Table of Contents

Payoneer, the $1.9B fintech company known for cross-border payments, just acquired Boundless – an Ireland-based Employer of Record platform founded by Dee Coakley and Emily Castles.

If you’ve been following the EOR space, you’ll know this isn’t Payoneer’s first move here. Last year, they acquired Skuad (now rebranded as Payoneer Workforce Management). Boundless is acquisition number two.

So what’s going on?

The Deal

Financial terms weren’t disclosed. But here’s what we know:

Boundless is a Dublin-based EOR that launched in 2019, backed by investors including Ada Ventures and Playfair Capital. They’ve built a reputation for helping companies employ remote workers globally – handling the unglamorous but essential stuff like payroll, taxes, benefits, and compliance.

Payoneer CEO John Caplan summed up the rationale pretty clearly: “The global talent landscape is shifting dramatically. From new visa policies to evolving labor regulations, companies everywhere are rethinking how they hire and manage global teams.”

Translation: the EOR market is getting hotter, and Payoneer wants in.

Why Europe Matters

Here’s the interesting part. By acquiring an Irish EOR, Payoneer isn’t just buying customers – they’re buying European expertise.

For a United States-based fintech trying to serve SMBs worldwide, that’s strategically smart. Europe’s employment regulations are notoriously complex and local knowledge matters. Boundless brings deep operational presence across multiple European markets.

Dee Coakley, Boundless’s CEO, put it this way: “Joining Payoneer allows us to bring our European expertise to a truly global platform.”

What This Signals for the EOR Market

Let’s zoom out for a second.

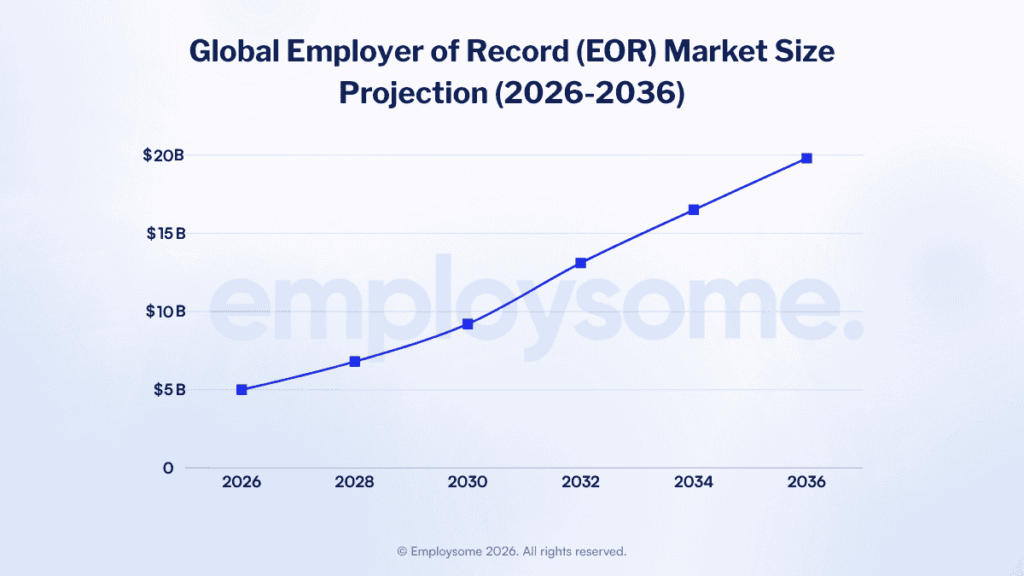

We’re seeing a clear pattern emerge: fintech and payments companies are eyeing the EOR space as a natural extension of their cross-border infrastructure.

Think about it. If you’re already helping businesses move money across borders, why not help them move people across borders too? The customer overlap is obvious, and the operational synergies are real.

Payoneer isn’t alone here. Revolut recently announced GlobalHire, signaling that the $75B fintech giant sees EOR as part of its future too.

For traditional EOR providers, this should be a wake-up call. Competition isn’t just coming from other EORs anymore – it’s coming from well-funded fintechs with existing customer bases and distribution advantages.

Our Take

The EOR market is consolidating. Fast.

Between Hightekers acquiring Serviap, Deel taking over Omnipresent, Revolut entering the space, and now Payoneer doubling down with Boundless, we’re watching the industry mature in real-time.

For companies shopping for an EOR, this consolidation brings both opportunities and risks. Bigger players mean more resources and broader coverage. But it also means your boutique EOR might get acquired tomorrow – and you’ll need to adapt.

Our advice? When comparing EORs, don’t just look at today’s capabilities. Consider the trajectory. Who’s growing? Who’s getting acquired? Who’s likely to still be independent in two years?

The EOR landscape in 2026 might look very different from the one you signed up for.

Written by

Courtney Pocock is a Copywriter & EOR/PEO Researcher at Employsome with 15+ years of experience writing for the HR, corporate, and financial sectors. She has a strong interest in global business expansion and Employer of Record / PEO topics, focusing on news that matters to business owners and decision-makers. Courtney covers industry updates, regulatory changes, and practical guides to help leaders navigate international hiring with confidence.

Our content is created for informational purposes only and is not intended to provide any legal, tax, accounting, or financial advice. Please obtain separate advice from industry-specific professionals who may better understand your business’s needs. Read our Editorial Guidelines for further information on how our content is created