Hiring internationally has become so common that many companies barely think twice before working with someone halfway across the world. But once you decide to officially bring that person into your organisation, you face a crucial decision in global hiring:

Should you hire the person as an independent contractor, or as a full employee through an Employer of Record (EOR)?

On the surface, the choice seems straightforward, but the cost, compliance obligations, and long-term risks are very different. Choosing the wrong option can lead to tax audits, unexpected liabilities, legal exposure, and operational headaches.

This guide breaks down the true cost of contractors vs. EOR employees, explains misclassification risks country-by-country, and helps you understand which model works best for employers and workers in real life.

Contractor vs. EOR Employee: What’s the Actual Difference?

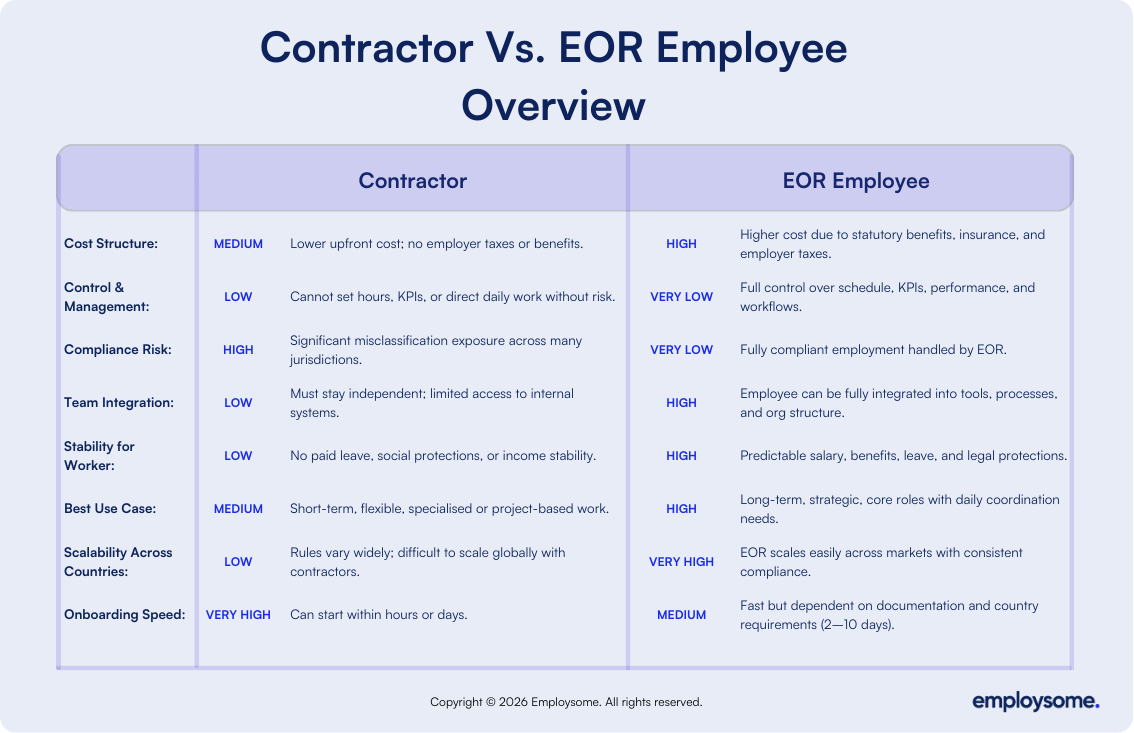

For employers, the decision often starts with cost vs. control.

Hiring a contractor appears cheaper because you only pay the invoice, no employer taxes, social contributions, insurance, or benefits. In many countries, full employment adds 20–45% on top of salary due to mandatory employer costs. Contractors are also fast to onboard and ideal for short-term or independent work.

But the lower cost comes with strict limitations. Across most jurisdictions, you cannot legally control a contractor’s schedule, integrate them deeply into your team, manage their performance, or assign them equipment. Once the relationship resembles employment, the company becomes liable for misclassification.

Employees – whether hired directly or through an EOR – carry higher upfront costs because they include statutory benefits, payroll taxes, insurance, and paid leave. However, employment offers full managerial control, long-term stability, and legal protection.

For employers building distributed teams, launching new markets, or hiring for leadership or core roles, an EOR employee is usually the safer, more scalable option.

From the worker’s perspective, the difference is even more pronounced:

- Contractors enjoy freedom and autonomy, but no paid leave, no social security, no severance, no unemployment protection, and highly variable income.

- Employees receive predictable salary, statutory benefits, pension contributions, and legal protections — especially valuable in countries with strong labour laws.

Contracting prioritises independence; employment prioritises long-term stability and career development.

Contractors Look Cheaper (Until They Don’t)

Almost every company starts global hiring with contractors. It’s fast, flexible, and seems cost-effective:

- No local entity required

- No payroll setup

- No benefits administration

- No employer taxes

And yes; the immediate savings can be substantial. In markets like France, Spain, Brazil, or Germany, employer costs alone can add 30–45% to total compensation.

But contractor simplicity only holds as long as you treat them as independent. The moment you begin setting working hours, giving KPIs, assigning a manager, or integrating them into your workflows, you cross into employee territory and authorities take notice.

This is where companies underestimate the risks of contractor misclassification.

The Real Cost of Contractor Misclassification

Misclassification penalties are often much higher than companies expect. When a contractor is deemed an employee, governments typically charge:

- All unpaid employer social contributions

- Backdated income tax withholdings

- Pension contributions

- Unpaid overtime or leave

- Benefits that should have been included

- Fines, penalties, and interest

- Up to several years of retroactive payments

In strict markets (Europe, LATAM, Canada, Australia), liabilities often reach 30–50% of total compensation for the entire misclassified period, sometimes more.

Here are one-sentence examples from enforcement cases worldwide:

- France: Up to 3 years of retroactive employer contributions + penalties.

- Spain: €10,000+ fines per worker + back Social Security payments.

- United Kingdom (IR35): Backdated income tax and employer NICs.

- Germany: Retroactive social contributions with interest.

- Netherlands: Back payments of social security premiums.

- Canada: Retroactive CPP/EI contributions + interest.

- Brazil: Retroactive FGTS, vacation pay, 13th salary.

- Mexico: Retroactive IMSS + substantial fines.

- Australia: Back pay, superannuation, and civil penalties.

- India: Retroactive benefits when contractors perform core business work.

- Philippines: Repayment of SSS, PhilHealth, and Pag-IBIG contributions.

- Italy: Retroactive contributions for “co.co.co.” reclassification.

The more countries you hire in, the more complex and risky contractors become.

Which Model Is Better? The Real Answer

There is no universal winner between contractors and EOR employees.

The right choice depends on:

- The level of control you need

- The worker’s role (core vs. project-based)

- Local employment laws

- Your company’s risk tolerance

- Whether you need long-term commitment

- Whether you plan to build a team in that country

Contractors are ideal when you need speed, flexibility, or short-term specialised work — and when the role is genuinely independent.

EOR employees are the safer, more scalable option when you need full control, team integration, long-term retention, or when you’re hiring in strict labour markets (EU, UK, LATAM, Canada, Australia).

Ultimately, the best model is the one that reflects how the person will actually work in your company.

Match the model to reality, not to what seems easiest upfront.

Written by

Courtney Pocock is a Copywriter & EOR/PEO Researcher at Employsome with 15+ years of experience writing for the HR, corporate, and financial sectors. She has a strong interest in global business expansion and Employer of Record / PEO topics, focusing on news that matters to business owners and decision-makers. Courtney covers industry updates, regulatory changes, and practical guides to help leaders navigate international hiring with confidence.

Our content is created for informational purposes only and is not intended to provide any legal, tax, accounting, or financial advice. Please obtain separate advice from industry-specific professionals who may better understand your business’s needs. Read our Editorial Guidelines for further information on how our content is created.