The $75B Fintech Giant Enters EOR: Why Revolut’s GlobalHire Could Reshape the Industry

Revolut just entered the Employer of Record market. And this isn’t just another startup trying to grab market share. It’s a $75B fintech. Their new product, GlobalHire, launches H2 2025 covering 160 countries.

Revolut is entering the Employer of Record (EOR) market. And this time, it’s not a scrappy startup trying to carve out a niche it’s a $75 billion fintech behemoth with 65 million customers, legal entities across 39 countries, and the kind of global payment infrastructure that most EOR providers can only dream of.

The company’s new EOR solution, GlobalHire, is set to launch in H2 2025, initially covering an impressive number of 160 countries. If you’ve been watching the EOR space consolidate around a few dominant players, this move should get your attention.

What We Know About GlobalHire

Revolut first signaled its EOR ambitions roughly 10 months ago. Now, the pieces are coming together. GlobalHire will offer full EOR services: payroll processing, benefits administration, tax compliance, and local employment contracts. A standalone app is expected to follow the initial launch.

The company has been actively hiring for EOR, legal and payroll roles (job post by Index Ventures, Revolut’s investor, on behalf of Revolut, specifically looking for an EOR role), building out the operational muscle needed to run a compliant global employment service. This isn’t a half-hearted experiment Revolut is going all in.

Why This Move Makes Strategic Sense

For anyone who’s followed Revolut’s trajectory, GlobalHire feels almost inevitable. Here’s why:

1. They Already Solve the Hardest Problem

Ask any EOR operator what keeps them up at night, and you’ll hear the same answer: global payments. Moving money across borders, managing FX, ensuring employees get paid on time in local currency it’s a nightmare of compliance, timing, and costs. Most EORs cobble together solutions with third-party payment providers, accepting slim margins on what should be a core competency.

Revolut processes billions in global transactions. They’ve built the payment rails. They’ve figured out the FX. They’ve navigated the regulatory requirements across dozens of jurisdictions. The hardest piece of the EOR puzzle is their core business.

2. Revolut People Sets the Stage

GlobalHire isn’t emerging from a vacuum. Revolut launched Revolut People, their HRIS platform, in December 2023. Originally built internally five years ago to manage their own scaling from hundreds to 10,000+ employees across 60+ countries, the platform now handles performance management, recruitment (with an integrated ATS), and core HR functions.

The product has gained traction G2 recognized it as a Grid Leader for Core HR in their 2025 Spring Report. More importantly, Revolut has been iterating on AI features: automated interviews, real-time performance summarization, and engagement analytics. They’re not just building an EOR; they’re building an integrated HR tech stack.

3. The Entity Infrastructure Already Exists

Here’s what most people miss: building a global EOR from scratch requires establishing legal entities in every country where you want to employ people. That’s expensive, time-consuming, and requires deep local legal expertise. It takes years.

Revolut already has legal entities in 39 countries. They’ve been operating as a global company for years, managing their own 10,000+ employees across these jurisdictions. The compliance muscle, the local knowledge, the legal infrastructure it’s already in place. Where gaps exist, they have the resources to fill them quickly.

4. Pre-IPO Revenue Diversification

Revolut’s IPO has been anticipated for years. With 2024 revenue hitting $4 billion (up 72% YoY) and net profit crossing $1 billion, the company is in strong financial position. Their recent $75 billion valuation in November 2025 up from $45 billion just a year earlier reflects investor confidence.

But public markets reward predictable, recurring revenue. EOR services fit that profile perfectly: sticky B2B contracts with monthly per-employee fees. It’s a compelling addition to the growth story.

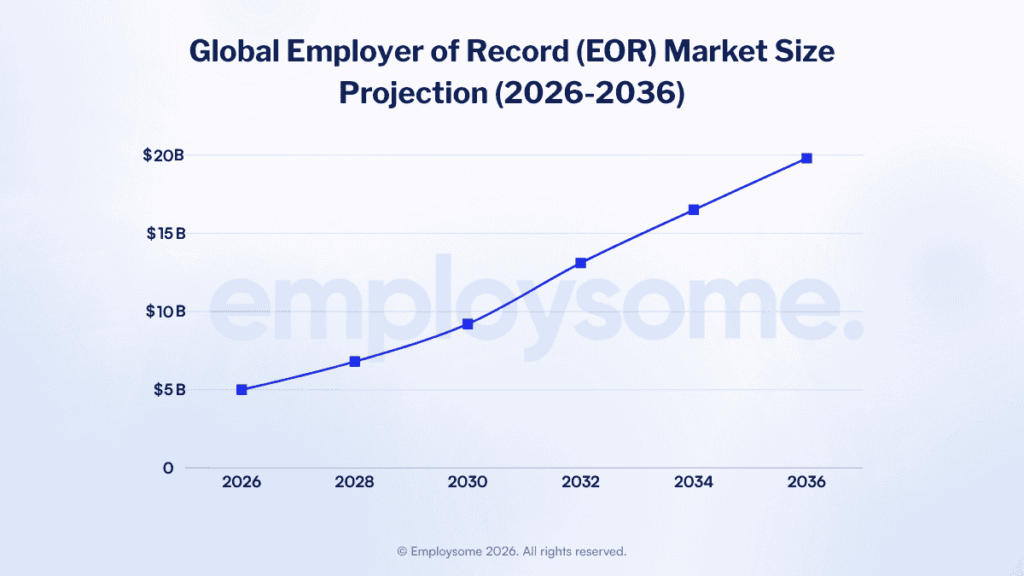

The Revenue Opportunity Is Massive

Let’s talk numbers. Deel currently the market leader crossed $1 billion in ARR in Q1 2025, growing 75% year-over-year. According to Deel CEO Alex Bouaziz in recent podcast interviews with 20VC, a substantial portion of that revenue comes directly from EOR services. At typical industry pricing of $500-600 per employee per month, the unit economics are attractive: 85% gross margins, consistent with top-tier SaaS businesses.

With Deel processing $22 billion in annual payroll for 1.5 million+ workers across 35,000 customers, the market has clearly validated the EOR model. Revolut is eyeing a slice of that pie and they have distribution advantages most competitors can’t match.

Expert View: What This Means for the Market

Our take on how GlobalHire will reshape the competitive landscape.

The Big Players Should Be Fine

We don’t expect GlobalHire to significantly threaten established leaders like Deel, Remote, or Rippling in the near term. These companies have built substantial customer bases, developed sophisticated platforms, and have the marketing budgets to compete on customer acquisition. Deel alone has raised ~$1.3 billion and commands a $17.3 billion valuation. They’re not going anywhere.

Mid-Market EORs Face Real Pressure

The companies that should be worried are small-to-medium EOR providers the ones already struggling with margin compression and limited differentiation. Players like Pebl (formerly Velocity Global) and even G-P face a difficult choice: compete on price against a well-capitalized competitor, or find a defensible niche before it’s too late.

Consolidation Will Accelerate

We’ve already seen this movie. In October 2025, Deel acquired Omnipresent a London-based EOR competitor. Industry sources tell us this wasn’t a strategic acquisition in the traditional sense, Omnipresent was facing severe financial pressure. The transaction value reportedly came in around $15 million a fraction of what the company had raised.

Expect more of this. The EOR market saw a wave of nine-figure funding rounds in 2020-2021. Many of those companies are now struggling to justify their valuations as growth slows and competition intensifies. Revolut’s entry adds another well-funded competitor to a market that may not have room for everyone.

What We Expect on Pricing

Given Revolut’s financial position and strategic goals, we anticipate aggressive pricing potentially among the most competitive in the market. Here’s our reasoning:

In-house infrastructure: Unlike EORs that rely on third-party partners for EOR operations, payroll, payments, compliance, or local entities, Revolut can run most operations internally. That means better margins and more pricing flexibility.

Deep pockets: With $4 billion in annual revenue and strong profitability, Revolut can afford to subsidize growth in a new product line. They’ve done this before.

Distribution advantage: Revolut Business already serves 500,000+ companies. Cross-selling EOR to existing customers dramatically reduces acquisition costs.

Land-and-expand strategy: Starting with contractor payments (lower complexity, faster adoption) before upselling to full EOR makes sense. Global payroll outsourcing could follow, though that may require acquiring existing payroll engine companies given the complexity of local tax calculations and statutory requirements.

The Bigger Picture

Revolut’s EOR play is part of a broader trend: fintech companies expanding into adjacent HR and workforce management services. The logic is straightforward if you already manage a company’s financial infrastructure, why not manage their employment infrastructure too?

For Revolut specifically, this represents a significant strategic bet. They’re not just adding a feature; they’re entering a complex, regulated market that requires operational excellence across dozens of jurisdictions. The opportunity is real, but so are the execution risks.

What’s clear is that the EOR market is maturing. The era of easy growth and generous valuations is over. Winners will be determined by operational efficiency, product quality, and the ability to deliver genuine value to customers not just who raised the most money.

Revolut has the resources to compete. Now we’ll see if they have the execution.

Bottom Line

Revolut’s EOR play is part of a broader trend: fintech companies expanding into adjacent HR and workforce management services. The logic is straightforward if you already manage a company’s financial infrastructure, why not manage their employment infrastructure too?

For Revolut specifically, this represents a significant strategic bet. They’re not just adding a feature; they’re entering a complex, regulated market that requires operational excellence across dozens of jurisdictions. The opportunity is real, but so are the execution risks.

What’s clear is that the EOR market is maturing. The era of easy growth and generous valuations is over. Winners will be determined by operational efficiency, GlobalHire positions Revolut as a serious EOR contender, leveraging their core strengths in global payments and financial infrastructure. While we don’t expect immediate disruption to market leaders, the entry of a $75B player will accelerate consolidation and put additional pressure on mid-tier providers.

For companies evaluating EOR solutions, Revolut’s entry is good news more competition means better pricing and innovation. For EOR providers, it’s a reminder that the competitive landscape never stops evolving.

We’ll be watching GlobalHire closely as it rolls out. Stay tuned for our full review once the product launches.

—

Employsome is the first independent platform to compare Employer of Record pricing, coverage, and features in real-time. Compare EORs for free.

Written by

Courtney Pocock is a Copywriter & EOR/PEO Researcher at Employsome with 15+ years of experience writing for the HR, corporate, and financial sectors. She has a strong interest in global business expansion and Employer of Record / PEO topics, focusing on news that matters to business owners and decision-makers. Courtney covers industry updates, regulatory changes, and practical guides to help leaders navigate international hiring with confidence.

Our content is created for informational purposes only and is not intended to provide any legal, tax, accounting, or financial advice. Please obtain separate advice from industry-specific professionals who may better understand your business’s needs. Read our Editorial Guidelines for further information on how our content is created.

Other posts

More Industry News