But what does it actually mean to work with an EOR that owns its local entity versus one that uses third-party partners? And how does this impact you as an employer and also your employees? We’ve taken a look at how EORs operate today and how it impacts their clients and employees alike.

Looking to find a suitable EOR? Compare real-time pricing. 24/7 & for free.

How EORs Operate Today

Nowadays, when finding the best Employer of Record (EOR) service, many EORs claim they operate in “180 countries.” But how is that realistically possible? Setting up and running a legal entity in a foreign country is expensive and time-consuming: you need lawyers, local representatives, notaries, bank accounts, payroll systems, compliant employment agreements, and ongoing adherence to local labour laws.

No EOR provider can justify this level of investment in every market, especially in countries where they only have a handful of clients. It simply isn’t viable. That’s where there’s a big difference in the market:

- EORs operating with a wholly-owned infrastructure of legal entities,

- EORs operating through a network of local In-Country Partners (ICPs), and

- EORs that operate through a combination of both owned entities and ICPs.

We’ve taken a look at all three operational models and how the work in detail below.

Owned Entity (Direct EOR Model)

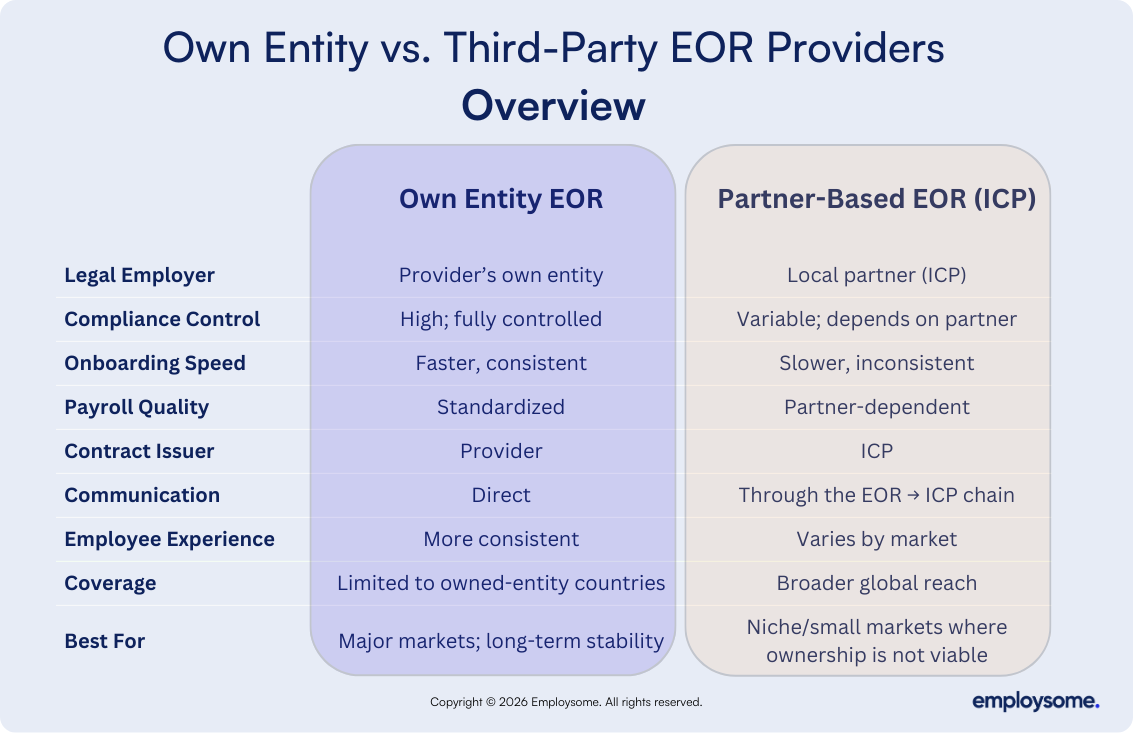

EORs operating through their own local entity control the full employment lifecycle. They are responsible for compliance, they create the employment agreement and sign them with the employee.

They have full control which often means they can make changes faster, and support you directly (because they do not need to email the ICP first). They are the legal employer of the employee and your only point of contact. Often they run their own payroll but many EORs actually still use a partner (often an ICP) to run payroll.

In-Country Partner (Indirect EOR Model)

Today, many EORs rely on ICPs to deliver services in markets where they don’t have their own subsidiaries. The EOR industry is extremely competitive, and acquiring leads is costly, so providers don’t want to miss out on any opportunity. As a result, they advertise global coverage and then either pass the client to a partner or operate through an ICP behind the scenes.

Third-party EORs, by contrast, rely on in-country partners (ICPs) to act as the legal employer. Service quality depends heavily on the partner that is used, and capabilities may vary across markets. Also responses to any change requests or questions are often delayed as the EOR provider need to reach out to the ICP to get the answers from them. This back and forth is quite prone to errors and not the most efficient set-up.

Hybrid EOR Model

A hybrid EOR essentially operates through a combination of an owned infrastructure of legal entities and through local third-party providers. It’s fair to say that most of the global EORs are operating using a hybrid model simply because building up a global infrastructure takes a lot of time. What most of those EORs do is gradually transition out their EOR workforce from a local in-country partner over into their owned infrastructure over time.

💡 Employsome Insights: 95% of EOR providers do not run their own payroll

You might think that if an EOR has their own entity in a country, they do not rely on any partners. This is actually false! Employsome research has shown that 95% of providers actually do not run their payroll inhouse. They actually rely on ICPs or external payroll providers to run their payroll for them.

An Employer/Company Perspective

For employers, the biggest difference is who holds the employment relationship.

With an owned-entity EOR, the service agreement is directly between you and the provider, not a subcontractor. The provider takes full legal responsibility, can execute changes faster, and offers more predictable HR workflows. While some owned-entity EORs still outsource payroll, they typically maintain tighter control and better coordination.

With a third-party EOR, the employer often interacts through an indirect chain: you → EOR → ICP. Communication can be slower, and processes differ market by market. If you hire in multiple countries, you may end up dealing with several different ICPs in the background; some excellent, some less reliable which creates variability in service and compliance risk.

You still sign the service agreement with the EOR provider so on paper you do not see any difference between working with an EOR provider that owns their entity or not.

💡 Employsome Insight: How do know if an ICP is used?

Often you will never know. EORs often do not declare this during the process and try to make the process as smooth as possible that you will actually never know. They usually only declare this on the employment agreement of your employey.

Employee Perspective

For employees, the difference shows up in who signs their contract and provides HR support.

Under an owned-entity EOR, the contract is issued directly by the provider’s local subsidiary, resulting in clearer employer identity, more standardized benefits, and more reliable HR and payroll support.

Under a third-party EOR, the employee signs a contract with the local in-country partner (ICP) rather than the EOR brand they see on the platform. HR policies, benefits, and support quality depend on the partner, which can feel inconsistent, especially for employees hired across multiple countries. They will still be using the tech platform provided by the EOR provider and comtact the EOR provider’s support and not the ICP directly.

💡 Employsome Insight: Is the employment contract signed with the EOR provider or local third-party provider?

When the EOR provider has their own entity, the employee signs directly with the EOR provider. When a third-party provider (ICP) is used, you sign the employment agreement with the provider. The legal responsibility is therefore not with the EOR provider but with the local partner.

Which Model Is Better? Our Honest Verdict

So what is better? To be honest, there isn’t a single clear answer. In larger, established EOR markets – such as the United States, major APAC economies, or core European countries – we generally recommend working with providers that own their local entity, as this typically delivers faster changes, more control, and a more consistent employee experience in one sentence.

When you want to hire in smaller or less developed markets (especially across Africa), there is usually no realistic alternative to using an EOR that works through an In-Country Partner (ICP) if you want to stay with the large global providers. The other option is to work directly with the smaller local provider – essentially, the ICP itself – but we don’t usually recommend this because reliability is harder to assess, reviews are rare, and most lack a proper platform or structured support.

In these cases, it is generally better to rely on a larger provider like Deel, Multiplier, Rippling, or Remote, because they manage all communication with the ICP, which can be challenging for companies to handle themselves. They also already pre-vetted these partners and monitor performance. It is also not seldom that those provider switch ICPs for you in case performance is not good. All that you do not need to worry about.

At Employsome, our goal is to make this landscape more transparent: to show clearly which providers use third parties, and to make it easier for you to evaluate smaller regional providers. There are excellent ones – they’re just often hard to identify.

Written by

Courtney Pocock is a Copywriter & EOR/PEO Researcher at Employsome with 15+ years of experience writing for the HR, corporate, and financial sectors. She has a strong interest in global business expansion and Employer of Record / PEO topics, focusing on news that matters to business owners and decision-makers. Courtney covers industry updates, regulatory changes, and practical guides to help leaders navigate international hiring with confidence.

Our content is created for informational purposes only and is not intended to provide any legal, tax, accounting, or financial advice. Please obtain separate advice from industry-specific professionals who may better understand your business’s needs. Read our Editorial Guidelines for further information on how our content is created.