, onboarding and termination assistance, compliance alerts, and AI-supported guidance. Strong depth across HR, legal, and compliance topics.

✓ Platform & Integrations (4.0/5): Stable enterprise platform covering payroll, employment documents, time-off, expenses, reporting, and compliance workflows. Includes G-P Assist AI. SOC 2 and ISO 27001 certified. Integrations available with major HRIS/HCM systems (Workday, SAP SuccessFactors, UKG, BambooHR, HiBob). Reliable, but less automation-heavy than newer tech-first platforms.

3.8/5

✓ Entity Ownership (5/5): G-P operates through its own legal entity in France using a direct employment model. This is the most compliant approach for the French market, avoiding the risks of consultant-style arrangements used by some competitors.

✓ Onboarding Speed (4.0/5): More bureaucratic sales and onboarding process compared to competitors; slower but thorough. Ensures full compliance with France’s stringent employment requirements from day one. Higher service fees reflect the additional work required.

✓ On-Site HR Support (5/5): Strong local expertise in French labor law. Direct employment model means employees are managed exactly as your own team members; you can assign daily tasks, set schedules, and conduct performance reviews while remaining 100% compliant.

✓ Visa & Work Permit Support (4.5/5): France permits EOR visa sponsorship. G-P can sponsor work permits for non-EU nationals through its owned entity with established processes.

✓ In-Country Compliance (5/5): 100% compliant direct employment model. Handles complex French requirements including 35-hour workweek, RTT days, mutuelle health insurance, extensive leave entitlements, works council obligations, and strict termination procedures.

✓ Local Add-Ons (4.5/5): Supports statutory benefits and competitive French packages including mutuelle, meal vouchers (tickets restaurant), and transport allowances. Direct employment model allows full benefit customisation.

4.7/5

Direct employment model: G-P hires employees directly through its French entity structure, improving compliance control and payroll accuracy.

Extensive global reach: Large international footprint supports companies hiring in France as part of broader multi-country expansion.

Regular compliance updates in local employment law: Strong HR and legal teams track France’s frequent labour law changes, including updates to working time rules, probation periods, and social contribution rates.

High onboarding & offboarding fees: France’s administrative requirements amplify G-P’s already premium pricing for employee lifecycle changes.

Less tech savvy: Platform functionality and automation lag behind newer EOR competitors with modern, API-driven systems.

G-P is best for large enterprises and established companies looking for complete control of their employees rather than a more autonomous remote employee abroad. G-P is also suitable for companies that work in regulated industries such as financial services and healthcare.

Oyster is a global EOR and payroll platform designed for companies that prioritize compliance, transparency, and structured international hiring. Oyster offers localized employment contracts, global payroll, contractor payments, benefits administration, and risk-mitigation tools like its Oyster Shell misclassification protection. The platform is known for its clean UI, strong compliance guardrails, and predictable processes rather than automation-heavy workflows. Oyster is especially popular with risk-averse teams, HR leaders, and companies hiring their first global employees.

Global

Ø Fee per Employee per Month, First Year

- B-Corp Certified

- Excellent UI/UX

- Owned entity infrastructure in most markets

✓ Global Coverage & Services (4.0/5): EOR services in 100+ countries covering compliant employment contracts, payroll processing, statutory filings, expense reimbursements, and offboarding. Delivery is standardized and compliance-first.

✓ Pricing & Transparency (4.0/5): Flat EOR pricing of USD 699 per employee/month. Pricing is public and predictable. FX markup rates are not disclosed and can reach an estimated up to 8%.

✓ Payment & Contract Terms (4.0/5): Invoices are net 7 days. A minimum one-month security deposit applies and may increase based on risk. Deposits are refunded only after termination and settlement of all invoices. Late payments accrue 1.5% interest per day.

✓ Customer Experience & Support (4.5/5): Guided onboarding, strong compliance documentation, and structured support workflows. Onboarding speed varies due to regulatory checks.

✓ Platform & Integrations (4.3/5): Clean, intuitive platform with core HRIS functionality (leave, expenses, invoicing, reporting). Fewer native integrations and less automation than Deel or Remote.

4.2/5

✓ Entity Ownership (4.5/5): Operates through its own French legal entity, enabling direct employment.

✓ Onboarding Speed (4.0/5): Slower onboarding due to labour law complexity and mandatory registrations.

✓ On-Site HR Support (4.5/5): Strong handling of French employment contracts, collective agreements, and payroll administration.

✓ Visa & Work Permit Support (4.0/5): Advisory immigration support available for common routes.

✓ In-Country Compliance (4.5/5): Reliable handling of URSSAF contributions, payroll taxes, and termination rules.

✓ Local Add-Ons (4.5/5): Mutuelle coordination, statutory benefits, expense handling, and compliant local benefits structures.

4.4/5

Strong compliance handling: strict, template-based approach, which fits France’s complex labor laws extremely well.

Clear processes for onboarding and employment contracts: Oyster’s localized templates reduce legal risk.

Transparent invoicing and predictable EOR pricing: Oyster’s employer burden calculators helps avoid surprises.

Slower onboardings: Can take more than 10 business days.

Limited flexibility on contract adaptations: Oyster tends to reject non-standard changes.

Oyster is ideal for VC-backed startups, remote-first SMEs, and ethical multi-country organizations prioritizing employee development, cultural cohesion, and compliant global onboarding. Companies seeking transparent pricing and a proactive compliance approach will benefit most. In contrast, businesses that need extensive local, in-person HR support or large-scale custom integrations may want to explore other options.

Multiplier is one of the leading EOR providers in the market and has a global coverage of 120+ countries and more than 150 owned entities worldwide. Multiplier offers their services at a lower cost than most other providers.

Global

Ø Fee per Employee per Month, First Year

✓ Global Coverage & Services (5.0/5): EOR services across 120+ countries, including contractor management, global payroll outsourcing, statutory compliance, benefits administration, and immigration support in selected jurisdictions.

✓ Pricing & Transparency (4.0/5): Generally clear pricing and competitive for scaleups at $505 per EOR contractor, though FX markups apply (stated ~2%, reported higher in some cases) and country-level cost breakdowns are not always fully transparent upfront.

✓ Payment & Contract Terms (4.5/5): No minimum contract commitment and flexible agreements. However, invoices are issued early and short payment windows (often ~7 days) can impact cash flow.

✓ Customer Experience & Support (4.5/5): Improved support quality in recent years with a solid self-service knowledge base. Support experience and escalation handling can vary by region.

✓ Platform & Integrations (4.5/5): Strong, modern platform with clean UX, efficient onboarding, and good multi-country reporting. Integration depth and automation are slightly behind top tech-first EORs.

4.5/5

✓ Entity Ownership (4.5/5): Operates through its own French entity called Multiplier Technologies France MTF SAS, giving Multiplier direct control over employment contracts, payroll execution, and statutory compliance under the Code du Travail.

✓ Onboarding Speed (4.5/5): Fast, platform-driven onboarding. Automated workflows allow hires to be completed quickly once documentation is finalized.

✓ On-Site HR Support (3.5/5): France-focused HR and payroll support available, but no large dedicated on-the-ground HR team for in-person handling.

✓ Visa & Work Permit Support (3.5/5): Immigration coordination supported for standard cases, though not a core strength compared to immigration-specialist EORs.

✓ In-Country Compliance (4.5/5): Strong handling of French labor requirements, including URSSAF registration, mutuelle santé, pensions, unemployment insurance, social contributions, and paid leave compliance.

✓ Local Add-Ons (3.5/5): Mandatory benefits and compliant payroll included; flexibility for bespoke benefits or complex setups is more limited.

4.0/5

Cost effective pricing: Flat 400 USD service fee positions Employer below most French focused EOR competitors.

Quick onboarding in 24 to 72 hours: Fast document handling helps accelerate hiring in a country known for strict contract validation.

Clear user experience: Intuitive interface makes it easier for teams unfamiliar with French employment rules to stay compliant.

Strong payroll automation: Sses unified systems to manage French taxes, social premiums with fewer manual steps.

No French entity: France is delivered via a partner, which reduces control over compliance and slows response to France specific issues.

Limited in country expertise: Offshore support team may lack depth on French labour law, convention collective rules, and termination norms.

Currency exposure for non EUR billing: Pricing in foreign currencies introduces conversion costs compared with France based EORs billing in euros.

Multiplier is best suited for start-ups to mid-sized companies that want to hire employees and contractors in France quickly for a low price. Multiplier’s platform is also ideal for companies seeking automation and simplicity over deep customization.

Native Teams is a flexible, cost-effective EOR and payments platform designed primarily for startups and SMEs hiring across Europe, Africa and emerging markets. Their model combines EOR employment, contractor payments, multi-currency wallets, and virtual cards into one ecosystem, making them especially appealing for companies needing both employment and payment infrastructure.

Global

✓ Global Coverage & Services (4.0/5): Broad EOR coverage across multiple regions, supporting both employees and contractors, with solid payroll and cross-border payment capabilities. Service depth and consistency vary by country.

✓ Pricing & Transparency (3.6/5): Some pricing is published publicly, but country-level costs are often higher than advertised and additional fees are not always clear upfront.

✓ Payment & Contract Terms (4.5/5): No minimum commitment and simple onboarding and exit mechanics, with limited supported payment currencies.

✓ Customer Experience & Support (4.0/5): Dedicated account management available, though documentation and guidance for complex edge cases are limited.

✓ Platform & Integrations (4.1/5): Covers core HRIS functionality, but lacks advanced automation, zero-touch onboarding, and native integrations found in tech-first platforms.

4.0/5

✓ Entity Ownership (4.0/5): Operates via a compliant local setup in France, enabling lawful employment without requiring clients to establish their own entity.

✓ Onboarding Speed (4.0/5): Straightforward onboarding process with predictable timelines, suitable for standard French employment setups.

✓ On-Site HR & Local Support (4.0/5): Reliable local support for payroll, leave management, and employee administration, though depth is more limited for highly complex or non-standard cases.

✓ Visa & Work Permit Support (3.5/5): Basic guidance available, but immigration support is more limited compared to providers with dedicated visa advisory teams.

✓ In-Country Compliance (4.5/5): Strong handling of French labor law requirements, including payroll, statutory social contributions, leave rules, and employee protections.

✓ Local Add-Ons (4.0/5): Supports standard benefits and compliance guidance, but offers fewer customization options and advanced consulting services than larger enterprise-focused EORs.

4.1/5

Owned French entity: Unlike many partner-based EORs, Native Teams employs through its own local entity in France, improving control over payroll, SLAs, and compliance.

Strong digital wallet + payments infrastructure: Native Teams allows employees to receive salary into its wallet system, enabling faster payouts and multi-currency handling something most EORs do not offer in France.

Integrated contractor + employee model: Supports switching between contractor invoicing and full employment within the same platform, useful for companies transitioning French workers from freelance status to CDI.

Simplified benefits approach: Native Teams offers straightforward statutory benefits administration rather than complex private benefits bundles, reducing employer cost compared with larger EORs.

Limited enterprise tooling: No advanced HRIS, reporting, or API integrations, competitors like Deel, Remote, and G-P offer deeper tech stacks.

Less mature French compliance resources: Smaller legal/compliance team means fewer in-depth guides, less documentation, and slower updates compared with established players.

No advanced mobility services: No visa or in-depth immigration support in France, unlike providers with full mobility desks.

Lean support model: Support responsiveness is decent but not at the level of providers with 24/7 or dedicated account teams; capacity is narrower.

Native Teams works best for small and medium companies that care deeply about keeping their costs down and don’t mind fewer frills. It is effective for companies that care more about time-to-hire metrics than customized support.

Hightekers bought Rivermate and is one of the medium-sized EOR providers with more than 4000 employees employed globally. With a French founder, France is something of a home market for Hightekers and now Rivermate. Originally, Hightekers focused on IT and engineering freelancers and expanded beyond to all kinds of industries. Now Rivermate is offering Portage Salarial under a local entity in France. This enables Rivermate to onboard much faster than other providers.

Global

Ø Fee per Employee per Month, First Year

✓ Global Coverage & Services (4.0/5): Rivermate provides EOR services across 30+ countries via local partners, covering compliant, country-specific employment contracts, payroll, taxes, statutory benefits, and HR administration. It supports employee relocation, visa guidance, global payroll-only setups, and optional global health insurance. Following its acquisition by Hightekers, Rivermate can also leverage Hightekers’ broader international reach and owned-entity infrastructure, improving coverage depth and execution in additional markets. Coverage quality can still vary by country, but the combined footprint strengthens its overall global delivery.

✓ Pricing & Transparency (4.5/5): Public EOR pricing starts from €299 per employee/month, with no percentage-based payroll markups. Contractor of Record (COR) pricing is clearly listed at €99–€199 per contractor/month, and recruitment services are success-based at 15% of annual salary. Final EOR pricing can still vary by country complexity, but overall transparency is strong compared to peers.

✓ Payment & Contract Terms (4.0/5): Flexible contracts with no long-term commitments. Supports payroll payouts in 120+ currencies with local bank transfers. Contractor agreements are signed directly by Rivermate (COR, not Agent of Record), reducing misclassification risk. Public documentation on notice periods and detailed legal terms is more limited than enterprise-grade providers.

✓ Customer Experience & Support (4.5/5): 24/7 human support via Slack, WhatsApp, email, and phone, plus a dedicated account manager. Strong third-party feedback and proven handling of complex compliance cases, particularly in Europe. Occasional response delays (up to ~24 hours) have been reported during peak periods.

✓ Platform & Integrations (3.8/5): Clean, user-friendly platform covering contracts, payroll, time off, expenses, and employee self-service. Suitable for day-to-day EOR operations, but limited native integrations with HRIS, accounting, and finance systems. Advanced reporting often requires external BI tools.

4.2/5

✓ Entity Ownership (4.5/5): Rivermate delivers EOR services in France through Hightekers’ owned French legal entity, enabling direct employment, stronger compliance control, and no dependency on third-party partners.

✓ Onboarding Speed (4.5/5): Employees can typically be onboarded within 5–7 business days, including compliant contract drafting and payroll registration under French law.

✓ On-Site HR Support (4.5/5): Access to France-based HR and payroll teams via Hightekers, providing local-language support and practical guidance. Physical on-site presence is available when required but not guaranteed for every engagement.

✓ Visa & Work Permit Support (4.0/5): Immigration coordination and work permit support available through Hightekers’ mobility specialists. Suitable for standard visa cases, though complex or highly customized immigration scenarios may require additional scoping.

✓ In-Country Compliance (4.5/5): Strong handling of Code du Travail, URSSAF registrations, social security contributions, mutuelle health insurance, pensions, paid leave, and termination procedures.

✓ Local Add-Ons (4.5/5): French benefits administration, payroll outsourcing, contractor-to-employee conversions, optional global health insurance, and integrated recruitment-to-employment workflows via Rivermate and Hightekers.

4.4/5

French company: Local language and same timezone support

Uses the portage salarial model: faster onboarding and better legal protection

Reduced misclassification risk: Through the portage salarial liencce from Highteckers

Limited tech: Compared to other providers

License restrictions: Not suitable for junior roles with low salaries and for non autonomous roles

Rivermate is great for companies that want to hire employees with the portage salarial model in France. This means they are well suited for hiring consultants, engineers, and more autonomous employees rather than more junior candidates that must be managed. Also the portage salarial model enabled companies to hire with short-term contracts.

Agility is a UK-based Employer of Record provider that supports companies hiring talent in the UK without establishing a local entity. They focus on compliant employment, payroll, and HR administration, offering hands-on support through a small but experienced local team. While they lack a global footprint and advanced software tools, Agility HR is a strong fit for companies seeking a practical, locally specialised EOR partner for hiring in the UK.

Global

Ø Fee per Employee per Month, First Year

✓ Global Coverage & Services (3.8/5): Strong coverage across Europe with in-country HR advisory for compliance, terminations, and audits. Visa and work permit support included. Country-specific benefits administration available. Coverage breadth is moderate outside core regions. Limited contractor-first or equity-related services. No equity management, global equity tools, or contractor-management functionality.

✓ Pricing & Transparency (4.0/5): Clear, quote-based pricing with consistent structure across markets. Setup fee disclosed upfront (GBP 500 / USD 670). No FX markup, VAT, or hidden payroll processing fees. No early termination or offboarding fees. No public pricing calculator. Custom quotes add friction for fast-scaling teams. Pricing above average of other providers.

✓ Payment & Contract Terms (4.0/5): No minimum commitment required. Clearly defined payroll cut-off (7th of month). Legally vetted, localized contracts per country. Long notice period (90 days). Limited payment methods (bank wire only, GBP-focused). Deposits of one month gross salary + employer taxes apply.

✓ Customer Experience & Support (4.5/5): Dedicated account manager included. Strong experience handling complex employment cases. WhatsApp and phone support available. Responsive first response times (≤12 hours). No live chat. No compliance alerts or AI-driven support. Support model is manual and region-dependent.

✓ Platform & Integrations (3.2/5): Functional portal for payroll, contracts, and documents. Not a modern HRIS platform. No advanced automation (time-off, cost analytics, WFM, API). No deep integrations (e.g., ATS, ERP, HRIS). UI and UX less polished than competitors.

3.9/5

✗ Entity Ownership (3.0/5): Agility operates through a local partner in France rather than an owned entity. Partner-based model adds a layer between client and employment operations in a market with complex labor regulations.

✓ Onboarding Speed (3.5/5): Onboarding available but France’s stringent employment requirements and Agility’s hands-on, manual approach may extend timelines compared to automated platforms.

✓ On-Site HR Support (3.5/5): Support coordinated through local French partner with Agility’s dedicated account managers. WhatsApp and phone support available with ≤12 hour response times. Region-dependent support model.

✗ Visa & Work Permit Support (3.0/5): Guidance on work permits and visas provided but Agility is not a licensed sponsor. Limited immigration support compared to larger EOR providers.

✓ In-Country Compliance (3.5/5): Local partner handles French labor law compliance including 35-hour workweek, RTT days, mutuelle requirements, extensive leave entitlements, and complex termination procedures. Manual compliance approach without AI-driven alerts.

✓ Local Add-Ons (3.0/5): Supports French statutory benefits including mutuelle health insurance and meal vouchers (tickets restaurant). Less extensive add-on options compared to larger providers. No equity management or contractor tools.

3.3/5

Agility EOR is best for companies expanding into APAC that want fast, human support rather than a software-heavy EOR platform. They’re a strong fit for SMEs and scaling teams hiring a handful of employees in markets like Singapore, Malaysia, and Thailand, and for employers who need reliable compliance handling without complex automation. Agility is less suitable for companies needing large-scale global coverage or a deeply integrated HR tech ecosystem.

Parakar is a European-focused regional EOR provider that has been around since over 20 years. They’re known as a trusted reseller for several large global EORs. Unlike global EOR platforms, Parakar positions itself as a regional expert for Europe with deep local HR, payroll, and immigration knowledge, making them a strong choice for companies that value hands-on support over software-heavy automation. They’re also a trusted implementation partner for major global EORs, which speaks to their compliance strength but also means they are more traditional, more service-led, and typically more expensive than tech-first competitors.

Regional

Ø Fee per Employee per Month, First Year

- Europe-Focus

✓ Global Coverage & Services (3.0/5): Strong coverage across multiple European countries with deep local HR and compliance expertise. However, Parakar has no meaningful reach outside Europe and is not suitable for global or multi-continent hiring strategies.

✗ Pricing & Transparency (1.0/5): High setup fees (≈ USD 750) and high monthly EOR fees (≈ USD 750 per employee). Additional charges apply for variable pay, off-cycle payroll, FX (reported up to 8%), onboarding, offboarding, and country-specific extras, resulting in unpredictable monthly costs.

✓ Payment & Contract Terms (3.0/5): Traditional European service contracts with predictable structures, but includes a 3-month commercial notice period and limited flexibility for short-term or fast-scaling hiring needs.

✓ Customer Experience & Support (4.0/5): Strong, human-led support model with experienced local HR teams. Well suited for complex payroll, visa processes, and statutory requirements, though support is limited to EU time zones and not designed for high-volume or self-service workflows.

✗ Platform & Integrations (1.0/5): No proprietary HRIS or software platform. No integrations with HR, finance, or ATS systems. Processes rely heavily on email, manual workflows, and third-party tools.

2.4/5

✓ Entity Ownership (4.5/5): Operates through a strong local French setup with deep on-the-ground HR and payroll expertise, enabling direct execution without heavy reliance on third-party vendors.

✓ Onboarding Speed (4.0/5): Onboarding is efficient for France, typically completed within 1–2 weeks depending on contract complexity and collective agreement requirements.

✓ On-Site HR Support (4.5/5): Experienced French HR professionals available for day-to-day employee management, terminations, and complex labour-law cases.

✓ Visa & Work Permit Support (4.0/5): Immigration and work permit coordination supported for standard cases, though timelines depend on prefecture processing and are less optimized than tech-first EORs.

✓ In-Country Compliance (4.5/5): Strong handling of French labour law (Code du Travail), URSSAF registrations, social charges, pensions, mutuelle, and collective bargaining agreements.

✗ Local Add-Ons (3.5/5): Solid core HR and compliance services, but fewer scalable add-ons compared to larger global EOR platforms.

4.2/5

Europe focus: Great partner if you focus on hiring only in Europe

High-touch, personalised support: Ideal if you prefer human support over automation

Strong compliance: Understand local authorities, social security rules and all complex European laws

Limited global coverage: Not a global EOR, but Europe only

High monthly fees: Fees are around $700 for most countries

High setup fees: Parakar charges additional $700 for every onboarding

Parakar is best suited for companies that want high-touch, locally specialised HR support in Europe, especially in France, Germany, or the Netherlands, and value accuracy over automation. It is not the right choice for teams that need fast onboarding, modern software tools, or broad global coverage beyond Europe. Overall, Parakar works well for employers seeking long-term, stable European hires, but is less suitable for startups or scaleups that prioritise speed, tech-enabled workflows, and cost efficiency.

Employer of Record Legislation & Compliance in France

EOR providers in France operate similar to EOR providers in other countries, assuming full legal responsibility for the employee.

However, France is one of the most regulated labour markets in the world, strongly favouring employee rights. With 30-35 paid vacation days on average, up to 52% employer taxes and strict termination law, hiring in France can be both attractive and challenging. There is also the complication that hiring under the Portage Salarial model requires special licensing (more on what this means further below).

If you still decide to hire France, choosing a trustworthy and locally experienced EOR provider is essential, arguably even more important than in other countries. Especially for handling complex offboarding and language-specific requirements.

Key Considerations When Choosing the Best EOR in France

That being said, how can you decide in this overcrowded market full of EOR providers claiming to be “the best”? After 10+ sales calls that all sound the same, it’s easy to get lost.

At Employsome, we’ve simplified the process for you. As such, we developed a structured process to evaluate providers by using two independent rating system:

- A Global Score that reflects the provider’s international performance

- A Local France EOR Score that rates the on-the-ground presence, legal structure and performance in France

Legal Frameworks Under Which EORs Operate in France

In France, there are three main legal frameworks under which an Employer of Record can operate: direct employment model, portage salarial (umbrella or freelancer employment model) and travail temporaire (temporary work or staff leasing).

Direct Employment Model

The direct employment model is used by some EOR providers whereby they use their own French legal entity to directly employ the worker as a normal French employee following all local labour rules. This means that all standard French labour laws include paying for healthcare, pension, unemployment insurance and so on. Most EOR providers like Multiplier use this employment model with their own entities.

Portage Salarial Model

The portage salarial model is commonly used by EOR providers for white-collar professionals such as consultants, engineers, and IT specialists. It is formally recognized in the French Labour Code (Articles L1254-1 to L1254-31). In this framework, the EOR provider (or wage portage company) acts as the legal employer of the worker and is responsible for contracts, payroll and HR administration, while invoicing you (the client company) for services.

This solution is used by Deel and Parakar and has the advantage of protecting both the client and the employee from misclassification.

Travail Temporaire (Labour Leasing) Model

The travail temporaire (labour leasing) model, on the other hand, requires authorization from the DREETS, the French regional labour authority. Only companies registered as “Entreprise de Travail Temporaire (ETT)” can legally provide temporary staffing services. Most international EOR providers do not hold a DREETS authorization and therefore can not use the labour leasing model.

Typically, only local staffing agencies are therefore licensed to offer short-term flexibility and seasonal contracts. This model requires a DREETS license, a more conservative approach for enterprises and corporate compliance. Usually only traditional staffing agencies like Adecco hold this license.

Hiring in France: What You Need To Know

Holiday Pay & Working Hours

France is one of the most regulated countries and they offer quite a lot of benefits to employees.

The statutory minimum holidays are 25 days per year, so 2.5 days earned per month of effective work. Most French companies provide 30 – 35 days per year to stay competitive. The days are accrual which means that an employee collects those days throughout his working year. Employees can take leave after one week of employment but would only have 2 days to take at that time- Some companies have contradictory waiting periods so employees can only take paid leave after the stated waiting period stated in the contract.

While some companies use a calendar system to calculate leave, most French employees are used to a different reference period from June 1st to May 31st.

France has eleven official public holidays but only one is universally paid and mandatory off: labour day on May 1. If holidays fall on a weekend, they are not compensated with another day.

Employment Contract

A French employment EOR contract must either be a permanent contract which is the default form in France of a fixed-term contract. A fixed-term contract can only be renewed twice before without cause. All French employment contracts must have a French version in order to be valid.

We created the following EOR contract checklist for you so you can see if the EOR provider follows all local laws. Contracts must include:

- Contract type (fixed term vs permanent), Fixed term must have a reasoning

- Contract must be in French

- Employer must be the EOR provider not your company

- Job title, responsibilities

- Applicable Collective Bargaining Agreement (CBA)

- Working hours

- GDPR & confidentiality clauses

- Probation period

Mandatory Health Insurance

The French healthcare system can be structured int two layers: a public health insurance layer that is called Sécurité Sociale and complementary health insurance called Mutuelle.

The first layer is the state insurance that is covering roughly 70% of all medical costs while the complementary health insurance is covering the remaining 30%. Since 2016 every employee in France must have both layers covered.

The EOR provider is therefore legally responsible for enrolling the employee in both. The public layer is funded by a mandatory payroll contribution which is calculated based on the gross salary and is shared between the employer and employee. The private health insurance is covering the rest and the employer must pay at least 50% of the fees. The rest can be deducted from the employee’s salary.

Sick Leave

Like in most European countries, France ensures the employee is covered when they are sick. The employee is required to see a certified doctor who sends the sick note directly to the CPAM (Caisse Primaire d’Assurance Maladie) and the employer as well within 2 days.

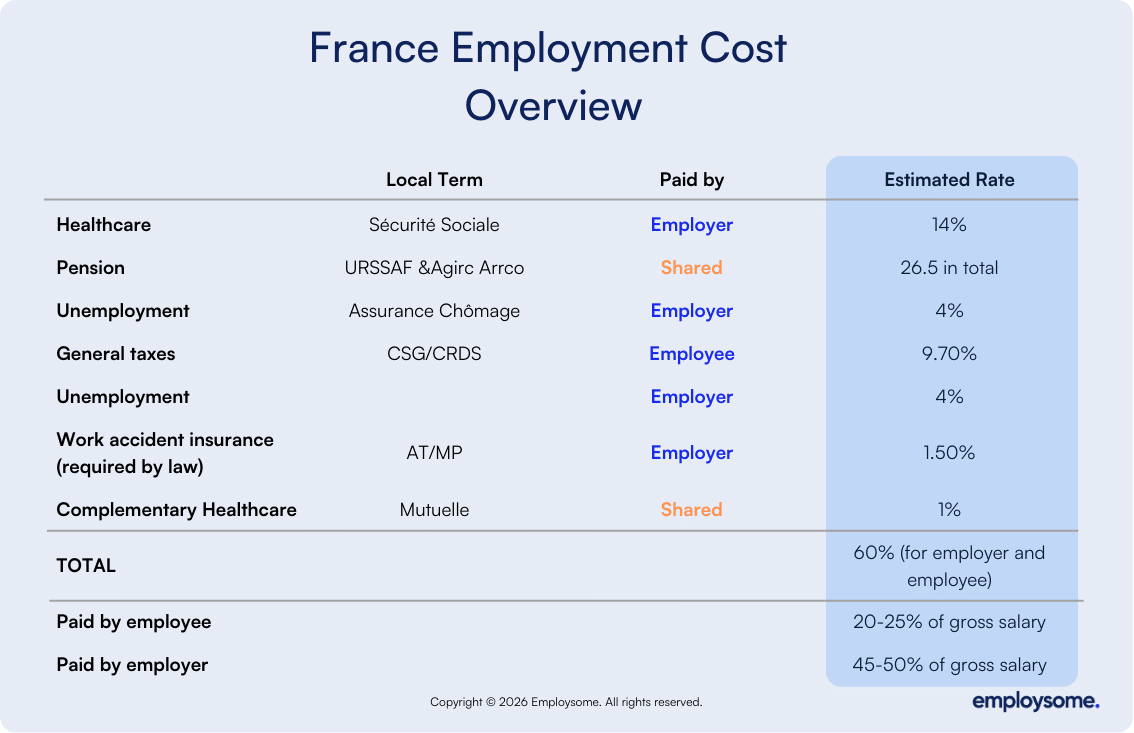

Employer Taxes in France

France has one of the highest employer burdens in the world. The EOR provider will be the one to calculate the burden, invoice you the total amount and then send burdens to the respective authorities. Still, it is crucial to get the full picture of total costs before hiring and also to be able to understand what the EOR provider is invoicing.

The most important burdens are:

Minimum Wage in France 2026 (Updated)

France’s statutory minimum wage, known as the SMIC (Salaire Minimum Interprofessionnel de Croissance), is set nationally and applies to all employees regardless of region, including those employed through an Employer of Record.

As of January 1, 2026, the SMIC is €12.02 per hour gross, which translates to €1,823.03 per month for a standard 35-hour workweek. The rate is reviewed annually by the government and can also be adjusted mid-year if consumer prices rise by more than 2%.

Employers should note that France’s 35-hour legal workweek is shorter than in most EU countries. Any hours worked beyond 35 per week are classified as overtime and must be compensated at 125% (hours 36 to 43) or 150% (beyond 43 hours) of the standard rate, unless a collective bargaining agreement specifies different arrangements.

The SMIC cannot be offset by bonuses, profit-sharing, or overtime premiums. Base hourly pay must meet or exceed the statutory rate independently of any supplementary payments.

For a full breakdown of the 2026 SMIC rate, sector-specific minimum wages, employer social security obligations, penalties for non-compliance, and a cost of living comparison across major French cities, see our complete guide: Minimum Wage in France: The Complete 2026 Guide.

How We Score & Rank EOR Providers in France

We evaluate EORs using two independent measures: the Global EOR Score and the France EOR Score. This lets us assess both a provider’s overall quality and how well they operate in the specific countries where you plan to hire. In other words, we apply our global EOR scoring model and adjust it for France’s local employment and compliance requirements.

Our reviews are fully independent. We continuously add new providers to give users more options. Some links are affiliate links, but they never influence scores or rankings. All ratings follow our published methodology and Editorial Guidelines.

Global EOR Score – Overall Provider Quality

This score reflects how well a provider performs globally across the areas that matter most when using an EOR:

-

Pricing & Transparency – clarity of total costs, fees, FX, deposits, and add-ons

-

Payment & Contract Terms – minimums, notice periods, security deposits, payment terms, ease of exit

-

Service Quality & Support – responsiveness, issue resolution, and expertise of the account team

-

Platform & Product – usability, integrations, security, and self-service tools

-

Global Add-On – global payroll, contractors, benefits, recruitment

Each category is rated 1 – 5; the Global EOR Score is the average.

France EOR Score – On-the-Ground Execution

This score shows how a provider performs in a specific country:

-

Entity Ownership – own entity vs. third-party partner, plus verification of registrations

-

Onboarding Speed – how quickly employees are hired and paid compliantly

-

On-Site HR Support – availability of in-country HR teams and local-language help

- In-Country Compliance – licensing, registration, following all local labour laws

-

Local Add-Ons – benefits, HR services, and expertise tailored to that market

Each category is rated 1–5; the France EOR Score is the average for that location.

How Final Rankings Are Calculated

We combine a provider’s Global EOR Score (40% weight) with all available France Performance Scores (60% weight) using a weighted average. As we verify more countries, the rankings update to reflect real-world performance – not marketing claims.

FAQ on Best EOR in France

Below is a list of frequently asked questions section to answer the most frequent question people ask when hiring through EOR in France.

If you’re hiring in multiple countries, our global EOR guide is a better starting point.

EOR does not automatically create PE risk but you should focus on some factors to reduce the risk. Foremost, you can lower that risk by not generating any local revenues in France and not creating contracts (should only be generated by the EOR provider). Ideally, your EOR employees should mainly work in support, marketing, or research rather than direct sales (that could generate revenue). Further, you should not have a registered office, a local bank account or local directors/ c-level in France employed as EOR.

No, it is not mandatory to pay out a 13th salary in France in general. However, in some industries the convention collectives require you to pay 13th months (e.g. in banking). Still, it is common practice to offer a 13th salary and many companies do so to stay competitive.

It is important to understand if their setup fits your requirements. Therefore, you can ask questions like:

- Do you have your own entity in France or do you operate through a partner?

- Do you have permanent or fixed-term contracts?

- Which collective bargaining agreements apply?

- Who manages the termination of the employee?

- When do you invoice us and when are employees paid?

- Are you GDPR compliant?

- Do you have any hidden fees? Any add-ons on exchange fees?

No, EOR providers do not need a license to operate in France as long as they are not labour leasing. Only temporary staffing agencies need to hold a license with DREETS.

The answer depends on which employment model the EOR uses. With the portage salarial (that Deel uses), the EOR provider mus declare with DREETS and appear on the national register. Most EOR providers use the direct employment model and therefore no license or registration is required.

Written by

Courtney Pocock is a Copywriter & EOR/PEO Researcher at Employsome with 15+ years of experience writing for the HR, corporate, and financial sectors. She has a strong interest in global business expansion and Employer of Record / PEO topics, focusing on news that matters to business owners and decision-makers. Courtney covers industry updates, regulatory changes, and practical guides to help leaders navigate international hiring with confidence.

Our content is created for informational purposes only and is not intended to provide any legal, tax, accounting, or financial advice. Please obtain separate advice from industry-specific professionals who may better understand your business’s needs. Read our Editorial Guidelines for further information on how our content is created.