Are you hiring a person in another country and coming across the term semi-monthly payroll? It can be quite confusing coming from a country that has a different system and many people confuse it with bi-weekly payroll (and don’t be fooled, those are completely different things).

But how does it actually work and how do they invoice for it? Let’s break it down in this glossary article.

What is semi-monthly payroll?

Semi-monthly payroll means that employees are paid twice per month usually on fixed dates. The goal is to have 24 (2 per month) payment periods per calendar year regardless how many weeks are in the month (main difference to bi-weekly payroll).

Typically, pay periods are on the:

- 15th and last day of he month

- 1st and 15th

- or 10th and 25th or month (rarely used)

Let’s try to understand it better with an example. For instance, an employee that earns 60,000 USD a month would be paid 2,500 USD per pay period (60,000 / 24 pay periods = 2,500)

As you see, semi-monthly payroll has that the employee can plan with receiving the same amount every month (compared to bi-weekly payroll) and getting paid more frequently (compared to monthly payroll).

In the US, payroll frequency used depends on the state you are hiring.

The U.S. Department of Labor defined the payday requirements for each state. For instance, in Alaska, Arizona and Georgia usually use a semi-monthly payment frequency.

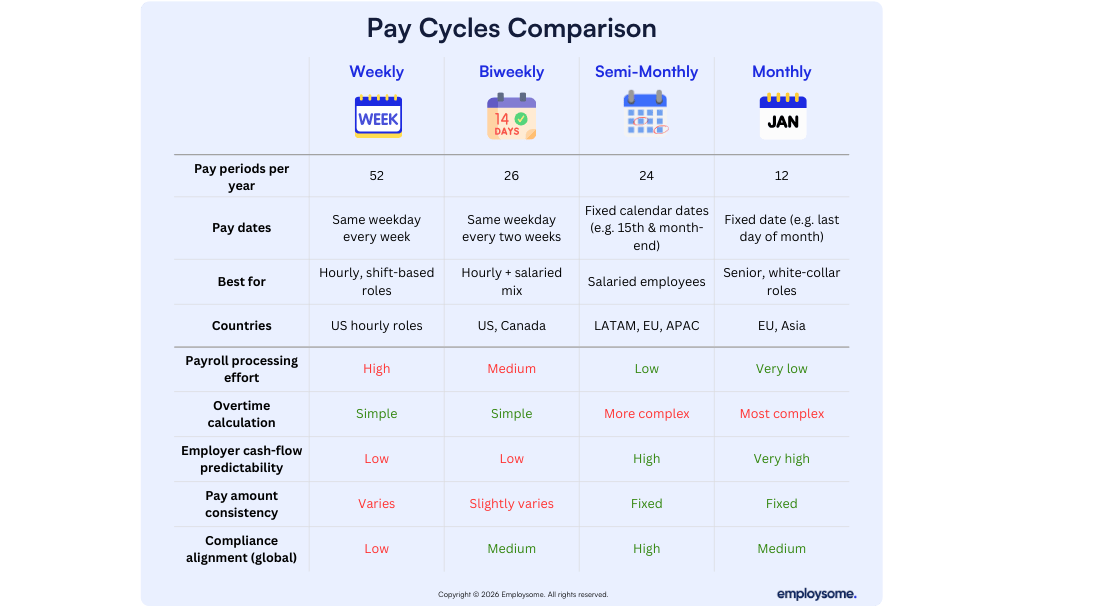

Semi-monthly payroll vs. bi-weekly payroll and other frequencies

So what is not the difference between semi-monthly and the other pay cycle frequencies?

Semi-Monthly vs. Weekly Payroll

Compared to semi-monthly payroll, weekly payroll offers faster payouts of wages but at a significant administrative cost. Weekly payroll requires 52 payroll runs per year, increases payroll processing effort, and creates less predictable employer cash flow. Within the EOR industry, not many providers offer weekly payroll as its just too many payments and invoicing becomes very tricky.

Semi-Monthly vs. Biweekly Payroll

Biweekly payroll is often confused with semi-monthly payroll, but the difference really matters. While Semi-monthly payroll has 24 payment periods per year (always 2 per month), biweekly payroll has 26 pay periods per year. This means that two months include an “extra” paycheck.

Many EORs offer semi-monthly payroll for US and Canada. Some EORs invoice 2 payment cycles in advance so you receive one invoice per month but employees are paid more often. The issue is that some months will include 3 payment cycles and will receive in higher invoices that might require some additional checks. We will be honest, bi-weekly payroll is difficult to understand and can result in some issues for budgeting, tax filings, calculating insurances and social security and can result in some errors of your EOR providers.

Semi-Monthly vs. Monthly Payroll

Monthly payroll is even simpler than semi-monthly payroll from an administrative standpoint, but it often shifts financial pressure onto employees. Receiving salary only once per month can be challenging for junior staff or workers that have a high percentage of their compensation from overtime pay. Also some employees do not enjoy that they have to wait a month for expenses to be reimbursed. All global and regional EOR providers offer monthly payroll. Some EORs offer an additional semi-monthly payout of expense and overtime pay in combination with monthly payroll.

Pros & Cons of Semi-Monthly Payroll

Predictable payroll costs: Same payroll amount every month (compared to bi-weekly payroll). Better for admin and cash flow planning.

Less room for admin mistakes: More efficient for income tax, social security and statutory benefits calculations.

Preferred by employees: Many employees prefer the predictability and higher frequency of payments

Hard to calculate hourly work: Pay periods can be uneven and calculating overtime can be more difficult.

Pay dates may be on a weekend/ bank holiday: Sometimes pay dates need to be adapted.

Final Thoughts

Semi-monthly payroll is a good alternative to bi-weekly payroll as it has a more rigid schedule and facilitates planning. It becomes a good alternative for companies that want to hire internationally. If you struggle with additional payroll complexitity and have difficulties managing yet another different payroll schedule, an Employer of Record (EOR) can help out.

👉 We’ve summarised the best EOR services in our top 10 guide.

If you are hiring internationally and you want to avoid and payroll risk, choosing the right payroll structure is very important and requires a lot of discussions with your EOR provider when no monthly payroll structure is used. Also always make sure you align how overtime is paid, when expenses are being paid out, how you are being invoiced in combination with the payroll frequency of your choice.

Written by

Dane Cobain is a Copywriter at Employsome and an accomplished author whose work spans fiction, non-fiction, and professional writing. Over the past decade, he has built a strong track record creating straightforward content for the HR, payroll, and corporate sectors. Dane brings a storyteller’s eye to the evolving world of global employment, with a particular focus on Employer of Record and PEO models. His articles explore industry trends and dedicated Best Of Guides when managing an international workforce.

Our content is created for informational purposes only and is not intended to provide any legal, tax, accounting, or financial advice. Please obtain separate advice from industry-specific professionals who may better understand your business’s needs. Read our Editorial Guidelines for further information on how our content is created.