Professional Employer Organizations (PEO) and Employer of Record (EOR) services are essential tools for small to large businesses. In just the United States, there are around 6 million small businesses that have employees. As soon as you hire your first worker, new compliance obligations appear. If you’re not prepared for major payroll and HR laws, it could result in significant fines and a major headache for your company.

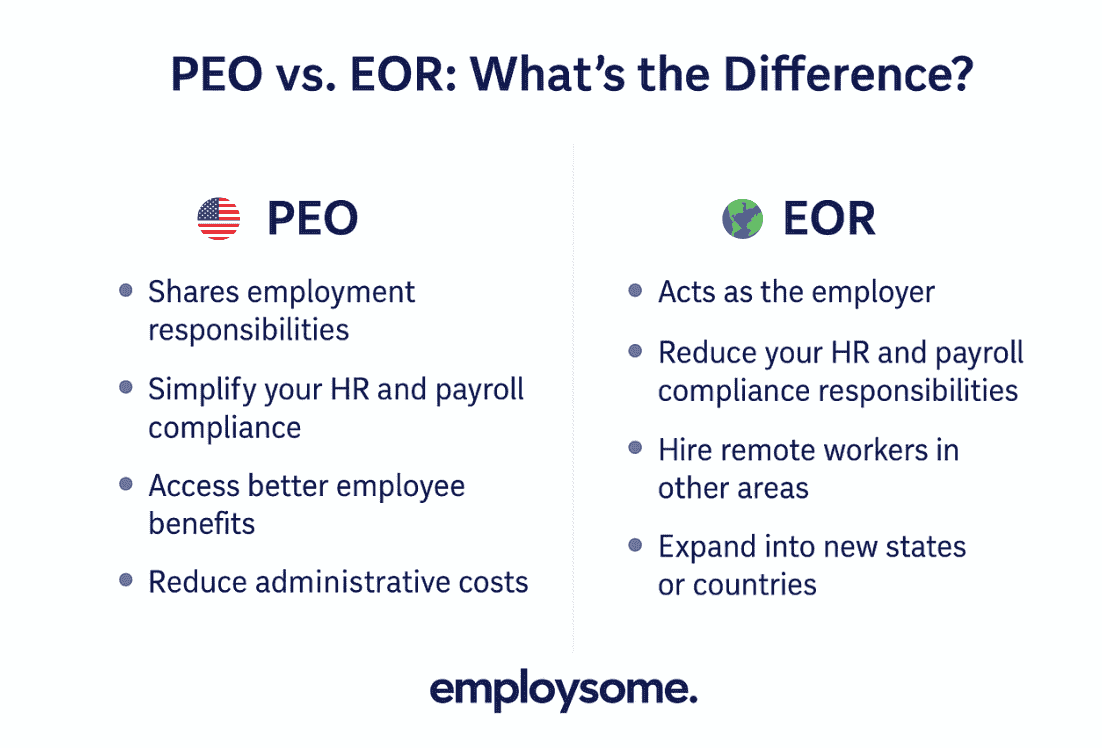

While PEO and EOR services have some major differences, both options can be effective choices for managing payroll and HR tasks at your organization.

What Is a PEO?

When considering the differences between a PEO vs. an EOR, the first step is to understand what a PEO is and how it works. At its heart, a PEO is basically outsourced HR services. As an organization, you can decide to outsource your services in whole or in part.

According to industry data, companies that hire a PEO grow twice as fast and are 50% less likely to go out of business. Unsurprisingly, the PEO industry has quadrupled in size since 2012.

Benefits of a PEO

There are a few key PEO advantages that make this type of HR approach popular among American businesses. A PEO is essentially a co-employer, so they share the duties of employment with you.

Once you’ve hired a PEO, you can enjoy the following advantages.

- Simplify your HR and payroll compliance.

- Ensure high-quality employee training and onboarding.

- Access better employee benefits.

- Outsource your benefits administration.

- Reduce administrative costs for payroll and HR.

- Boost employee satisfaction and retention.

- Achieve better scalability.

Drawbacks of a PEO

While handing off your payroll and HR duties to a PEO can lower your costs and give you better access to affordable employee benefits, there are some PEO disadvantages you should be aware of as well.

- The PEO must be paid, which creates an added cost for your business.

- You lose control over some of your HR and payroll functions.

- Some PEOs have hidden costs and fees.

- Your company becomes dependent on a third party.

What Is an EOR?

While a PEO shares employment responsibilities, EORs take on the duties of the employer. They handle all of your payroll, HR, and compliance responsibilities, so you don’t have to. Your company still manages the employee’s day-to-day duties, but the paperwork is dealt with by the EOR. For instance, your new hire agreements will list the EOR as the employer instead of you.

EORs are especially useful when you’re hiring remote workers or expanding into a new country. Understanding all of the employment laws and payroll taxes for each state or country is challenging, especially if you’re only hiring a handful of workers. By using an EOR, you can expand without having to worry about all of the nitty-gritty compliance details.

Benefits of an EOR

By engaging an EOR to hire an employee in a new jurisdiction without setting up a local legal enttiy, your company can enjoy a few distinct advantages. Because of how similar an EOR is to a PEO, many of the benefits are fairly similar.

- Expand easily into new states or countries.

- Reduce your HR and payroll compliance responsibilities.

- Hire remote workers in other areas.

- Improve your onboarding process.

- Lower your administrative costs.

- Mitigate employee misclassification risk.

- Boost employee retention and engagement.

- Enhance your overall employee experience.

Drawbacks of an EOR

Although there are many advantages to having an EOR, this might not be the right choice for everyone.

The following are a few of the EOR disadvantages you should consider.

- It can reduce the control you have over HR decisions.

- When you use vendors, you’re trusting the vendor to have good data security.

- The EOR may have a different culture or values, which can impact your workers.

- Operating through an EOR can limit some of your operational decisions as a business.

- With the vast amount of EORs out there, it’s sometimes difficult to find the best EOR for your individual use case.

What Is the Difference Between an EOR and a PEO?

Some of the benefits of an EOR and a PEO are fairly similar, such as enjoying more convenient administration processes and better compliance. To understand which format is best for you, you should consider some of the key differences between these two options.

- Insurance: PEOs often provide comprehensive PEO insurance options you can offer your employees. In comparison, EORs have different insurance benefits in different regions. Generally, EORs base their insurance options on the compliance requirements of each specific area.

- Business Structure: EORs are the employer of record, so they are legally considered the employer for any staff members or contractors you decide to hire. Meanwhile, PEOs are a co-employer.

- Risks: Because a PEO is a co-employer, you end up shouldering more of the risks and liabilities.

- Costs: While reviewing the PEO vs. EOR cost is important, the end price will generally be fairly similar. As a result, it’s generally better to focus on finding a provider that has the services, risk level, and benefits options you need.

- Services and Features: Finally, you should consider the type of services you need. PEOs often have a wide range of services, so you can select a plan that meets your needs. In comparison, EORs often focus more on international companies or businesses that want to expand into other states. As a result, they may have fewer customization options.

It’s important to remember that there can be as much variation between different service providers as there is between the EOR vs. PEO structures. Both EOR and PEO companies may charge fees based on a flat-fee structure, percentage of payroll, or a blend of both. Because of that, it’s essential to reach out for professional help in determining which provider is the right choice for your needs.

When Does a PEO Make the Most Sense?

If you want to retain more control over your HR processes, a PEO will often be a better choice. PEOs are co-employers, so you still have a significant amount of control.

Additionally, PEOs are ideal if you want a customized benefits package and tailored HR services. PEOs often have multiple health insurance, retirement, and benefits plans that you can choose from for your workers. They can cut through the red tape to find the most effective plans, saving you time and money.

PEOs are effective if you want a lot of benefits options and don’t plan on expanding internationally. Additionally, many PEOs have onboarding, training, and employee development support, so you can build better employee satisfaction and higher retention rates.

The number of employees you have can also impact your decision between PEO vs. EOR. At a PEO, you’ll often be required to have a minimum number of workers. In comparison, an EOR will typically allow you to have as many or as few workers as you want.

In general, the following kinds of organizations will benefit from using a PEO.

- Companies with limited resources

- Small to medium-sized companies that operate domestically

- Businesses that need help accessing and affording top benefits

- Organizations that lack HR expertise

- Companies that want scalable growth

When Does an EOR Make the Most Sense?

EORs really excel when it comes to international organizations. When a company moves into a new territory, they have to understand all of the added payroll and HR laws.

For example, the United States has a host of laws, like the Employee Retirement Income Security Act of 1974 (ERISA), that govern 401(k) plans and retirement benefits. In Canada, employers are legally obligated to contribute to the Canada Pension Plan (CPP) or the Quebec Pension Plan (QPP). Meanwhile, employers in Mexico must contribute to the Mexican Social Security Institute (IMSS).

Navigating all of these differences is challenging for a business that wants to expand into a new area. By working with an EOR, you can guarantee your legal compliance by putting someone else in charge.

The following types of organizations can benefit from using an EOR.

- Startups and businesses with limited resources

- Tech companies and organizations that want to expand into new markets

- Companies that have limited HR expertise

- Global consulting firms

- Companies that don’t have a legal entity in the country where they want to hire employees

- Organizations that have many remote workers

- Any business that wants to expand into international territories

Does an EOR Affect Your Employee Relationship?

By opting for an EOR, you will inherently end up changing your employee-employer relationship. Legally, the EOR becomes the worker’s employer, so they are responsible for HR compliance. While there are many administrative, legal, and cost benefits to using an EOR, this decision can also reduce the legal control you have over the employee.

How Does an EOR or PEO Mitigate My Risks?

As a business owner, risk mitigation is important for preventing unnecessary financial losses. If you mess up on a single line of a Form I-9, the minimum penalty for paperwork errors is $281. I-9s have multiple blanks to complete, and you have to complete a new I-9 for each worker. As a result, simple mistakes can quickly add up.

By ensuring you’re in legal compliance, handling paperwork, and providing you with workers’ comp, EORs and PEOs can help you avoid lawsuits. Even if you are sued, your legal compliance means the worker is less likely to win their case. Plus, they can handle unemployment taxes, create an employee handbook, and perform other tasks to mitigate your risks.

Looking to hire team members without an entity? Compare EOR pricing with Employsome. Real-time, 24/7 & for free.

Written by

Courtney Pocock is a Copywriter & EOR/PEO Researcher at Employsome with 15+ years of experience writing for the HR, corporate, and financial sectors. She has a strong interest in global business expansion and Employer of Record / PEO topics, focusing on news that matters to business owners and decision-makers. Courtney covers industry updates, regulatory changes, and practical guides to help leaders navigate international hiring with confidence.

Our content is created for informational purposes only and is not intended to provide any legal, tax, accounting, or financial advice. Please obtain separate advice from industry-specific professionals who may better understand your business’s needs. Read our Editorial Guidelines for further information on how our content is created.