After analyzing data from 200+ Employer of Record (EOR) providers, reviewing multiple industry reports, and tracking key market developments through 2025, we’ve developed a comprehensive market forecast that projects where this rapidly evolving industry is headed over the next decade.

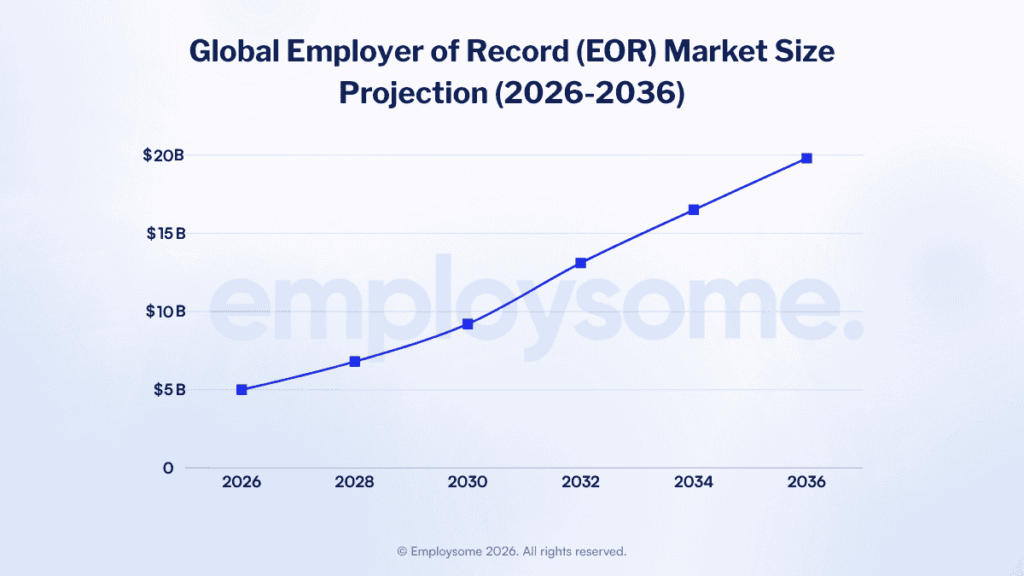

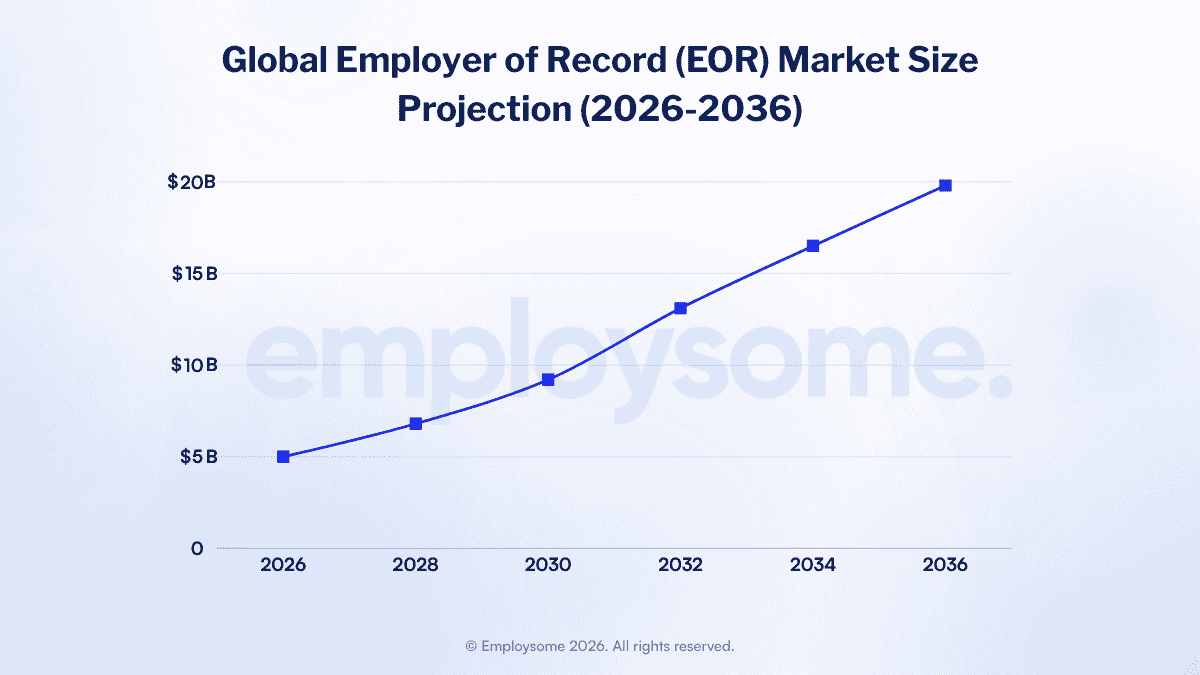

Key Takeaway: The global EOR market is positioned to grow from $5.0 billion in 2026 to approximately $19.8 billion by 2036, representing a compounded annual growth rate (CAGR) of 14.8%. This projection accounts for market definition expansion, accelerated adoption drivers, and the convergence of EOR with adjacent workforce management services.

Executive Summary

The Employer of Record industry has reached an inflection point. What began as a niche payroll/compliance solution for hiring employees internationally has transformed into critical infrastructure for the modern distributed workforce. Several converging factors, permanent remote work normalization, fintech companies entering the space, and increasing regulatory complexity, suggest the market is poised for significantly faster growth than current analyst estimates indicate.

Most existing market reports project the EOR industry reaching $7.8–10.5 billion by 2033-2035 at a 6.5–6.8% CAGR. We believe these estimates are too conservative because they:

- Define the market too narrowly – focusing only on pure-play EOR fees while excluding integrated services

- Underestimate remote work permanence – treating distributed teams as a temporary phenomenon

- Miss the fintech convergence – not accounting for players like Revolut entering the space

- Ignore SMB adoption acceleration – the next wave of growth comes from smaller businesses going global

- Overlook Africa’s growth – the continent’s youngest workforce and compliance complexity make it a major 2030s growth driver

Our model takes a broader, more realistic view of the integrated workforce management platform market that EOR providers are becoming.

Market Size Overview: 2026-2036

The EOR industry has seen rapid growth since its inception in the mid-2010s and especially during the Covid-19 pandemic. We’ve taken a closer look at the current and expected future growth.

Current State (2025-2026)

| Year | Market Size (USD) | YoY Growth |

|---|---|---|

| 2025 | $4.71 billion | — |

| 2026 | $5.01 billion | 6.4% |

The global EOR market closed 2025 at approximately $4.71 billion. Multiple data sources converge around this figure, including Global Growth Insights ($4.71B), Business Research Insights ($5.59B for broader definition), and Verified Market Research ($4.4B conservative estimate).

The Employsome Market Forecast Model (2026-2036)

Our proprietary model incorporates three key adjustments to traditional EOR market sizing done by non-industry expert firms:

| Year | Traditional Estimate | Employsome Forecast | Difference |

|---|---|---|---|

| 2026 | $5.0B | $5.0B | — |

| 2028 | $5.7B | $6.8B | +19% |

| 2030 | $6.5B | $9.2B | +42% |

| 2032 | $7.4B | $13.1B | +77% |

| 2034 | $8.4B | $16.5B | +96% |

| 2036 | $9.6B | $19.8B | +106% |

Traditional CAGR (2026-2036): 6.8%

Employsome Forecast CAGR (2026-2036): 14.8%

Year-by-Year Market Projections (2025-2036)

Below is our detailed year-over-year forecast with commentary on key growth drivers for each period:

Detailed Year-by-Year Breakdown

| Year | Market Size | YoY Growth | Key Growth Drivers |

|---|---|---|---|

| 2025 | $4.71B | — | Baseline year |

| 2026 | $5.01B | 6.4% | Revolut GlobalHire launch, continued remote work normalization |

| 2027 | $5.78B | 15.4% | Fintech convergence accelerates, SMB adoption surge begins |

| 2028 | $6.76B | 17.0% | AI-powered onboarding reduces costs, APAC market expansion |

| 2029 | $7.88B | 16.6% | LATAM nearshoring boom, platform bundling drives ARPU growth |

| 2030 | $9.16B | 16.3% | Enterprise adoption hits critical mass, regulatory complexity peaks |

| 2031 | $10.61B | 15.8% | African talent market acceleration begins, integrated payroll becomes standard |

| 2032 | $12.22B | 15.2% | Market consolidation creates dominant players, Africa expansion drives growth |

| 2033 | $13.99B | 14.5% | African continent becomes major growth driver, equity management bundled |

| 2034 | $15.89B | 13.5% | Mature market dynamics, focus shifts to retention and upselling |

| 2035 | $17.85B | 12.4% | Global workforce infrastructure fully normalized |

| 2036 | $19.82B | 11.0% | Market maturity, stable growth phase begins |

Our Growth Methodology: Why We Project Higher

Most market analysts use a straightforward approach: take current EOR-specific revenue, apply a conservative CAGR based on historical growth, and project forward. This methodology fails to capture several critical dynamics reshaping the industry.

Factor 1: Market Definition Expansion

Traditional EOR market estimates count only the management fee portion of EOR contracts (typically $400-$700/month per employee). This ignores:

Revenue streams increasingly bundled into EOR platforms:

- Global payroll outsourcing processing fees

- Contractor management and payments

- Benefits administration and insurance premiums

- Equity and stock option management

- Immigration and visa services

- HR software and HRIS subscriptions

Case in Point: Deel’s Multi-Product Strategy

Deel reported that customers using 3+ products increased by 480% in 2024. Their $1B ARR isn’t just EOR fees, it includes contractor payments, payroll, HR tools, and financial services. When Deel processes $22 billion in annual payroll, the platform captures revenue far beyond the base EOR management fee.

Our Adjustment: We expand the market definition to include integrated workforce management platform revenue, not just pure-play EOR fees. This adds approximately 30-40% to the addressable market.

Factor 2: Fintech Convergence

The entry of major fintech players fundamentally changes market dynamics.

Revolut’s GlobalHire (Launching H2 2026)

Revolut, valued at $75 billion with 65 million customers and legal entities in 39 countries, is launching EOR services under the “GlobalHire” brand. This matters because:

- Existing infrastructure: Revolut already processes cross-border payments and has built compliance frameworks across dozens of jurisdictions

- Distribution advantage: 65 million existing customers, many of whom are business users

- Aggressive pricing expected: Revolut can subsidize EOR with other financial services revenue

- Market validation: When a $75B fintech enters your space, it signals massive opportunity

Payoneer’s EOR Ambitions

Payoneer (NASDAQ: PAYO) acquired Skuad in 2024 and Boundless in January 2026, signaling a strategic push into integrated workforce management. These acquisitions give Payoneer:

- EOR capabilities across 160+ countries

- Existing relationships with SMBs doing cross-border commerce

- Payment infrastructure to support seamless global payroll

Our Adjustment: Fintech entry accelerates market growth by 2-3 percentage points annually through increased competition, lower prices, and expanded market awareness.

Factor 3: Remote Work Permanence

The debate about whether remote work is temporary has been settled. The data is conclusive:

Current Remote Work Statistics (2025-2026)

- 28% of the global workforce now works remotely (up from 19.5% pre-pandemic)

- 22-23% of US workers work remotely, comprising 32-36 million people

- 52% of US remote-capable workers are hybrid, 26% fully remote

- 98% of professionals want remote work options at least part-time

- 85% say remote work is the #1 factor in job applications (ahead of pay)

- 46% would quit if remote work flexibility was removed

Global Hiring Intent

- 87% of companies cite local tax/employment regulations as the hardest expansion task

- 74% rely on external experts for international HR guidance

- 65% use EORs specifically to reduce regulatory and compliance risks

- 58% of multinational organizations have adopted or are planning EOR services

Our Adjustment: Remote work normalization adds 4-5 percentage points to baseline growth as distributed teams shift from exception to default.

Factor 4: SMB Market Penetration

Enterprise adoption of EOR services is already high (58% of multinationals). The next growth wave comes from small and medium businesses:

Current SMB Adoption: ~56% of EOR users are SMEs

Addressable Market: Millions of SMBs worldwide are selling internationally but haven’t formalized international employment

Key enablers for SMB adoption:

- Self-service platforms reducing the need for enterprise sales processes

- Pricing transparency and competition driving costs down

- AI-powered onboarding reducing time-to-hire

- Integrated platforms eliminating multi-vendor complexity

Our Adjustment: SMB market penetration adds 3-4 percentage points to growth through 2030 as awareness and accessibility improve.

Factor 5: Geographic Expansion

Current regional distribution and growth rates:

| Region | 2025 Share | CAGR (2025–2036) | 2036 Projected Share |

|---|---|---|---|

| North America | 38–42% | 11.2% | 30% |

| Europe | 28–30% | 13.5% | 25% |

| Asia-Pacific | 22–24% | 17.1% | 27% |

| Latin America | 4% | 18.5% | 8% |

| Africa | 3% | 19.8% | 7% |

| Middle East | 3% | 14.2% | 3% |

APAC’s explosive growth (17.1% CAGR) driven by:

- Cross-border employment between China, India, Malaysia, and the Philippines

- Digital transformation and cloud HR adoption

- Nearshoring from high-cost Western markets

LATAM’s emergence (18.5% CAGR) fueled by:

- US companies near-shoring to time-zone-aligned talent

- Strong tech talent in Brazil, Mexico, Argentina, Colombia

- Cost savings of 30-70% versus US salaries

Factor 6: The African Continental Growth Opportunity

Africa represents the most compelling untapped growth driver for the EOR industry, particularly from the early 2030s onward. The continent’s structural characteristics make it uniquely suited for EOR adoption:

The Demographic Advantage

Africa has the youngest population globally, with a median age of just 19.7 years (compared to 38.5 in Europe and 38.1 in North America). By 2030, the continent will add 375 million people to the working-age population. This isn’t just quantity, it’s increasingly qualified talent:

- 70% of African youth are digitally active, with smartphone penetration growing 18% annually

- 11 million African graduates enter the workforce each year

- The tech talent pool is exploding, with hubs in Nigeria, Kenya, South Africa, Egypt, Rwanda, and Ghana

- English and French fluency provides language alignment with major global markets

Why Africa Is Predestined for EOR

Paradoxically, Africa’s infrastructural challenges make EOR solutions more valuable, not less:

- Fragmented compliance landscape: 54 countries with vastly different labor laws, tax systems, and employment regulations. No company can reasonably maintain legal entities across this complexity, EOR becomes the only practical solution.

- Limited payroll infrastructure: Traditional payroll systems struggle with multi-currency payments, banking fragmentation, and regulatory variation. EOR platforms abstract this complexity.

- Evolving regulatory frameworks: Many African nations are still formalizing employment law, creating compliance uncertainty that EOR providers are built to navigate.

- Currency and payment challenges: Cross-border payments remain difficult; EOR providers with established banking rails solve this at scale.

The Business Case for Hiring in Africa

Global companies are taking notice:

- Tech talent in Nigeria, Kenya, and South Africa costs 50-70% less than US equivalents

- Time zone alignment with Europe makes Africa ideal for remote teams serving EMEA markets

- The African Continental Free Trade Area (AfCFTA) is harmonizing trade and potentially labor regulations across 54 countries

- Major tech companies (Google, Microsoft, Amazon) have established African engineering hubs, validating the talent quality

EOR Provider Positioning

The EOR providers making early moves into Africa will capture disproportionate growth:

- Playroll has strong operational presence across Africa (South African founders, offices in multiple countries)

- GoGlobal maintains one of the strongest owned entity networks across the continent, including coverage in Mali, Zambia, and Senegal

- Deel and Remote have expanded African coverage significantly in 2024-2025

- Local players such as Africa Deployments are emerging to serve specific regional needs

Our Projection: Africa will contribute an additional 2-3 percentage points to global EOR growth from 2030 onward, accelerating through the mid-2030s as the continent’s digital transformation matures and multinational companies recognize the strategic imperative of accessing African talent compliantly.

Factors Contributing to EOR Market Growth

We believe there are four key factors contributing to the EOR industry’s future growth. They’re as follows:

1. Regulatory Complexity Is Increasing, Not Decreasing

Employment law is becoming more complex globally, not simpler:

Recent Regulatory Changes (2024-2026)

- Austria Teleworking Act (2025): New compliance requirements for remote workers

- Singapore Tripartite Guidelines (2024): Formal frameworks for flexible work

- EU Framework Agreement Updates: Ongoing harmonization efforts creating new compliance layers

- OECD Model Tax Convention Changes: Increased “permanent establishment” risk awareness

What This Means: Every new regulation increases the value proposition of outsourcing compliance to specialists. Companies face a choice: build expensive internal compliance teams or partner with EORs who amortize expertise across thousands of clients.

2. Technology Integration and AI

The EOR industry is rapidly adopting technology that improves unit economics:

Current Technology Adoption Rates

- 38% of new EOR deployments use cloud-based HRIS integration

- 32% adoption of AI-enabled onboarding systems

- 61% using cloud platforms for global HR management

- 41% API adoption for system integration

Impact of Technology:

- Reduced onboarding time from weeks to days (some providers claim 24-48 hours)

- Automated contract generation with local compliance built-in

- AI-powered payroll verification reducing errors

- Self-service platforms enabling SMB adoption without enterprise sales cycles

3. Talent Scarcity Forcing Global Hiring

Companies can no longer find all the talent they need locally:

- 73% of teams expected to have remote workers by 2028

- Global tech talent shortage estimated at 4 million+ developers by 2025

- Specialized skills (AI/ML, cybersecurity, data science) especially constrained

- Salary arbitrage making global hiring economically attractive

4. Platform Consolidation and Bundling

EOR is becoming one module in integrated workforce management platforms:

Typical Modern EOR Platform Includes:

- Employee hiring and onboarding (EOR core)

- Contractor management and payments

- Global payroll processing

- U.S. PEO Services

- Benefits administration

- Equity and stock option management

- Immigration and visa support

- HR software and time-off management

- Expense management

- Equipment provisioning

Revenue Impact: Deel customers using 3+ products increased 480% year-over-year, demonstrating the bundling strategy works.

Recent Market Developments

We’ve summarised below recent key market events that have shaped the industry’s dynamics.

Revolut Enters the EOR Market (H2 2026)

The $75 billion fintech giant Revolut is launching “GlobalHire,” an EOR service covering 160 countries. This represents the largest traditional fintech entry into the EOR space.

Why Revolut matters:

| Metric | Revolut | Deel (for comparison) |

|---|---|---|

| Valuation | $75B | $17.3B |

| Customers | 65 million | 35,000+ |

| Legal Entities | 39 countries | 100+ countries |

| Core Competency | Cross-border payments | Global employment |

Revolut’s advantages:

- Existing payment infrastructure reduces implementation costs

- Consumer and business users on platform create distribution

- Experience with regulatory complexity across financial services

- Capital to subsidize growth with competitive pricing

Expected impact: Increased price competition, accelerated SMB adoption, and market validation that attracts additional investment.

Deel Raises $300M at $17.3B Valuation (October 2025)

Deel completed a $300 million Series E round led by Ribbit Capital, Andreessen Horowitz, and Coatue Management.

Deel by the Numbers:

- $1B ARR reached in Q1 2025

- $100M monthly revenue as of September 2025

- $22B annual payroll processed

- 35,000+ corporate customers

- 1.5M+ workers paid through platform

- 75% year-over-year growth

- 3 consecutive years profitable

- ~$1.3B total raised since 2019

Strategic Plans:

- Strategic acquisitions continue (Atlantic Money, PaySpace, Omnipresent)

- AI investment for automation and efficiency

- Expansion to 100+ countries by 2029

- Integration of contractor, payroll, and HR products

Boundless Acquired by Payoneer (January 2026)

Ireland-based EOR platform Boundless was acquired by NASDAQ-listed Payoneer. This acquisition follows Payoneer’s 2024 acquisition of Skuad.

Strategic Implications:

- Payoneer building comprehensive financial stack for cross-border SMBs

- Combines payment rails + workforce management + compliance

- Strengthens European footprint specifically

- Signals ongoing consolidation in the EOR space

Macroeconomic Trends Impacting the EOR Market

While COVID-19 acted as a catalyst for early EOR adoption, it does not explain the industry’s long-term trajectory. Today, EOR growth is increasingly driven by structural shifts in how companies hire, operate, and expand globally.

The Remote Work Transformation

Remote work has fundamentally restructured how businesses think about hiring:

Global Metrics (2025-2026)

- 28% of global workforce works remotely (1B+ workers)

- Average 1.27 work-from-home days per week globally (stabilized from 1.6 in 2022)

- 52% of US remote-capable workers are hybrid, 26% fully remote

- 73% of teams expected to have remote workers by 2028

Employee Preferences

- 85% say remote work is the #1 factor in job applications

- 46% would quit if remote work was removed

- 76% say flexibility influences desire to stay with employer

- Workers value remote flexibility at 5-9% of salary equivalent

UK-Specific Data

- 3% of workers left jobs in past year due to lack of flexibility (~1.1 million workers)

- Demonstrates employees will act on preferences, not just state them

Business Drivers for EOR Adoption

Primary Motivations (2026 Survey Data)

- 87% cite local tax/employment regulations as hardest expansion task

- 74% rely on external experts for international HR guidance

- 65% use EORs to reduce regulatory and compliance risks

- 63% use EORs to lower costs of local entity setup

- 51% use EORs to access global talent

Adoption Rates

- 58% of multinational organizations have adopted or are planning EOR services (2025)

- 56% of EOR users are small and medium enterprises

Nearshoring Trends

- US-China tensions driving manufacturing diversification to LATAM and Southeast Asia

- European companies exploring Eastern Europe for cost-effective talent

- Supply chain localization increasing demand for regional hiring

Currency and Inflation

- Strong US dollar making USD-denominated salaries attractive in many markets

- Hyperinflation in some markets (Argentina) creating unique hiring dynamics

- EORs managing currency complexity for employers

Market Challenges and Restraints

While growth prospects are strong, several factors could moderate expansion:

Regulatory Uncertainty

- 42% of providers face legal complexity challenges

- 27% report client hesitation due to legal ambiguity around EOR models

- Some jurisdictions questioning the EOR structure itself (e.g., Germany’s AÜG licensing requirements)

Data Privacy Concerns

- 36% cite data privacy as a significant challenge

- GDPR, CCPA, and emerging privacy frameworks create compliance complexity

- Cross-border data transfer restrictions affecting global payroll operations

Pricing Pressure

- New entrants (Revolut, fintech players) likely to compress margins

- SMB market expects lower price points than enterprise segment

- Commoditization risk as basic EOR services become table stakes

Quality Variance

- 31% of users report payroll error risks

- Partner-based models (indirect EOR, e.g. Papaya Global or RemoFirst) create quality control challenges

- Support quality varies significantly across providers and regions

Frequently Asked Questions

To clarify the most common points around EOR, we’ve answered a few frequently asked questions below.

An Employer of Record is a third-party organization that becomes the legal employer of your workers in countries where you don’t have a legal entity. The EOR handles employment contracts, payroll, taxes, benefits, and compliance with local labor laws, while you maintain day-to-day management of the employee’s work.

The global Employer of Record market is valued at approximately $5.0 billion in 2026. Traditional estimates project growth to $7.8-10.5 billion by 2033-2035. Our expanded market definition, which includes integrated workforce management platforms, projects the market reaching $19.8 billion by 2036.

Traditional market estimates use a 6.5-6.8% CAGR. Our model, which accounts for market definition expansion, fintech convergence, remote work permanence, and SMB adoption, projects a 14.8% CAGR from 2026-2036.

Asia-Pacific is the fastest-growing region at approximately 17.1% CAGR, driven by cross-border employment and digital transformation. Latin America follows closely at 18.5% CAGR, fueled by US companies nearshoring to time-zone-aligned talent markets.

Key growth drivers include: permanent remote work adoption (28% of global workforce), increasing regulatory complexity across jurisdictions, talent scarcity forcing global hiring, technology integration reducing costs, and fintech companies (like Revolut) entering the market and increasing awareness.

EOR services typically range from $400-$1,500 per employee per month, depending on the provider and country. Entry-level providers like RemoFirst start around $199-$405/month, mid-market players like Deel and Remote charge $599-$704/month, and enterprise-focused providers like G-P charge $940+ per month.

The market leaders include Deel (largest by revenue at $1B ARR), G-P (longest-established enterprise provider), Remote (strong on owned entities and compliance), Papaya Global (technology-forward approach), and Oyster HR (Europe-focused). Emerging players like Revolut GlobalHire are expected to disrupt the market in 2026.

You can read more in our Best EOR Services guide.

Owned entity (direct) EOR: The provider operates their own legal entity in each country and directly employs workers. This offers stronger compliance control and liability clarity.

Partner model (indirect) EOR: The provider subcontracts employment to local third-party partners. This enables faster geographic expansion but introduces additional layers and potential quality variance.

EOR services are legal in most countries but operate under different regulatory frameworks. Some jurisdictions have specific requirements, for example, Germany requires an AÜG (temporary staffing) license for EOR operations. Companies should verify their provider’s compliance status in each target country.

EOR advantages: Faster time-to-hire (days vs. months), no upfront entity costs ($20,000-$150,000 saved), reduced compliance risk, easier exit if hiring plans change.

Local entity advantages: Full control over employment relationships, potentially lower long-term costs at scale (50+ employees), no third-party dependencies.

General guidance: EOR is typically more cost-effective for teams of 1-30 employees. Beyond that threshold, companies often evaluate entity establishment.

Revolut’s entry with GlobalHire (launching H2 2025-2026) is expected to: increase price competition through aggressive pricing, accelerate SMB adoption through existing customer base distribution, and validate the market opportunity (when a $75B fintech enters your space, it signals mainstream adoption). This could add 2-3 percentage points to annual market growth.

Final Verdict

The Employer of Record market stands at an inflection point. Traditional market estimates fail to capture the magnitude of change occurring:

The conservative view (6.5-6.8% CAGR to ~$10B by 2035) assumes EOR remains a niche compliance service for international hiring edge cases. This view underweights remote work permanence, ignores platform bundling economics, and misses fintech disruption.

Our view (14.8% CAGR to ~$20B by 2036) recognizes that EOR is becoming critical infrastructure for the distributed workforce economy. The market definition is expanding as EOR providers become full workforce management platforms. Fintech entry signals mainstream adoption. Remote work isn’t a phase, it’s structural.

Key indicators to watch:

- Revolut GlobalHire launch execution and pricing (2026)

- Deel’s path to $2B ARR and continued M&A

- Enterprise adoption rates surpassing 70%

- SMB market penetration growth

- APAC, LATAM and Africa regional acceleration

For businesses evaluating EOR providers, the market’s growth trajectory creates both opportunity and complexity. More options mean better pricing and features, but also require more careful due diligence to identify providers with staying power.

At Employsome, we track 100+ EOR providers across 50+ countries to help businesses find the right partner for their specific needs. Our data-driven approach cuts through marketing claims to reveal actual pricing, compliance capabilities, and on-the-ground performance.

Written by

Courtney Pocock is a Copywriter & EOR/PEO Researcher at Employsome with 15+ years of experience writing for the HR, corporate, and financial sectors. She has a strong interest in global business expansion and Employer of Record / PEO topics, focusing on news that matters to business owners and decision-makers. Courtney covers industry updates, regulatory changes, and practical guides to help leaders navigate international hiring with confidence.

Our content is created for informational purposes only and is not intended to provide any legal, tax, accounting, or financial advice. Please obtain separate advice from industry-specific professionals who may better understand your business’s needs. Read our Editorial Guidelines for further information on how our content is created.

Other posts

Read More