Globalization Partners Employer of Record (EOR) Review [2026]

Globalization Partners also known as G-P is a global EOR and one of the industry’s early pioneers.

Table of Contents

As part of our independent expert review and scoring process, we personally went through Globalization Partners (G-P) full sales and onboarding journey to hire EOR employees across multiple countries – so you don’t have to. This hands-on testing forms part of Employsome’s data-driven ranking methodology, where we evaluate each Employer of Record based on pricing transparency, onboarding speed, contract terms, platform quality, and real on-the-ground execution.

In our case, obtaining an initial price quote required three separate sales calls, and pricing ultimately landed among the highest we observed across all global EOR providers. From first contact to employee activation, onboarding took more than three weeks – significantly slower than several competing platforms we tested.

Because EOR performance can vary widely by country, we also assess Globalization Partners separately in each market. You can explore how it ranks in individual countries, compare its Global EOR Score vs. Country Scores, and see detailed pricing and delivery quality in our country-by-country Employer of Record comparisons.

Company Overview: Globalization Partners at a Glance

Globalization Partners (or “G-P”) is one of the most established and widely recognised Employer of Record (EOR) providers in the global employment industry and a true pioneer of the modern EOR model. Long before global hiring platforms became mainstream, Globalization Partners helped define how U.S. companies approach international hiring, cross-border employment, and compliant workforce expansion. At a time when building global teams typically required setting up local legal entities and navigating months of regulatory red tape, its Employer of Record solution offered a faster and fully compliant alternative.

Today, international hiring through an Employer of Record is significantly simpler – in large part because of the groundwork Globalization Partners helped establish in the early EOR market. This legacy still matters, particularly for U.S.-based enterprises scaling across Europe, APAC, and Latin America that need a reliable global EOR provider with deep compliance infrastructure.

Through its platform and global EOR services, Globalization Partners enables American companies to hire employees in more than 125 countries without opening foreign subsidiaries or managing complex local employment laws, payroll processing, tax withholding, or statutory benefits administration. While the company markets coverage in 180+ countries, our discussions with Globalization Partners confirm that active owned-entity operations currently span closer to 125 markets. For companies expanding internationally, this Employer of Record model allows HR and finance teams to focus on growth while Globalization Partners manages compliant onboarding, global payroll, employment contracts, and ongoing local labour-law compliance.

Key Features & Services of Globalization Partners

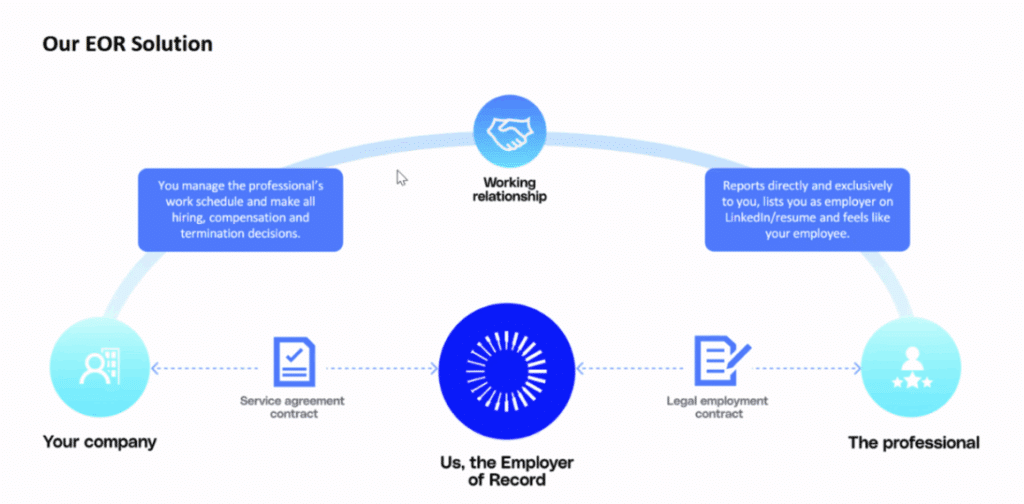

Global Employer of Record (EOR)

Globalization Partners acts as the legal employer for your staff in the U.S. handling all your HR needs like payroll processing, employer taxes, benefits and other compliance tasks. Globalization Partners concentrates on being 100% compliant with all federal and state employment laws.

Included services:

-

- Compliant employment contracts

- Local onboarding, identity verification, and right-to-work checks

- Monthly payroll processing, payslips, tax filings, and employer contributions

- Benefits administration (local health, pension, supplemental coverage)

- Time off management

- Terminations, offboarding, and severance compliance

- IP transfer, confidentiality, non-compete options

- Compliance and risk mitigation in each country

Global Payroll

For companies with their own foreign legal entities, Globalization Partners offers global payroll outsourcing:

Included:

- Payroll calculations & compliance across 100+ countries

- End-to-end payslip generation

- Automated tax filings

- Employer burden calculations

- Unified payroll calendar

- Global ledger and reporting

- Audit readiness features

This is typically used by mid-market and enterprise companies with large global workforces.

Global Contractor Management

Beyond EOR, Globalization Partners also offer independent contractor services under the Agent of Record Model. They allow companies to hire independent contractors and manage invoicing, payments, currency conversation for the. Globalization Partners’ international contractor payment platform is designed to simplify how companies handle global contractor relationships. Instead of relying on spreadsheets or scattered email threads, the system keeps all contractor information in one centralized location, which makes tracking and management easier.

The invoicing and payment process is also made easy. Users can submit invoices for contractors and send payments to over 190 markets in a relatively short time, which often cuts down administrative work. One of the more notable features is its compliance support: the platform uses AI to check contracts against local employment laws, pointing out possible misclassification issues and suggesting adjustments.

Core capabilities:

- Contract generation using localized templates

- Global payments in 150+ currencies

- Invoice collection and consolidated billing

- Optional classification assessments

- Automated reminders & compliance safeguards

Immigration & Global Mobility

Globalization Partners have a strong global mobility team that can help you with work visas, residence permits, tax compliance and managing general relocations. They will be your supportive point of contact in difficult residence permit cases or arranging housing for employees that are relocating. They will also monitor your immigration status and documents and make sure everything is taken care of before any visas expire.

Add-On Services

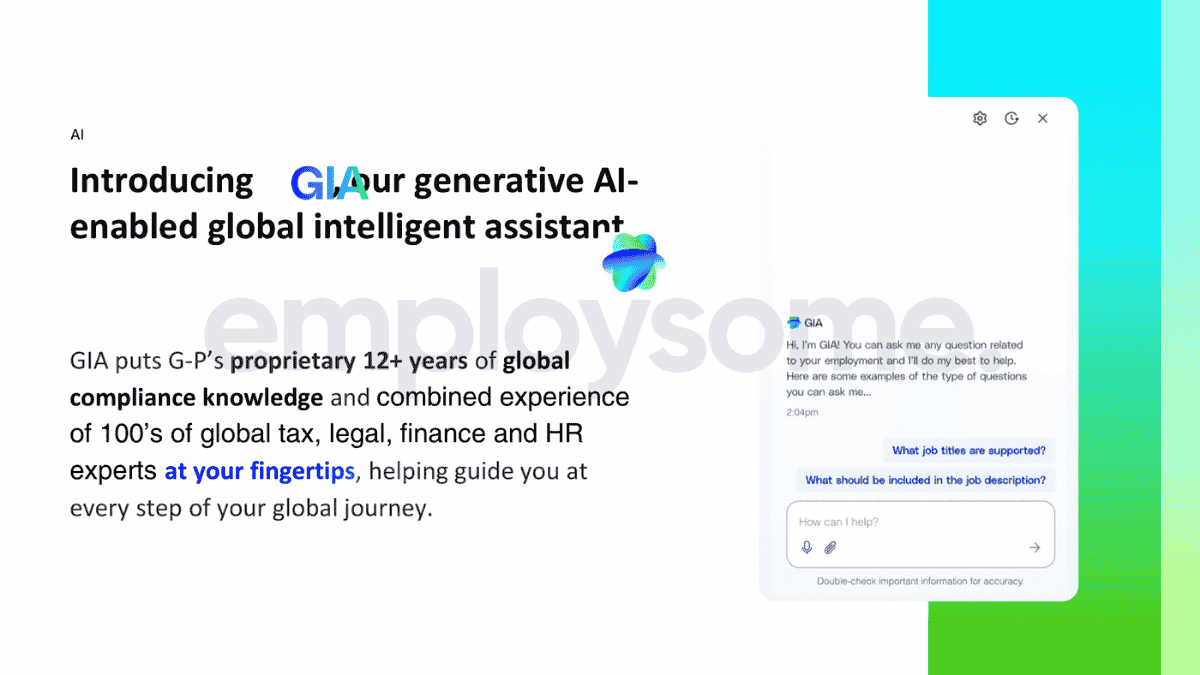

Globalization Partners also offer AI assistant GIA that makes HR and compliance work simple. It can review employment contracts across multiple countries in minutes which saves time and money.

GIA can also generate HR documents fast, and Gia even highlights the most important compliance details so decisions can be made confidently. Answers come from verified, expert-reviewed sources, and translations stay compliant across jurisdictions. So, no need to call a lawyer for every question. With support for over 50 countries, Gia automatically applies the right rules for wherever you’re working.

On top of that, they offer a wide range of additional services designed to make managing a global workforce more efficient. This includes everything from payroll management across multiple countries to handling equity and benefits for your team, all in a single platform.

For companies expanding internationally, these extra services can make a huge difference.

Our Personal Experience with Globalization Partners

Our first experience with Globalization Partners was slower and overly bureaucratic compared to other Employer of Record providers we’ve spoken with. It took two separate sales calls and multiple emails before I was finally able to see basic pricing information. For buyers evaluating several providers in parallel, this process is inefficient and unnecessarily overcomplicated.

When the pricing did arrive, it was positioned at the highest possible end of the market with by far the heaviest setup fee we’ve ever experienced of $2,820 along with a monthly base EOR fee of $705. And that’s per employee.

What made the process frustrating was not the price point itself but the lack of upfront transparency. Globalization Partners required me to provide detailed information, including exact employee salaries, before releasing a quote. Pricing was only disclosed during the second call, which created the impression of barriers rather than openness.

The overall tone of the sales experience was also less client-oriented than competitors. While many EOR providers present themselves as eager and collaborative partners, Globalization Partners felt distant and somewhat unfriendly. The interaction gave me the impression that I had to “prove” our company was worth working with, rather than being met with genuine enthusiasm to support my expansion needs.

Overview of Globalization Partners’ Pricing

$920

Ø per employee per month (first year)$65

per employee per month$29

per employee per month$2,820 (!!)

additional per EOR employee per month on payroll plan1 to 2.5 month(s)

of total cost of employment depending on credit check outcome3%

Exchange fees on top5% p.a.

per month + recovery costs$250

per wire$1,000

per employee per offboardingHow Globalization Partners is Scoring Overall

Globalization Partners are an enterprise-grade global Employer of Record with deep compliance maturity, owned entity coverage in key markets, and one of the strongest support organizations in the EOR industry. It is best suited for larger, risk-averse companies that prioritize legal certainty and service depth over speed, flexibility, or transparent pricing.

3.8 /5.0

✓ EOR services across 125+ countries

✓ Covers compliant employment contracts, payroll processing, statutory filings, terminations, and benefits administration

✓ Supports contractor management (USD 39/month), global payroll, immigration & visa services

✓ Insurance and pension support, background checks, equipment procurement, and equity & stock option administration available

✓ Well suited for regulated, high-risk, and enterprise environments (e.g. listed companies or banking institutions)

✗ Less flexible for lightweight or non-standard employment setups

✗ Broad coverage comes with heavier processes and controls

4.5 /5.0

✓ Stable enterprise pricing once contracted

✓ Costs are predictable after onboarding

✗ No public or self-serve pricing (sales-led only)

✗ Typical EOR pricing around USD 940 per employee/month

✗ One-time setup fee: ~USD 2,820

✗ Security deposits of 1–2.5 months of total employment cost (credit-check dependent)

✗ FX markup estimated at ~3%

✗ No country-level pricing breakdowns available upfront

3.0 /5.0

✓ Strong, compliance-driven global contract framework

✓ Consistent contracting standards across regions

✓ No fixed minimum commitment publicly disclosed in all markets

✗ Enterprise-leaning terms with limited flexibility

✗ Invoices issued around the 15th of the month, net-7 payment terms

✗ Late payment interest: 5% p.a.

✗ Offboarding fees (~USD 1,000) may apply

✗ Service continues until full legal offboarding is completed, extending costs in some jurisdictions

3.0 /5.0

✓ Dedicated account managers for all customers

✓ Live chat (~2-minute first response) and phone support

✓ Structured onboarding and termination support

✓ Proactive compliance alerts (labor law changes, risk flags)

✓ AI-supported guidance (G-P Assist) for HR and compliance topics

✓ Strong depth across legal, HR, and regulatory advisory

✗ More consultative and process-heavy than product-led EORs

4.5 /5.0

✓ Stable enterprise platform for payroll, employment documents, time-off, expenses, reporting, and compliance workflows

✓ Includes G-P Assist AI

✓ SOC 2 and ISO 27001 certified

✓ Native integrations with major HRIS/HCM systems (Workday, SAP SuccessFactors, UKG, BambooHR, Personio, HiBob)

✗ UX feels outdated compared to newer EOR platforms

✗ Limited automation and self-serve workflows

✗ Integration ecosystem trails tech-first competitors

4.0 /5.0

Globalization Partners Country Coverage: Owned Entities vs Partner Network

Globalization Partners operate mainly via owned entities given that they’ve been in the EOR market for almost 10 years now. They might have more entities that we were not able to publicly verify. We’ve summarised all entity details that were available to us.

Ready to compare EORs?

With Employsome, you can compare real-time prices of 100+ EORs, online within seconds. Whether it’s a global EOR or a local hidden gem, we’ll let you run quick quote online, and let you decide which EOR is the right good fit.

Globalization Partners Contract Terms

The agreement runs until terminated.

- Voluntary termination: 30-day notice

- Breach: 7-day cure period

Customers must inform G-P when ending a contractor relationship and still pay all outstanding invoices and G-P fees.

G-P is not liable for:

- Contractor performance

- Contract enforceability

- Invoice errors

- Contractor misclassification

- Customer’s relationship with the contractor

Liability is capped at the lesser of:

- 12× monthly G-P Fees for the contractor(s) involved, or

- USD $100,000.

No liability for indirect, incidental, special, or consequential damages.

Each party indemnifies the other for breaches, data violations, or gross negligence.

The customer must additionally indemnify G-P for:

- Misclassification claims

- Contractor work-related claims

- Any disputes arising from the customer–contractor relationship

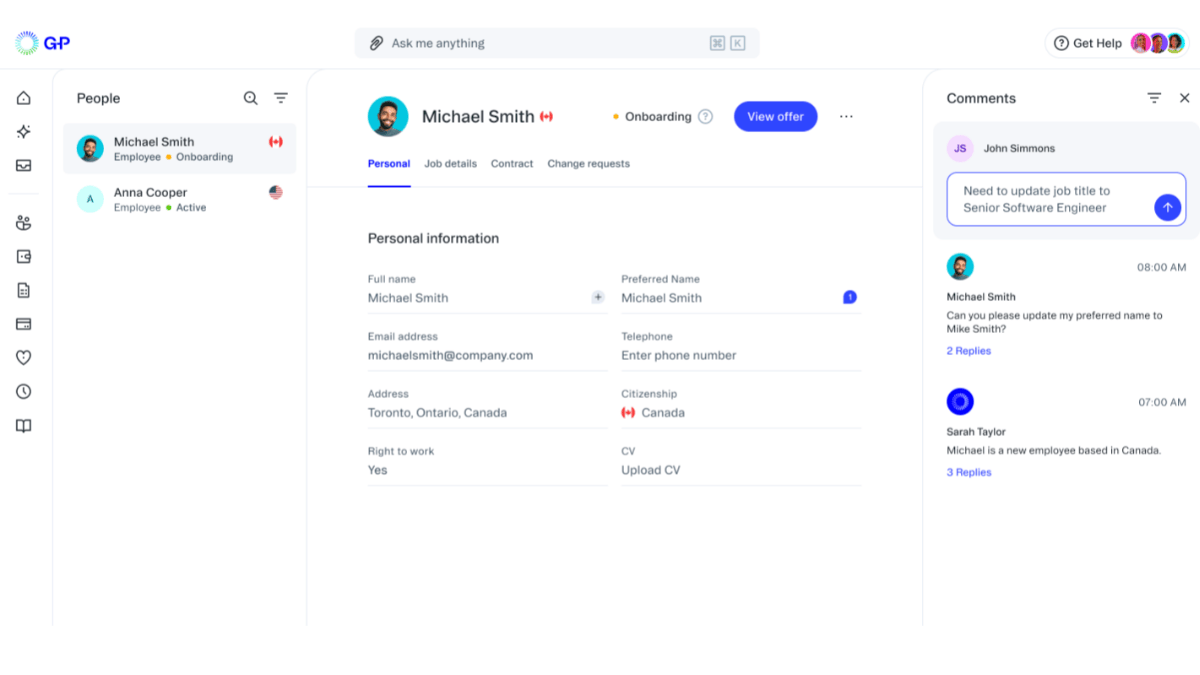

Globalization Partners’ Platform Deep Dive: Onboarding, Payroll, and Employment Workflow

Sign-Up & Account Setup

Globalization Partners follow one of the most controlled and sales-led onboarding models in the EOR industry. While you can technically create an account on the Globalization Partners platform, full functionality is not enabled until after speaking with sales and completing several mandatory reviews. Unlike Deel or Oyster HR, where users can explore the platform immediately, Globalization Partners restricts access until commercial and compliance checks are done.

Most companies must complete the following steps before accessing the operational parts of the platform:

- Book a call with Sales

- Go through a scoping and pricing discovery session

- Receive a tailored commercial proposal

- Undergo internal G-P risk evaluation

- Accept G-P’s Terms and finalize contracting

Only after this multi-step process does Globalization Partners activate the customer environment inside the platform.

Account creation starts on the Globalization Partners platform (formerly Meridian), where users enter company details, registered address, industry classification, and legal contacts. After registration, Globalization Partners requires a mandatory KYB/compliance review, which includes:

- Verification of legal entity documents

- Confirmation of beneficial ownership and authorized signatories

- Global sanctions & restricted-party screening

- Validation of the company’s operating jurisdictions and business activities

This review is required before you can onboard your first employee or contractor. The reason: Globalization Partners carries full employer liability in each country, so it enforces stricter front-loaded checks compared to competitors.

Overall, the setup process is more manual and structured than Deel or Remote, but consistent with Globalization Partners’ enterprise-grade compliance model.

Contractor & Employee Onboarding

Globalization Partners use two different onboarding flows depending on whether you hire an EOR employee or an independent contractor.

1. Employee (EOR) Onboarding

The EOR onboarding flow is highly structured and compliance-heavy. After the hiring request is submitted, Globalization Partners perform:

- Eligibility verification (right-to-work + local labor law checks)

- Role and classification review

- Mandatory benefits and statutory entitlements setup

- Contract localization using country-specific templates

Employers can request custom clauses, but Globalization Partners’ legal team must approve them to ensure compliance in the hiring country. This sometimes limits flexibility but ensures all contracts follow local statutory requirements.

Once the contract is approved, the employee completes their profile in the platform, uploading:

- ID documents

- Tax forms

- Bank details

- Any country-specific declarations

In most countries, onboarding takes 7–14 days, but in high-complexity markets (LATAM, APAC), it can take longer because Globalization Partners rely on local partner entities.

2. Contractor Onboarding

For contractors using Globalization Partners’ Contractor, onboarding is faster but still regulated:

- Customer uploads or customizes a Consultancy Agreement

- Contractor submits identity and banking details

- Globalization Partners perform sanctions screening

- Contractors cannot be onboarded if they fail compliance checks

There is no milestone-based payment model (unlike Deel), and Globalization Partners act only as a payment facilitator – not as a Contractor Of Record.

Payments, Payroll & Invoicing

Globalization Partners operate a structured two-step funding and payroll workflow designed to ensure accuracy and compliance across all their countries.

Funding & Invoicing

Before each payroll cycle, Globalization Partners issue a pre-funding invoice on the 15th of each month, which includes:

- Gross salaries

- Employer taxes & social contributions

- Benefits and allowances

- Globalization Partners service fees

- FX rates, partner bank fees, statutory add-ons

After payroll is processed, Globalization Partners send a post-payroll settlement invoice, usually on the 1st of the next month, to reconcile:

- Variances

- Tax deltas

- Pro-rations

- Bonuses

- Adjustments after cutoff

Late payments incur 3% monthly interest p.a., and Globalization Partners may pause payroll, increase deposits or, worst case, terminate for repeated non-payment. We’ve came across cases in which Globalization Partners stopped the EOR services all together and offboarded employees when invoices were overdue for too long. As such, caution and on-time payments are required. We believe this is Globalization Partners’ right to proceed with rigorous terminations with clients that do not pay on time.

Payroll Execution

Once funds are received:

- Globalization Partners pay salaries locally

- Submits employer taxes to authorities

- Generates payslips and reports

- Handles benefits and statutory filings

Payroll is monthly in most markets, with adjustments for countries requiring semi-monthly or biweekly scheduling.

Contractor Payments

For contractors:

- Customer approves invoices in the platform

- Globalization Partners’ partners (Wise, Payoneer, banks) transfer funds

- FX applied at Globalization Partners’ rate at approval time

Payouts typically take 2 to 5 business days depending on banking rails and country.

Globalization Partners Platform Deep Dive

Dashboard, Design & User Experience

Globalization Partners provide a clean, enterprise-style dashboard with a strong focus on compliance visibility. Administrators can view active employees, pending onboarding tasks, required documents, upcoming payroll cycles, and alerts. The interface is more structured and conservative than Deel or Oyster, with fewer customization options but strong clarity.

For employers, Globalization Partners’ dashboard feels built for HR and legal teams who prioritize control rather than automation. There are no advanced workflows or drag-and-drop rules, but navigation is intuitive and predictable.

Employees can log into the Globalization Partners platform or mobile app to complete onboarding, upload documents, update personal data, submit expenses, and request leave. The app mirrors the web interface and provides:

- Access to payslips

- Time-off balance overview

- Bank details & personal info updates

- Notifications for approvals or missing documents

Compared to Deel (more modern) or Remote (more minimal), Globalization Partners’ experience is functional and compliant, but less feature-rich. There are no career tools, no learning modules, and no engagement features. It’s strictly operational.

Spend Management & Expenses

Globalization Partners expense management system offers EOR employees to submit expenses via the Globalization Partners platform or mobile app. Employers can then view, approve and reject expenses. Once the expense is accepted, the amount is added to the invoice and Globalization Partners reimburse the employee through local payroll. Employees are required to upload expense related information and receipts in PDF or image format.

While the Globalization Partners expense management system offers the basic functionalities required for sufficient expense management, they do not offer any sync with expense of accounting tools like expensify, concur, or Xero. This means that employees would need to submit expenses through your internal system if required as well as through Globalization Partners. Further, Globalization Partners do not offer any custom approval chains or auto-deny workflows. They do not offer mileage tracking or any kind of virtual cards.

| Feature | Globalization Partners | Deel | Oyster HR | Remote | Papaya Global |

| Expense uploads | ✔ | ✔ | ✔ | ✔ | ✔ |

| Payroll reimbursement | ✔ | ✔ | ✔ | ✔ | ✔ |

| Concur / Expensify integration | ❌ | ✔ | ✔ | ❌ | ❌ |

| Expense automations | ❌ | ✔ | ✔ | ❌ | ❌ |

| Accounting / ERP sync | ❌ | ✔ | ✔ | ✔ | ✔ |

| Spend cards | ❌ | ✔ | ❌ | ❌ | ❌ |

| Multi-country policy rules | ❌ | ✔ | limited | ❌ | ❌ |

Time-Off & Leave Management

Globalization Partners provides a standard leave management system as part of their EOR suite. While it is functional and legally compliant, it is not extensive. Currency, the system only allows one leave approver and no custom leave policies. You can set up company-wide PTO policies, unlimited PTO and regional leave policies. Unlike OysterHR, Remote or Deel, Globalization Partners does not sync data with any HRIS systems.

| Feature | Globalization Partners | Deel | OysterHR | Remote | Papaya Global |

| Statutory compliance | ✔ | ✔ | ✔ | ✔ | ✔ |

| Custom leave policies | ❌ | ✔ | ✔ | limited | limited |

| HRIS syncing | ❌ | ✔ | ✔ | ✔ | limited |

| Calendar integration | ❌ | ✔ | ✔ | ❌ | ❌ |

| Multi-step approvals | ❌ | ✔ | ✔ | ❌ | ❌ |

| Employee self-service | ✔ | ✔ | ✔ | ✔ | ✔ |

| Manager approvals | ✔ | ✔ | ✔ | ✔ | ✔ |

Compliance Engine & Risk Controls

This is where Globalization Partners stands out.

The platform includes built-in compliance guardrails that force correct workflows and block actions that create risk. Examples include:

- Mandatory identity, tax, and eligibility verification

- Automatic enforcement of statutory notice periods

- Contract templates with jurisdiction-specific clauses

- Restrictions on misclassification risk

- Automatic tax and labor law updates

- Alerts for local policy conflicts

Globalization Partners’ compliance engine is stricter than Remote or Deel, matching Oyster’s conservative approach but with a more enterprise-grade structure.

Payments & Invoicing Experience

Globalization Partners operate on a pre-funding model. Clients receive monthly invoices that must be fully funded before payroll can run. Once funded, Globalization Partners process payroll and distributes net salaries locally.

Experience highlights:

- One consolidated invoice per country

- Itemized breakdowns for salary, employer costs, benefits, and fees

- No instant payouts

- FX and payment method fees borne by the client

- Strict cutoff dates per country

- Settlement invoices may follow if adjustments are needed

Payments flow works well, but the interface is more rigid than Deel’s or Remote’s, with fewer automation features.

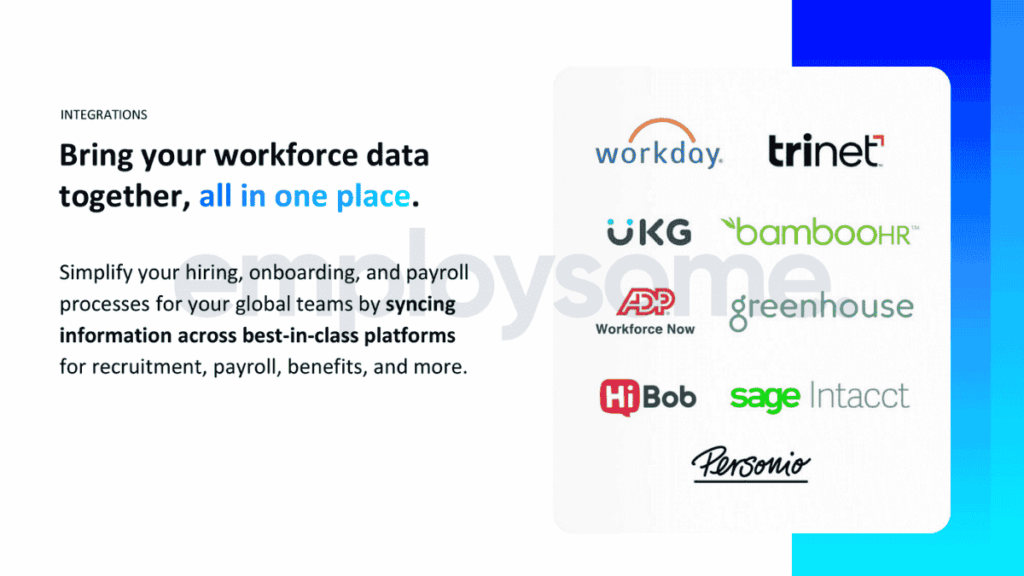

Integrations, AI & Automations

Globalization Partners provide a focused but reliable set of integrations that cover the essential systems HR, finance, and payroll teams rely on. While the ecosystem is smaller than providers like Deel or Remote, the available integrations are enterprise-grade, compliance-oriented, and built around maintaining a clean, single source of truth across platforms. Most connectors sync employee lifecycle data from your HRIS into Globalization Partners, ensuring consistent records for global hires. Below is a breakdown of Globalization Partners’ integration categories:

This is Globalization Partners’ strongest integration category, offering reliable syncing with leading HRIS systems.

Employee data changes made in the HRIS (e.g., title, department, manager, compensation) automatically update in Globalization Partners.

Supported HRIS Systems:

- BambooHR – Syncs global data and avoids duplicate records

- Personio: Keeps employee records aligned as a single source of truth

- TriNet: SSO login + automatic data exchange

- UKG Pro & UKG Ready: Real-time sync of employee and contractor records

- Workday: Syncs lifecycle information, including job title and salary changes

- SAP SuccessFactors: Pushes employee details from Globalization Partners into SAP

- HiBob: Streamlines onboarding and removes data duplication

These integrations help HR teams maintain accurate global employee data without manual updates across multiple tools.

Globalization Partners connect with several major payroll and finance providers to streamline AP, onboarding, and workforce management.

ADP TotalSource

- One-click access to Globalization Partners via SSO

- Enables onboarding Globalization Partners’ employees inside ADP

- Designed for companies already using ADP’s PEO model

ADP Workforce Now

- Real-time sync of Globalization Partners’ employee information into ADP

- Ensures a unified workforce dataset across both systems

Sage Intacct

- Centralizes Accounts Payable reporting

- Globalization Partners invoices sync into Sage Intacct for easier reconciliation

Paylocity

- SSO-based login

- Allows teams to access Globalization Partners using Paylocity credentials

- Supports essential tasks for EOR professionals

Globalization Partners does not offer direct integrations with Expensify, Concur, Xero, QuickBooks, or other spend management tools. Expense data does not sync automatically into ERP systems beyond Sage Intacct.

G-P API

Globalization Partners provides an API that enables:

- One-way or bi-directional data flows

- Syncing Globalization Partners employee data into internal systems

- Integrating onboarding, job changes, or payroll data into proprietary tools

- Embedding Globalization Partners data into HRIS dashboards, analytics, or workforce systems

The API is designed for teams needing deeper integration logic beyond pre-built connectors.

Globalization Partners also offer a public G-P API (REST), allowing companies to:

- pull employment data

- sync team profiles

- push onboarding data

- automate time-off and reporting flows

Although not as flexible as Deel’s API, Globalization Partners’ design is focused on controlled compliance workflows suitable for enterprise teams.

Globalization Partners include a built-in AI assistant designed to help users navigate global employment rules and the Globalization Partners platform more efficiently. If you have any questions like “how to hire an EOR employee in the UK” or “How many mandatory vacation days exist in Spain” or anything else on global employment laws, the assistant can bring instant clarity and compliance context. The assistant provides quick answers to compliance questions (such as notice periods, statutory leave rules, or required onboarding documents) and offers guidance on how to complete tasks inside the platform.

It functions mainly as a support and knowledge tool, not an automation engine. It helps explain country-specific employment rules, assists with onboarding steps, and directs users to the right features within the platform. Unlike Deel’s workflow-driven AI, Globalization Partners’ assistant does not automate payroll, generate contracts, or run complex workflows, but it does make compliance information easier to access and reduces reliance on support tickets.

Pros & Cons of Globalization Partners

Well-established reputation with large enterprises

The platform is trusted by major corporations and global enterprises. Their strong track record with large clients demonstrates stability, operational maturity, and the ability to handle complex organizational needs at scale.

Reliable benefits administration through established insurance partners

Globalization Partners work with reputable insurance carriers to deliver consistent and well-structured employee benefits packages. This ensures high-quality coverage and reduces administrative complexity for clients.

Strong compliance expertise across key global markets

Globalization Partners have deep experience handling employment, payroll, and HR compliance in multiple regions. Their long operational history gives companies confidence when hiring internationally or navigating complex local regulations.

High price point & limited transparency in pricing

The provider tends to have a significantly higher cost structure compared to most competitors. Pricing information is not fully transparent, and companies may need to go through extended discussions with sales before receiving clear cost breakdowns. Onboarding fees of up to 1000 USD make the offering nt competitive.

Long and complex sales process & onboarding timeline

Both the sales cycle and the onboarding process are slower than average. It may take longer for new clients to sign contracts, and employees might face delays before they can be fully onboarded and start working.

Platform may lack maturity and modern UX compared to Deel and Multiplier

Although the platform is fully functional, the interface feels less modern and intuitive than newer EOR solutions like Deel or Remote. Companies looking for the most streamlined digital experience might find it less user-friendly.

Who Globalization Partners Is Best For

This visual highlights where this provider performs best across common buyer dimensions, based on Employsome’s independent, data-driven analysis. It reflects typical real-world usage patterns rather than marketing positioning.

Compare Globalization Partners with Others

Written by

Dane Cobain is a Copywriter at Employsome and an accomplished author whose work spans fiction, non-fiction, and professional writing. Over the past decade, he has built a strong track record creating straightforward content for the HR, payroll, and corporate sectors. Dane brings a storyteller’s eye to the evolving world of global employment, with a particular focus on Employer of Record and PEO models. His articles explore industry trends and dedicated Best Of Guides when managing an international workforce.

Our content is created for informational purposes only and is not intended to provide any legal, tax, accounting, or financial advice. Please obtain separate advice from industry-specific professionals who may better understand your business’ needs. Read our Editorial Guidelines for further information on how our content is created7